USD/CAD Price Analysis: Bears in control and eye lower to 1.3320

- US Dollar under pressure, commodities up.

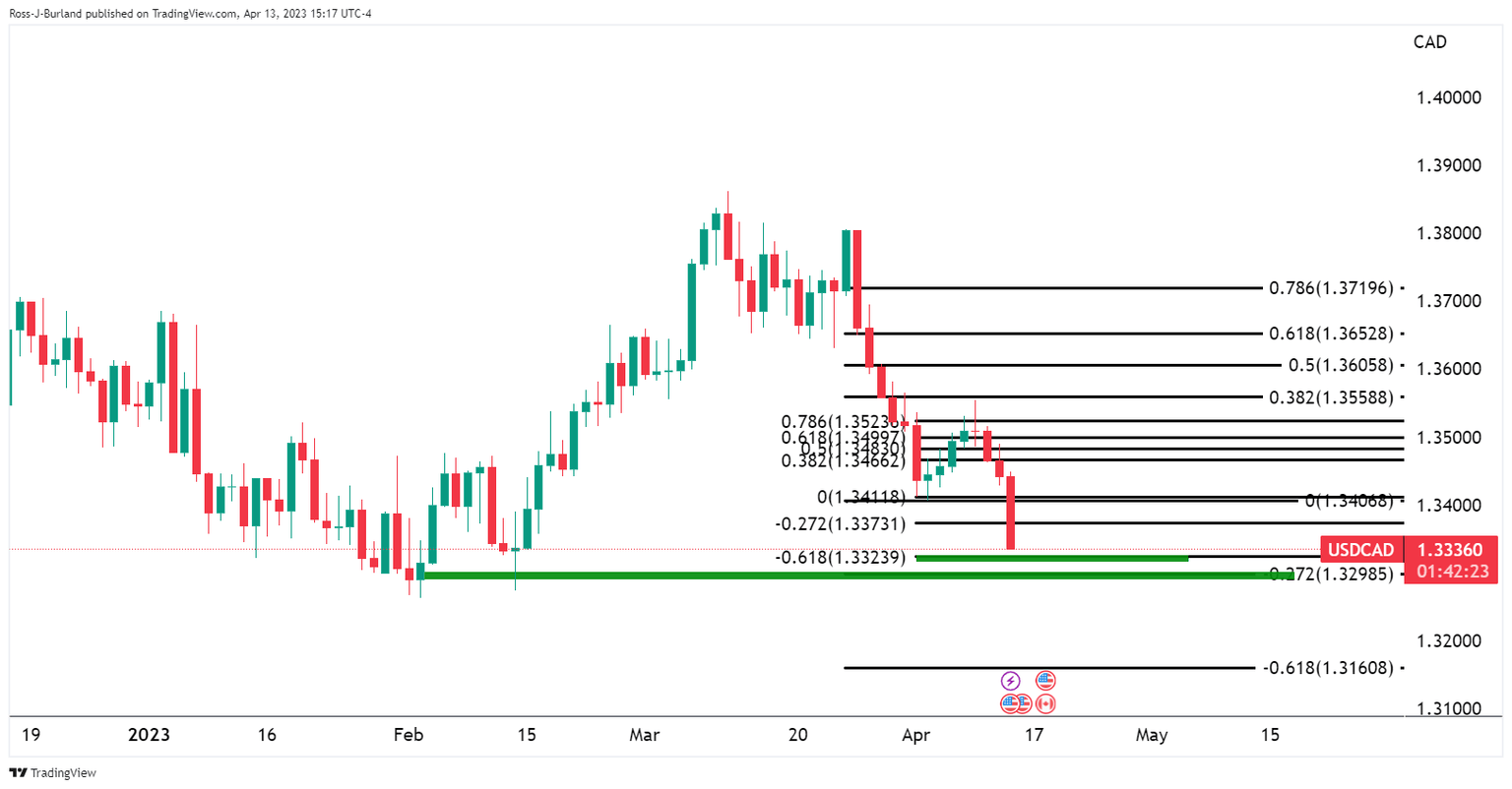

- USD/CAD bears eye 1.3320 for the coming sessions and lower for the upcoming days.

