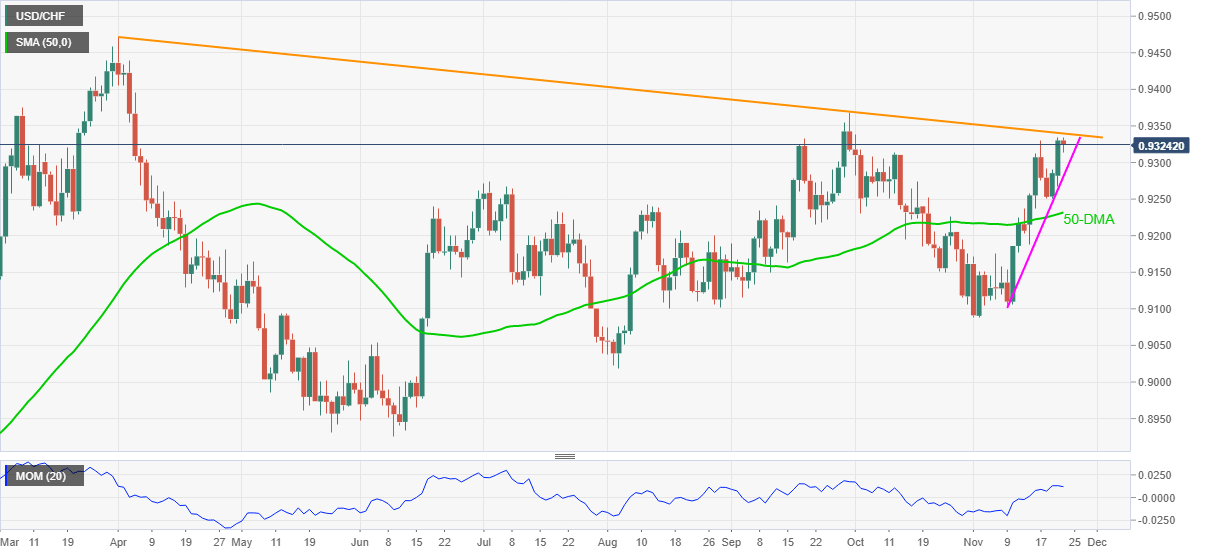

USD/CHF Price Analysis: Eases below 0.9340 key hurdle

- USD/CHF pauses two-day uptrend, steps back from seven-week high.

- Firmer Momentum, fortnight-old support line keep buyers hopeful of crossing seven-month-old resistance line.

- July’s high, 50-DMA add to the downside filters.

USD/CHF consolidates recent gains around 0.9320 during early Tuesday, following two-day advances to poke October’s high.

In doing so, the Swiss currency (CHF) pair eases below a downward sloping trend line from early April. However, an ascending support line from November 09 and a firmer Momentum line favor USD/CHF buyers to aim for the 0.9340 immediate resistance.

On a daily closing beyond 0.9340, the previous month’s top of 0.9368 can act as an intermediate halt before directing the quote towards the yearly high, marked in April around 0.9475.

Meanwhile, the 0.9300 threshold will precede the stated immediate support line, near 0.9230, to challenge short-term USD/CHF sellers.

Additionally, July month’s high of 0.9275 and the 50-DMA level of 0.9231 offer extra tests for the pair sellers to pass ahead of retaking the controls.

To sum up, USD/CHF buyers can ignore the latest pullback moves.

USD/CHF: Daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.