USD/CHF Price Analysis: Further upside past 0.9800 appears difficult

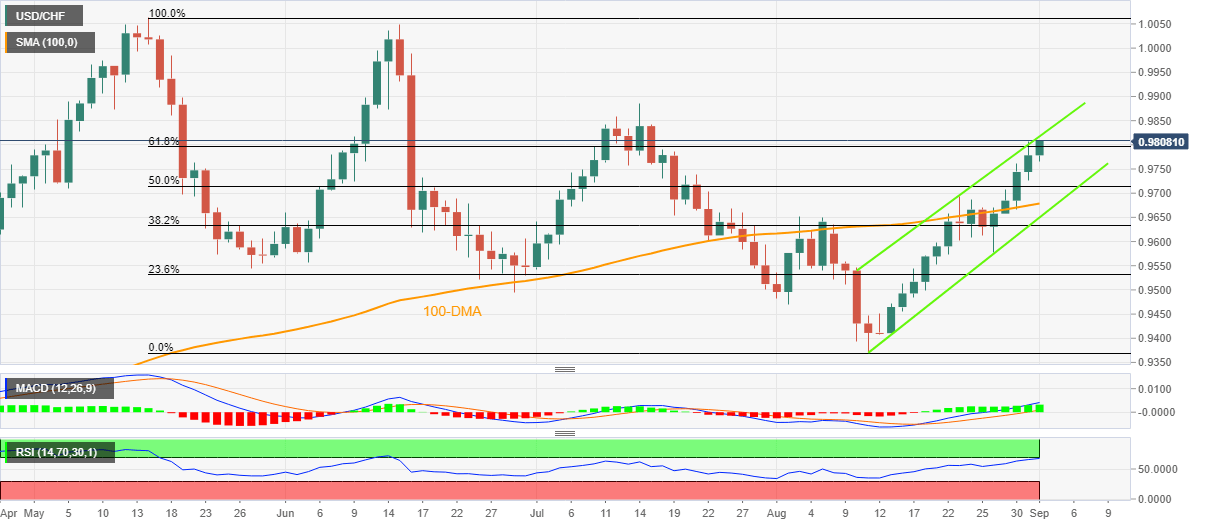

- USD/CHF renews 1.5-month high inside three-week-old bullish channel.

- Overbought RSI, 61.8% Fibonacci retracement level challenges immediate upside.

- Channel’s top, July’s peak add to the upside filters.

- 100-DMA could probe bears before the bullish channel’s support line.

USD/CHF takes the bids to refresh the six-week high near 0.9805 during Thursday’s Asian session. In doing so, the Swiss currency (CHF) pair attacks the 61.8% Fibonacci retracement level of the May-August downside during the five-day uptrend.

It’s worth noting, however, that the overbought RSI (14) challenge the quote’s further upside near the 0.9800 threshold.

Even if the quote stays beyond 0.9800, the upper line of the three-week-long bullish channel, near 0.9820, could challenge the USD/CHF buyers.

If at all the prices ignore RSI and cross the hurdle near 0.9820, July’s peak of 0.9885 will act as the last defense of the bears.

On the contrary, pullback moves may initially test the 50% Fibonacci retracement level of 0.9715 before highlighting the 100-DMA support near 0.9680-75.

Should the USD/CHF sellers manage to conquer the 0.9680 support, the aforementioned channel’s support line, at 0.9650 by the press time, will be crucial before giving them control.

To sum up, USD/CHF remains on the bull’s radar but the upside room appears limited.

USD/CHF: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.