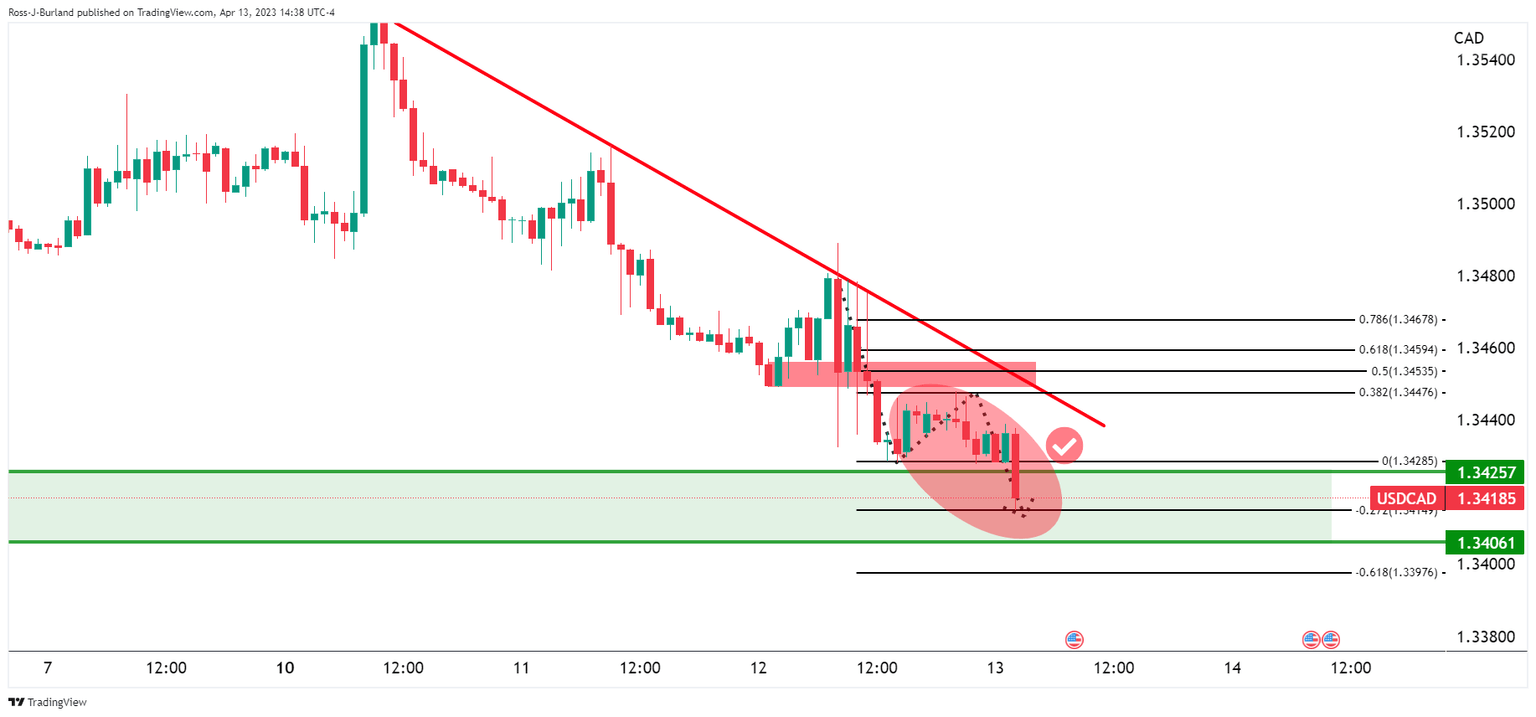

In the prior analysis, USD/CAD Price Analysis: Bears are in the market and eye test of 1.3400, which arrived at a bearish bias, it stated that on the hourly chart, ´´we can see that the price is being rejected at old support again. A 38.2% Fibonacci retracement aligns with prior support that would be expected to act as resistance on a restest while the bears commit to the front side of the bearish trend. This in turn could lead to an additional push lower and into the target area of the 1.3400s.´´

USD/CAD prior analysis

USD/CAD H1 chart

USD/CAD, live updates

As illustrated, the price dropped into the target on the test of the 38.2% Fibonacci retracement in a textbook outcome.

Meanwhile, the US Dollar came under further pressure on Thursday and markets have jumped at the opportunity to long commodities as per the following CRB chart:

As such, the Canadian Dollar has found support, sending USD/CAD down like a stone and in line with the prior analysis:

Before:

After:

The forecast is into the 1.3270s for the coming days on a break of 1.3320:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.