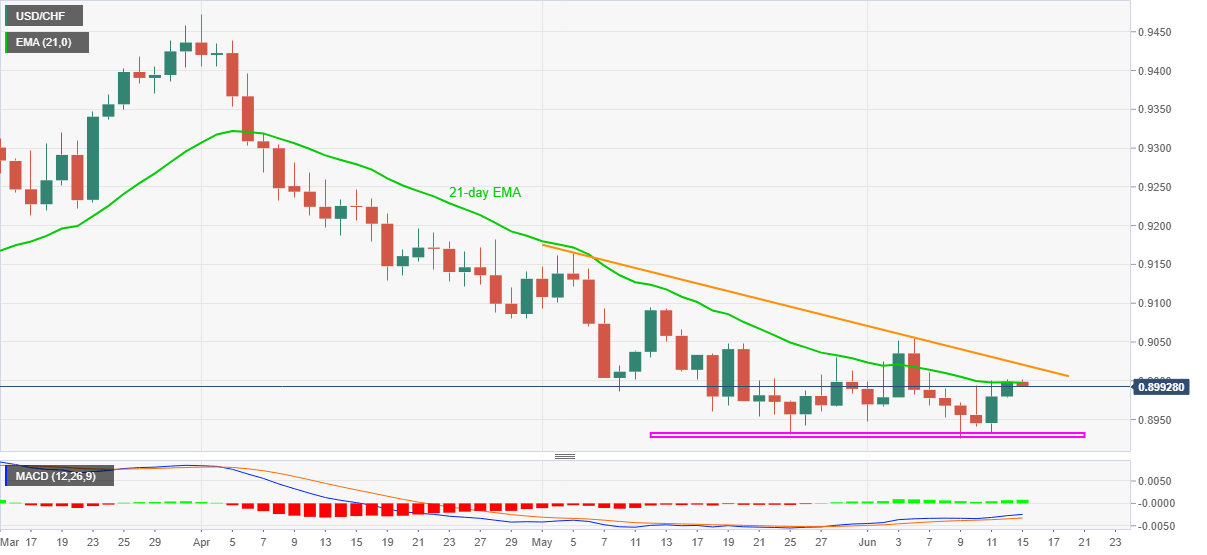

USD/CHF Price Analysis: Consolidates recent gains below 21-day EMA

- USD/CHF holds lower ground after a two-day uptrend.

- Descending triangle, bullish MACD keeps buyers hopeful beyond 0.8925.

USD/CHF eases to 0.8993, down 0.06% intraday, amid sluggish trading ahead of Tuesday’s European session.

The Swiss currency pair rose during the last two days before recently stepping back from 21-day EMA near the 0.9000 threshold.

Even so, upbeat MACD signals and a short-term falling triangle favor USD/CHF bulls unless the quote refreshes the multi-month low of 0.8926.

It should, however, be noted that pullback moves towards 0.8970 and then to 0.8950 can’t be ruled out.

Meanwhile, an upside clearance of 21-day EMA hurdle around the 0.9000 needs to confirm the bullish chart pattern with a daily close beyond 0.9020 to aim for the previous month’s top surrounding 0.9165.

However, the monthly top near 0.9055, followed by the mid-May high near 0.9095, acts as an intermediate halt during the run-up to 0.9165.

USD/CHF daily chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.