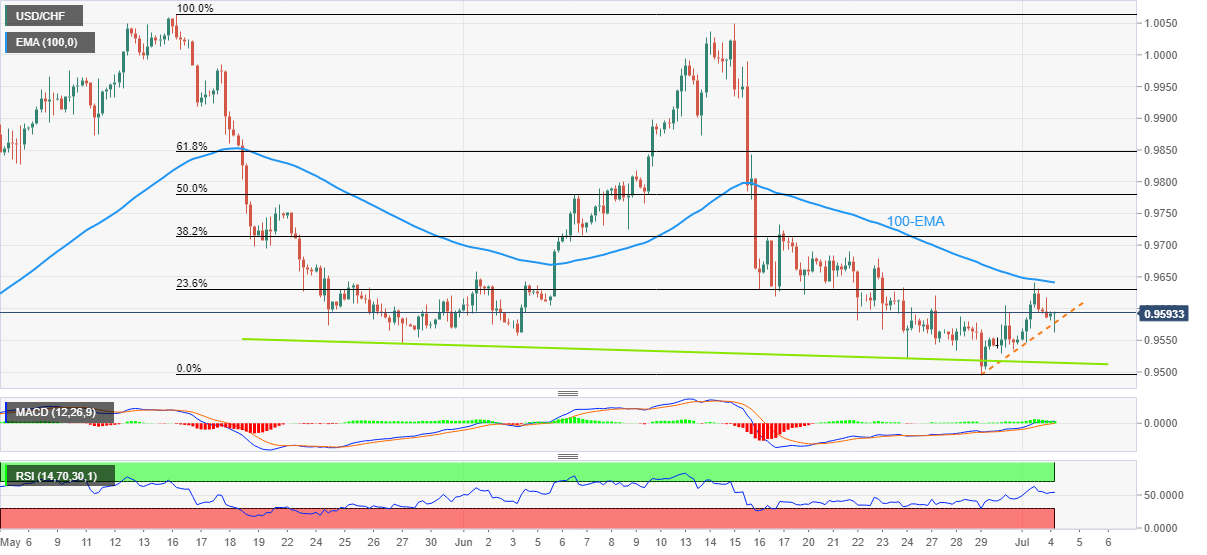

USD/CHF Price Analysis: Extends pullback from 100-EMA on strong Swiss inflation

- USD/CHF refreshed intraday low on upbeat Swiss inflation data for June.

- Clear downside break of immediate support appears necessary to convince bears.

- Recovery remains elusive below 50% Fibonacci retracement level of May-June downside.

USD/CHF fades bounce off intraday low as sellers flirt with three-day-old support heading into Monday’s European session. That said, the Swiss currency (CHF) pair trades around 0.9585 by the press time.

The quote renewed its daily low after the Swiss Consumer Price Index (CPI) rose to 0.5% MoM and 3.4% YoY versus the respective market consensus of 0.3% and 3.2%.

It’s worth noting that the USD/CHF weakness also takes clues from the failures to cross the 100-EMA, around 0.9640 by the press time.

However, sellers not only need to break the immediate support line surrounding 0.9575 but also keep reins past a downward sloping trend line from May 27, close to 0.9515 at the latest, to reject the bulls.

Following that, the south-run can aim for March’s high of 0.9460.

Alternatively, recovery moves need to cross the 100-EMA level of 0.9640 to convince short-term USD/CHF buyers.

Even so, the 38.2% and 50% Fibonacci retracement levels, around 0.9715 and 0.9780 in that order, could challenge the pair buyers.

Overall, strong prints of the Swiss inflation data add strength to the bearish bias over the USD/CHF pair.

USD/CHF: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.