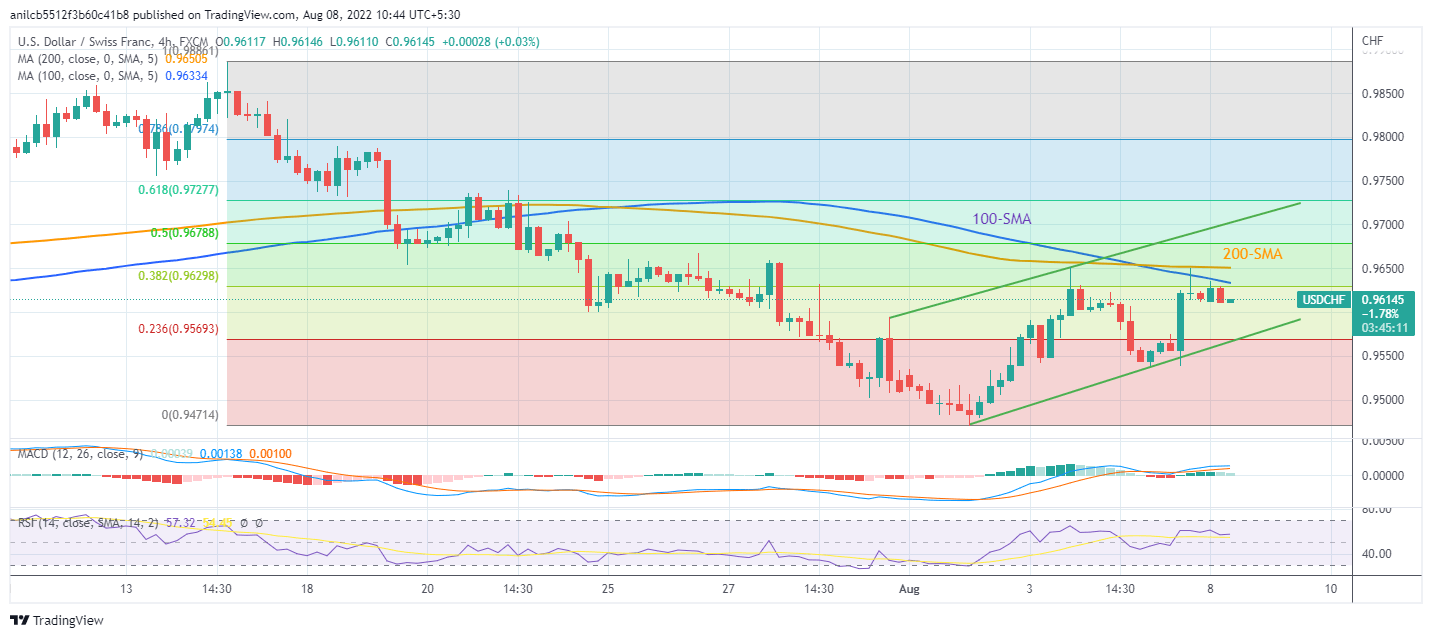

USD/CHF Price Analysis: Retreats from key SMAs towards 0.9600

- USD/CHF takes offers to refresh intraday low, extends pullback from 100-SMA, 200-SMA.

- RSI retreat, sluggish MACD signals also keep sellers hopeful.

- One-week-old ascending trend line challenges bears, short-term bullish channel keeps buyers hopeful.

USD/CHF renews intraday low around 0.9610, keeping the previous day’s pullback from the key SMAs during early Monday morning in Europe.

Given the RSI retreat and the MACD line’s recent struggle, the USD/CHF prices are likely to extend the latest weakness towards the 0.9600 threshold.

However, a convergence of the one-week-old ascending trend channel’s support line and 23.6% Fibonacci retracement of the July 14 to August 02 downturn, close to 0.9570, could challenge the pair bears afterward.

In a case where USD/CHF sellers break the 0.9570 support, the odds of witnessing the fresh monthly low, currently around 0.9470 can’t be ruled out.

Alternatively, the 100-SMA and the 200-SMA limit the short upside moves of the pair respectively around 0.9635 and 0.9650.

During the quote’s run-up beyond 0.9650, the 50% Fibonacci retracement level and the upper line of the stated channel, close to 0.9680 and 0.9700 in that order, will be important to watch for the USD/CHF bulls.

Overall, USD/CHF is likely to consolidate recent gains inside a bullish chart pattern.

USD/CHF: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.