USD/CAD Price Analysis: Bears are in control and target a break of daily lows

- USD/CAD bears are in the market and target the 1.3440-50s.

- A break below 1.3440 opens the risk to test 1.3400 prior lows and bearish extensions as per the weekly chart.

USD/CAD bears are taking out key structure in what could be the beginnings of a bearish extension for the days and weeks ahead as the following top-down analysis illustrates.

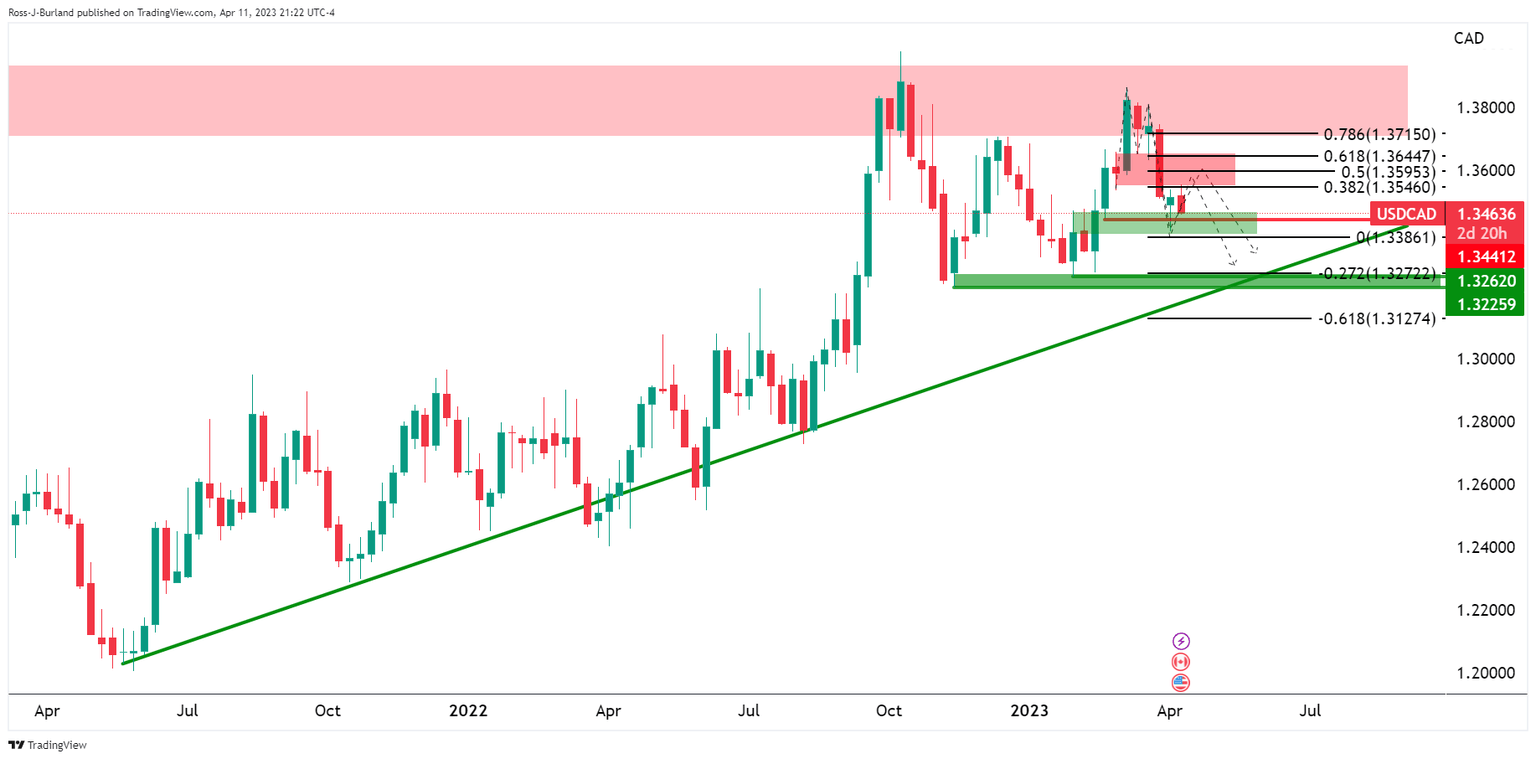

USD/CAD weekly chart

The M-formation is a reversion pattern but the bears are in control and the current candle is not going in the ´direction of the neckline for a restest. Instead, we could be in for a downside extension and a break of last week´s lows:

