USD/CAD steady as US Dollar dips on tariff unease and mixed data

- USD/CAD trades near the 1.3900 zone amid ongoing Greenback weakness.

- Fed officials highlight tariff-driven risks, while Durable Goods data sends mixed signals.

- Key resistance is clustered near 1.3905 and 1.4000, with support at 1.3865 and 1.3848.

The USD/CAD pair was seen hovering around the 1.3900 zone on Thursday, mildly lower on the day, as the US Dollar (USD) struggles to maintain momentum amid renewed tariff uncertainty and conflicting US economic signals. Despite a stronger-than-expected headline Durable Goods report, underlying data fell flat, reinforcing caution among investors. Canadian Dollar (CAD) sentiment, meanwhile, remains stable but lacks the upside strength shown by other major currencies, as the pair stays within a narrow consolidation band established earlier in the week.

Federal Reserve (Fed) Governor Christopher Waller struck a cautious tone on Thursday, suggesting that tariffs could distort labor market dynamics and weigh on corporate hiring decisions. He emphasized that many firms remain frozen by policy uncertainty and warned that rate cuts could eventually follow if unemployment begins to rise. Meanwhile, Cleveland Fed President Beth Hammack echoed the call for patience, hinting at possible adjustments as soon as June if economic conditions warrant.

In terms of economic data, US Durable Goods Orders surged 9.2% in March, far exceeding expectations. However, the core figure excluding transportation came in flat, tempering enthusiasm. Separately, Initial Jobless Claims ticked up to 222K, reflecting a slight softening in labor market conditions. Despite the data-driven bump, USD sentiment was mostly overshadowed by the ongoing debate around trade policy. President Trump and Treasury Secretary Bessent reiterated that no concessions had been made to China on tariffs, underscoring the lack of progress in negotiations and weighing on the DXY, which drifted near 99.30.

Technical outlook

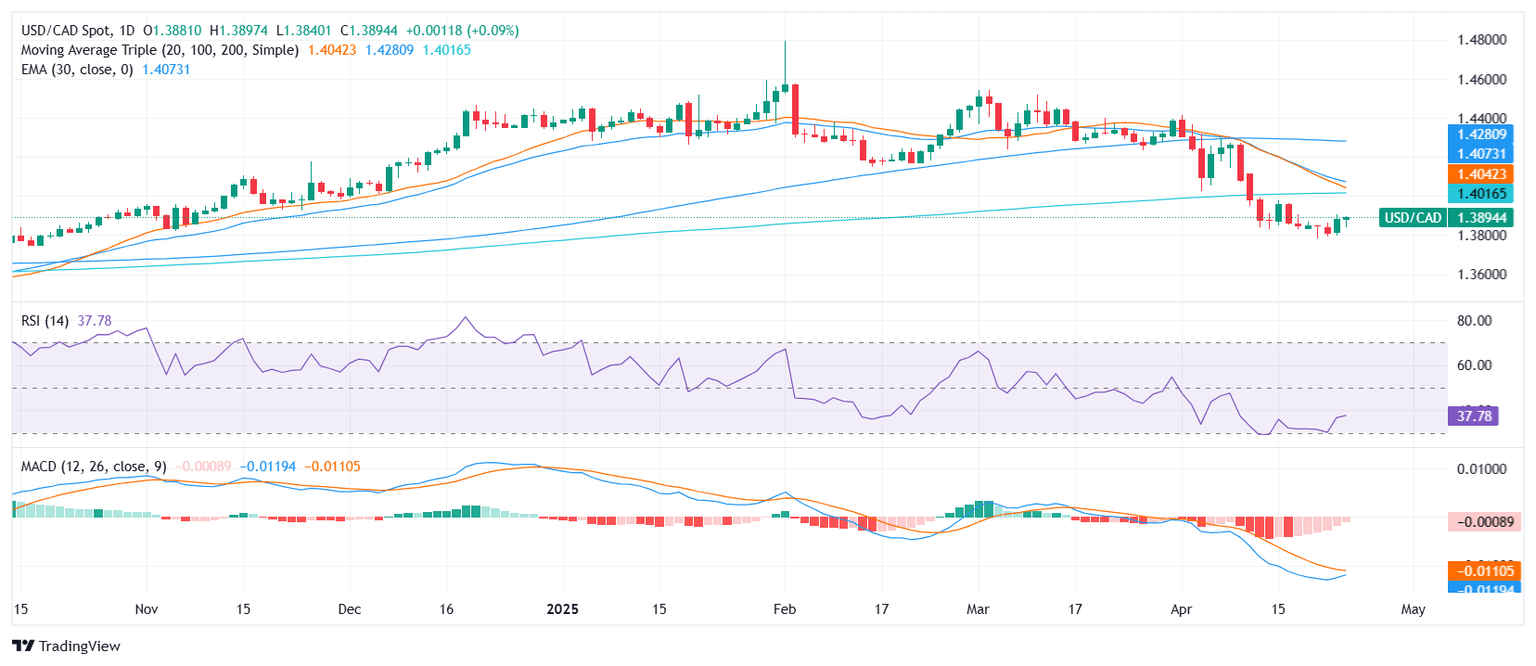

From a technical perspective, USD/CAD maintains a bearish tone. The Relative Strength Index (RSI) sits in neutral territory around 37 recovering from oversold conditions, while the Moving Average Convergence Divergence (MACD) continues to point lower. Momentum offers a slight counterweight with a mild buy signal, though the Stochastic %K remains subdued near oversold levels.

Trend-following indicators reinforce the downside bias. The 20-day, 100-day, and 200-day Simple Moving Averages, along with the 10-day and 30-day Exponential Moving Averages, are all sloping downward, capping upside attempts. Resistance is noted at 1.3905, followed by the 1.4002–1.4009 area, while support lies at 1.3865 and 1.3848. A clear break below this range could expose the pair to further downside, targeting the 1.3745 region next.

In summary, unless clearer progress emerges on trade talks or macro data significantly shifts expectations, USD/CAD may continue to drift within its current range, with risks tilted to the downside.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.