USD/CAD Price Analysis: Set for further downside below 1.3000

- USD/CAD keeps week-start break of weekly support, off intraday low.

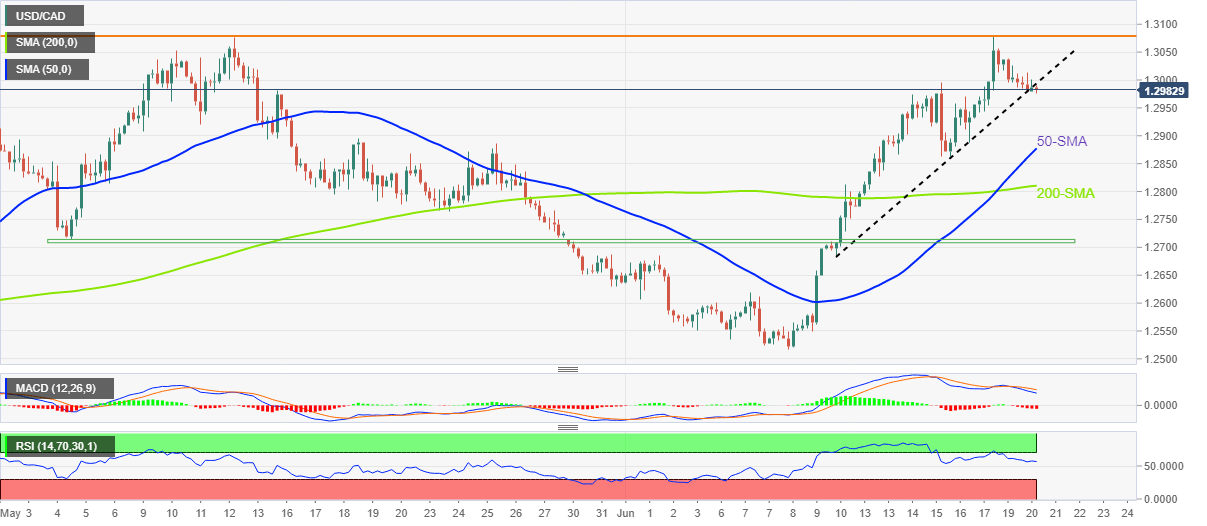

- Double tops around 1.3080 and downbeat oscillators keep sellers hopeful.

- Key SMAs can probe the downside ahead of six-week-old horizontal support.

- The late 2020 peak can lure the bulls on crossing 1.3080.

USD/CAD bounces off intraday low of 1.2975, at 1.2983 by the press time, as it extends the previous day’s losses during Tuesday’s Asian session.

In doing so, the loonie pair holds onto the downside break of a one-week-old ascending trend line, previous support, while keeping the Friday’s U-turn from a 19-month high.

It’s worth noting that the Loonie pair ticked up to refresh the multi-month high before reversing from 1.3075. In that process, the quote portrayed a double-top bearish chart pattern surrounding the 1.3080-75 area.

Hence, the double-top formation and a downbeat break of the immediate support, not to forget bearish MACD signals and descending RSI line, suggest the USD/CAD pair’s further downside.

As a result, the 50-SMA and the 200-SMA levels, respectively around 1.2880 and 1.2810, are likely luring the short-term bears before directing them to the horizontal area comprising multiple levels marked since early May around 1.2710.

On the contrary, recovery moves need to jump back beyond the support-turned-resistance line, close to 1.2990 by the press time, to recall the buyers. Also acting as an immediate upside filter is the 1.3000 psychological magnet.

Should the USD/CAD pair remains firmer past 1.3000, it can again aim to cross the 1.3080 hurdle, which in turn holds the key for a rally toward the latest 2020 levels surrounding 1.3175-80.

USD/CAD: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.