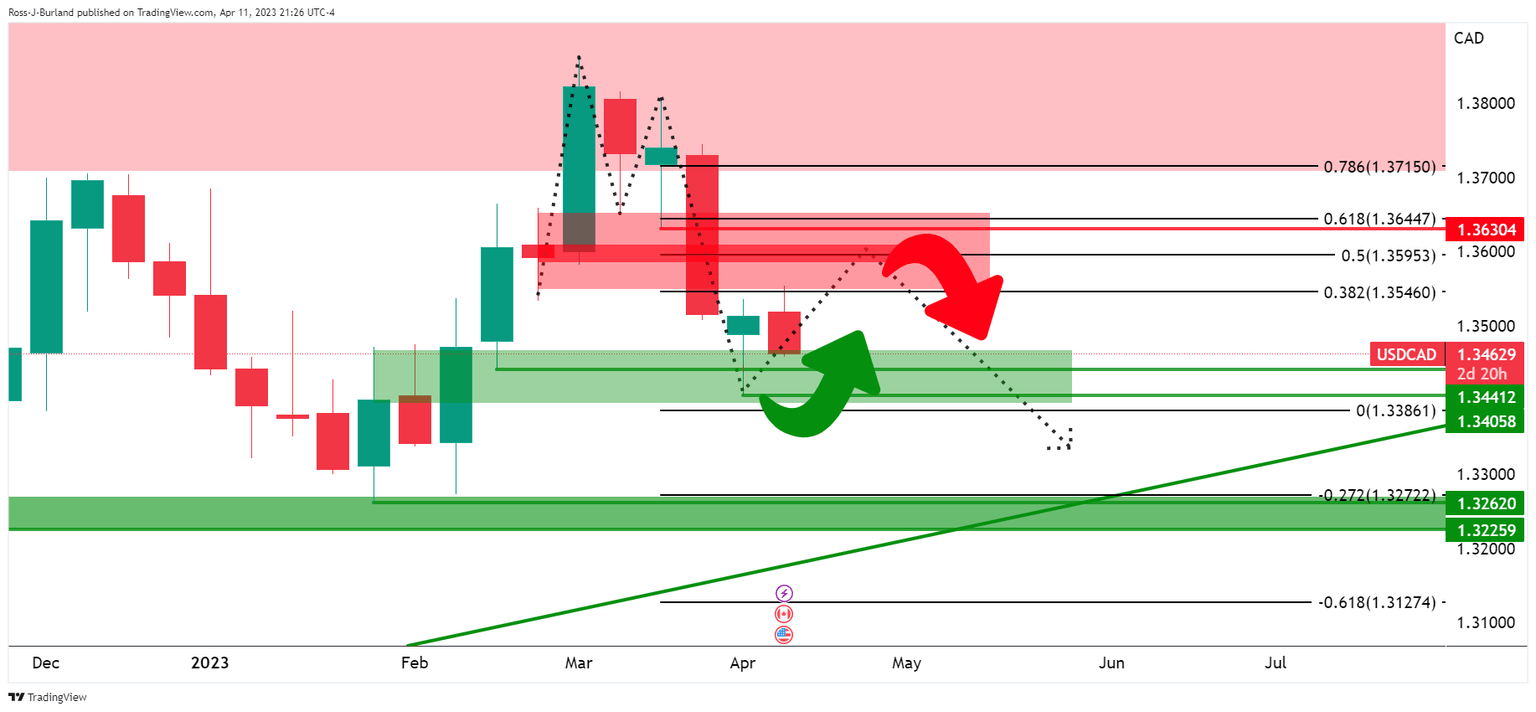

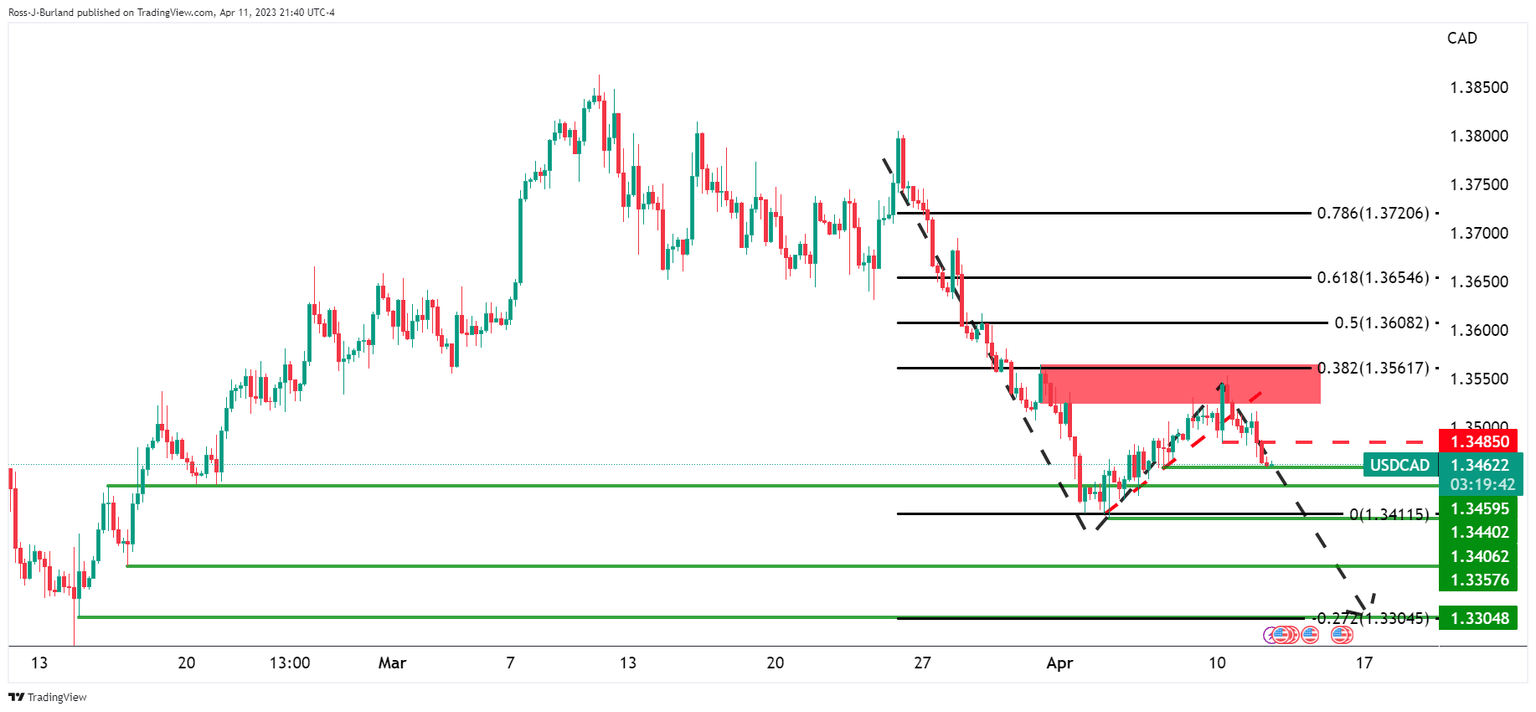

USD/CAD daily chart

The daily chart´s prior bearish impulse of six days of consecutive bear closes has seen a correction towards the 38.2% Fibonacci retracement of that bearish run/impulse. While a fuller test of the Fibo scale is more desirable, there is a significant possibility that the bears will stay the course and break below the recent lows for a bearish extension.

