USD/CAD Price Analysis: Bulls are holding the fort at daily support

- USD/CAD bulls could be about to step in again at critical support.

- The 61.8% golden ratio is in view near 1.2650.

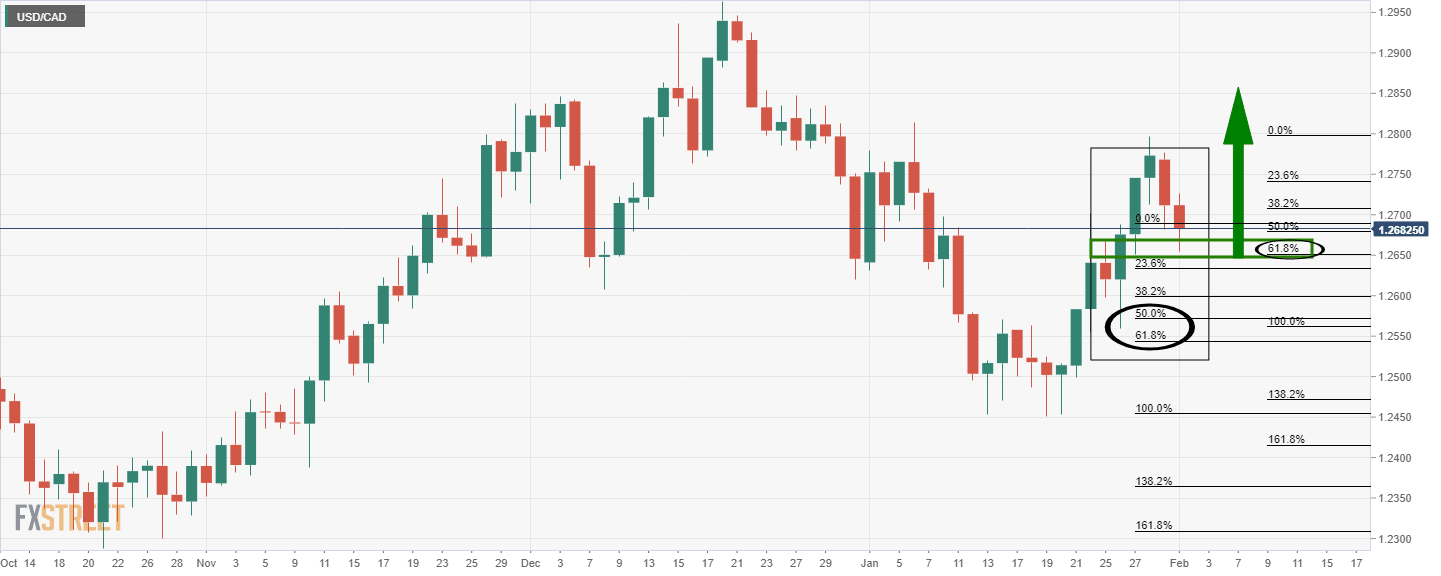

As per the prior analysis, USD/CAD Price Analysis: Bears have eyes on 61.8% golden ratio, the bears sank their teeth into the bullish rally and hit the 61.8% target. Since then, the bears gave way to the bulls and a fresh corrective high has been scored. This leaves prospects for a fresh surge to the upside depending on a number of conditions, as illustrated in the analysis below.

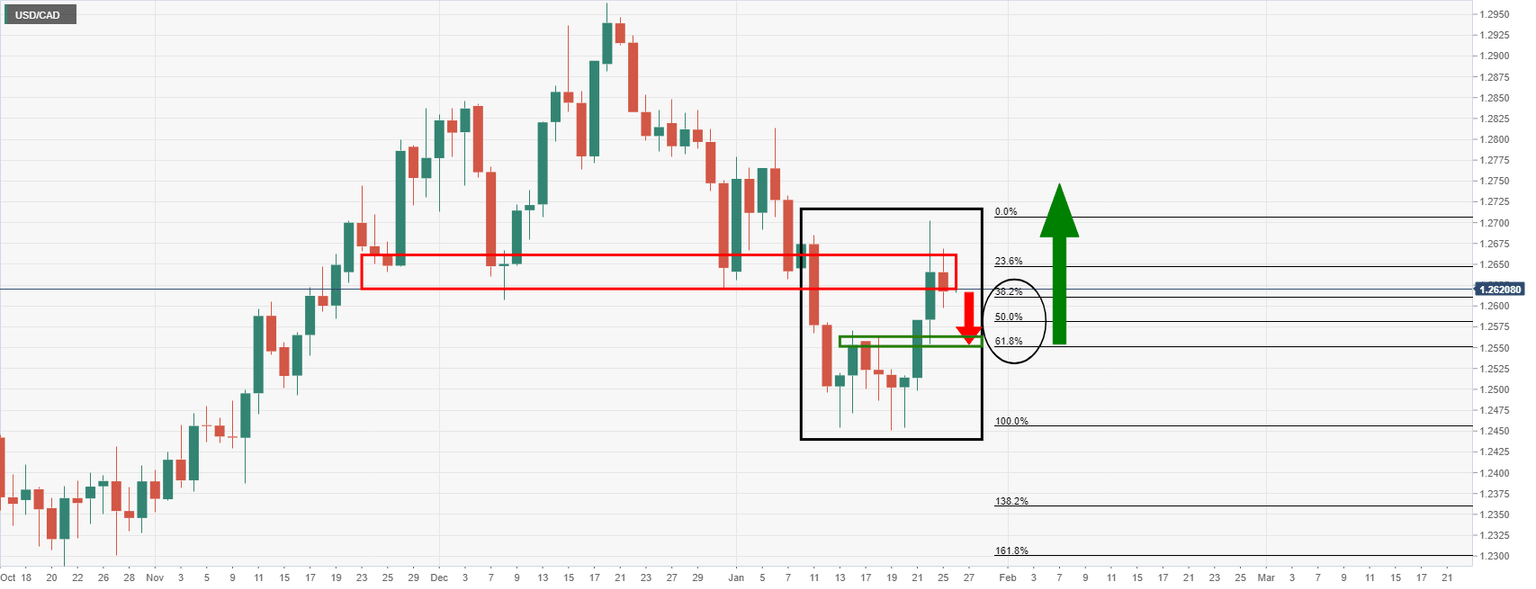

USD/CAD, prior analysis

The W-formation's neckline near the 61.8% Fibonacci level was a target area for the imbalance in price which has since been mitigated as follows:

As illustrated, the price tested the area near the neckline and rallied to score a fresh recovery high. The pair is now correcting that rally and is on the verge of making another 61.8% ratio retracement towards 1.2650. If this zone holds, then there will be prospects for an upside extension in the coming days.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.