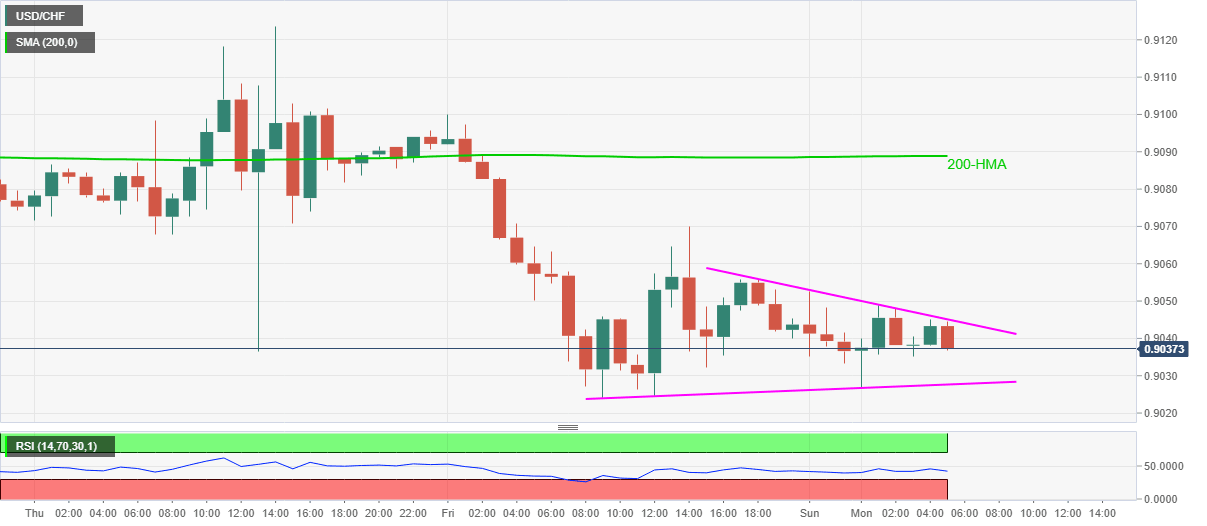

USD/CHF Price Analysis: Seesaws in a symmetrical triangle around multi-month low

- USD/CHF takes a U-turn from the short-term triangle resistance near 0.9050.

- Sustained trading below 200-HMA, normal RSI keep the bears hopeful.

- Bulls need a fresh monthly high for conviction.

USD/CHF recedes to 0.9039 while heading into the European session on Monday. Even so, the pair trades inside a symmetrical triangle getting support and resistance line from August 28.

Considering the normal RSI conditions, as well as the pair’s declines below 200-HMA, the quote is likely to remain weak with the formation’s support of 0.9027 acting as immediate rest-point during further weakness.

It should, additionally, be noted that the 0.9000 threshold may question the sellers past-0.9027, which if ignored can divert the moves to January 20, 2015 top near 0.8840.

Meanwhile, an upside clearance of the triangle’s resistance, at 0.9045 now, will challenge a 200-HMA level of 0.9088 before attacking the previous week’s tops near 0.9130.

Though, the buyers aren’t expected to be convinced unless the pair refreshes the monthly high above 0.9242.

USD/CHF hourly chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.