USD/CAD Price Analysis: Drops to fresh low since February 2018

- USD/CAD stays offered near multi-month low, eyes further losses.

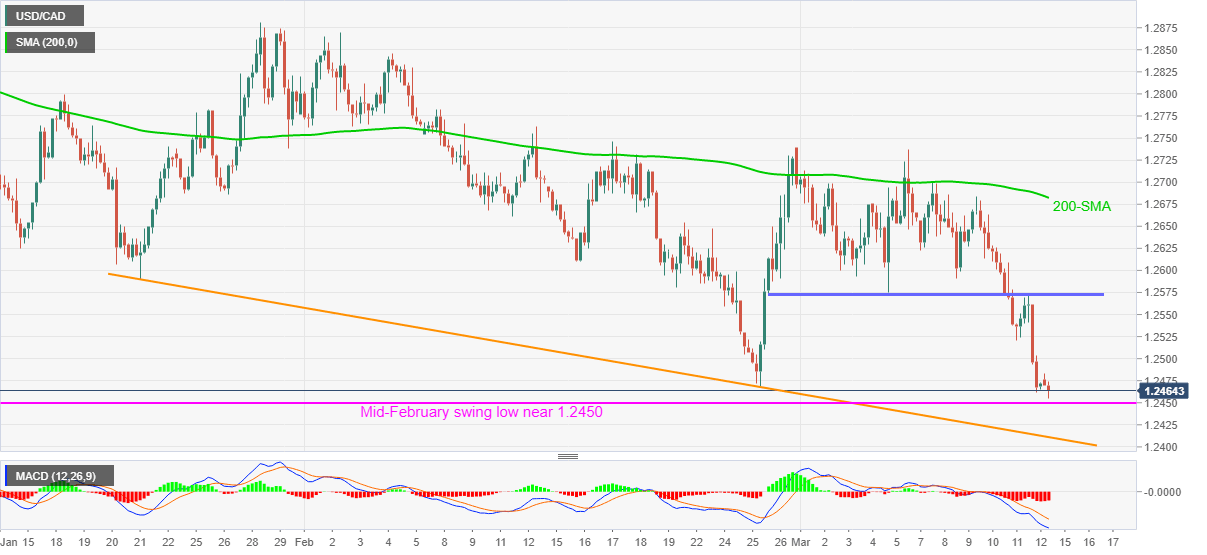

- Bearish MACD, failures to cross two-week-old horizontal resistance favor sellers.

- 200-SMA adds to the upside filters, descending support line from late January lures bears.

USD/CAD drops to the fresh 37-month low while taking offers near 1.2455 during early Monday. In doing so, the quote justifies the latest week’s downswing from short-term horizontal resistance amid bearish MACD.

The sellers are currently eyeing the mid-February lows near 1.2450 while keeping a downward sloping trend line from January 21, currently around 1.2410 on the table.

Should USD/CAD sellers refrain from stepping back around 1.2410, the year 2018 low near 1.2250-45 should return to the chart.

Meanwhile, the corrective pullback may eye to regain the 1.2500 threshold but multiple lows marked since February 25 near 1.2575 can question further recoveries.

Even if the USD/CAD bulls manage to cross the 1.2575 hurdle, which is less likely, the 200- SMA level of 1.2682 will be a tough nut to crack.

USD/CAD four-hour chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.