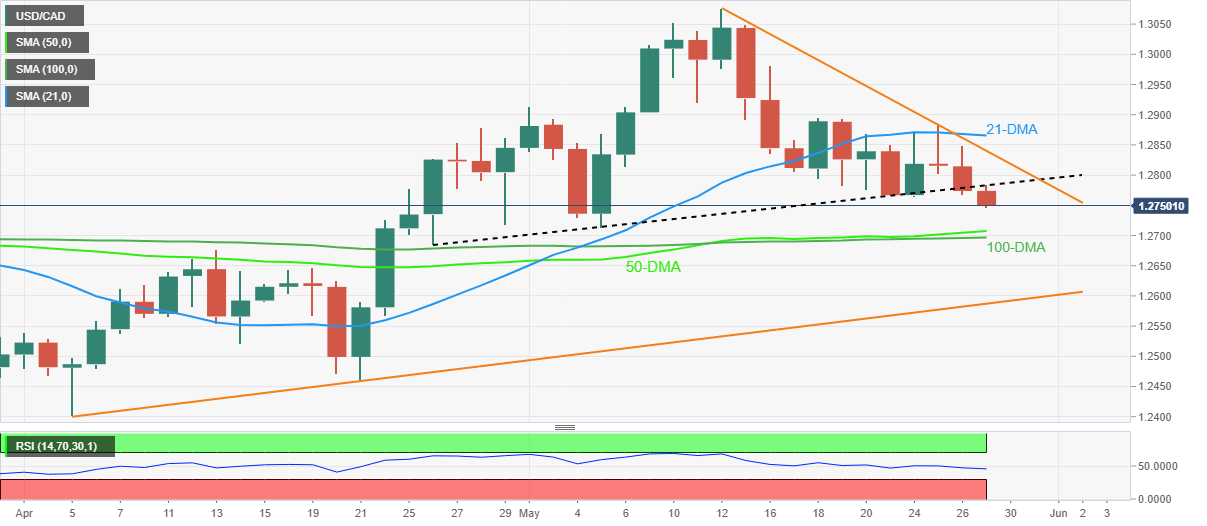

USD/CAD Price Analysis: Renews three-week low as bears eye 1.2700

- USD/CAD remains on the back foot around the lowest levels in three weeks.

- Break of monthly support, descending RSI keeps sellers hopeful.

- Bulls need to cross 21-DMA to retake control, 100/50-DMAs lure bears.

USD/CAD takes offers to refresh intraday low, also the lowest level in three weeks, as bears cheer a clear downside break of the monthly support. That said, the Loonie pair stays depressed at around 1.2750 by the press time of early Friday morning in Europe.

An absence of oversold RSI joins the aforementioned trend line breakdown to favor sellers targeting a convergence of the 100-DMA and the 50-DMA, near 1.2700-2690.

However, the USD/CAD weakness past 1.2690 appears difficult, which if taken place could direct the quote towards an upward sloping support line from April 05, close to 1.2585.

Meanwhile, the support-turned-resistance line from late April, near 1.2785, restricts the USD/CAD pair’s recovery moves.

Following that, a two-week-old resistance line and the 21-DMA, respectively around 1.2840 and 1.2865, will challenge the buyers.

Overall, USD/CAD bears are all set to refresh the monthly low but the key moving averages may restrict further declines.

USD/CAD: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.