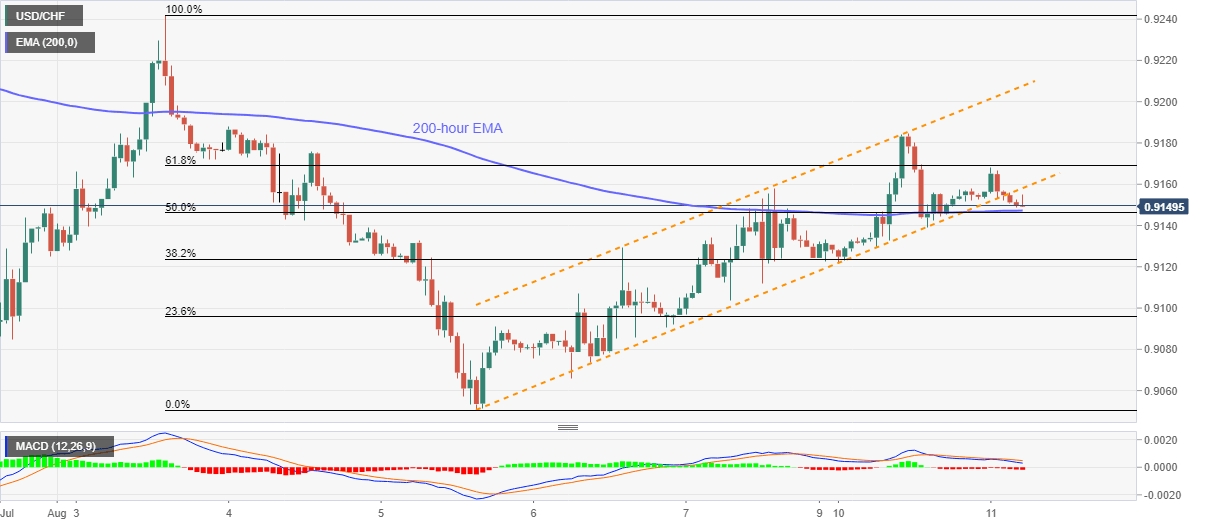

USD/CHF Price Analysis: Bounces off 200-hour EMA to regain 0.9150

- USD/CHF recovers from 0.9148 after breaking one-week-old ascending trend channel.

- Buyers will wait for entries unless stepping back inside the channel formation.

- The weekly low can offer immediate support ahead of 0.9100 round-figures.

USD/CHF trims initial losses while picking up bids near 0.9152 during the pre-European session on Tuesday. The pair broke a four-day-old ascending trend channel formation but 200-hour EMA and 50% Fibonacci retracement of its August 03-05 downside triggered its latest pullback.

Even so, bearish MACD challenges the optimism while also highlighting the channel’s support line, at 0.9160. If at all the pair manages to cross 0.9160, 61.8% Fibonacci retracement level around 0.9168 could gain market attention.

However, bulls’ ability to cross 0.9168 will swiftly cross 0.9200 to attack the channel’s upper line, currently around 0.9210.

Meanwhile, a downside break of 0.9147 support confluence will direct the sellers towards the weekly low near 0.9122 and then to the 0.9100 threshold.

In a case where the bears command past-0.9100, Wednesday’s multi-month low of 0.9050 will be the key ahead of 0.9000 psychological magnet.

USD/CHF hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.