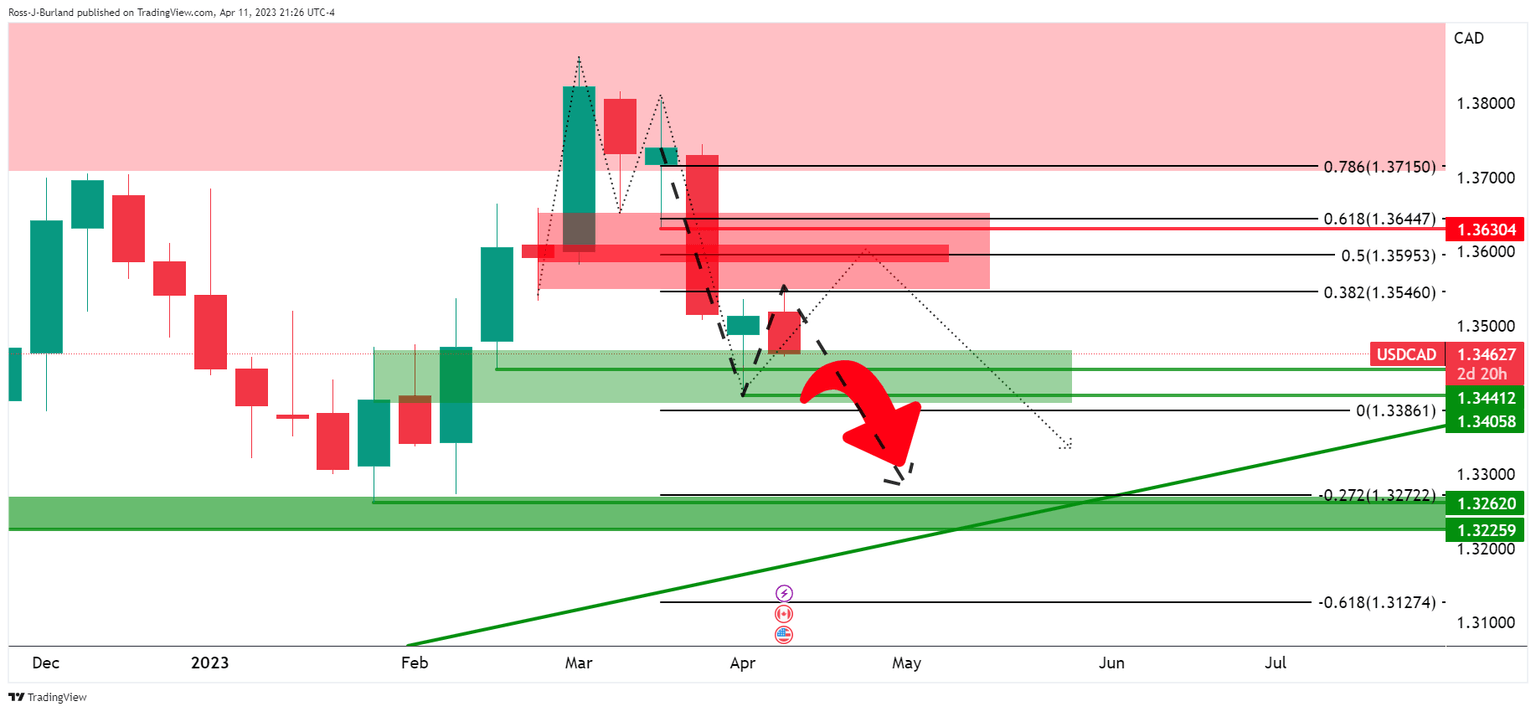

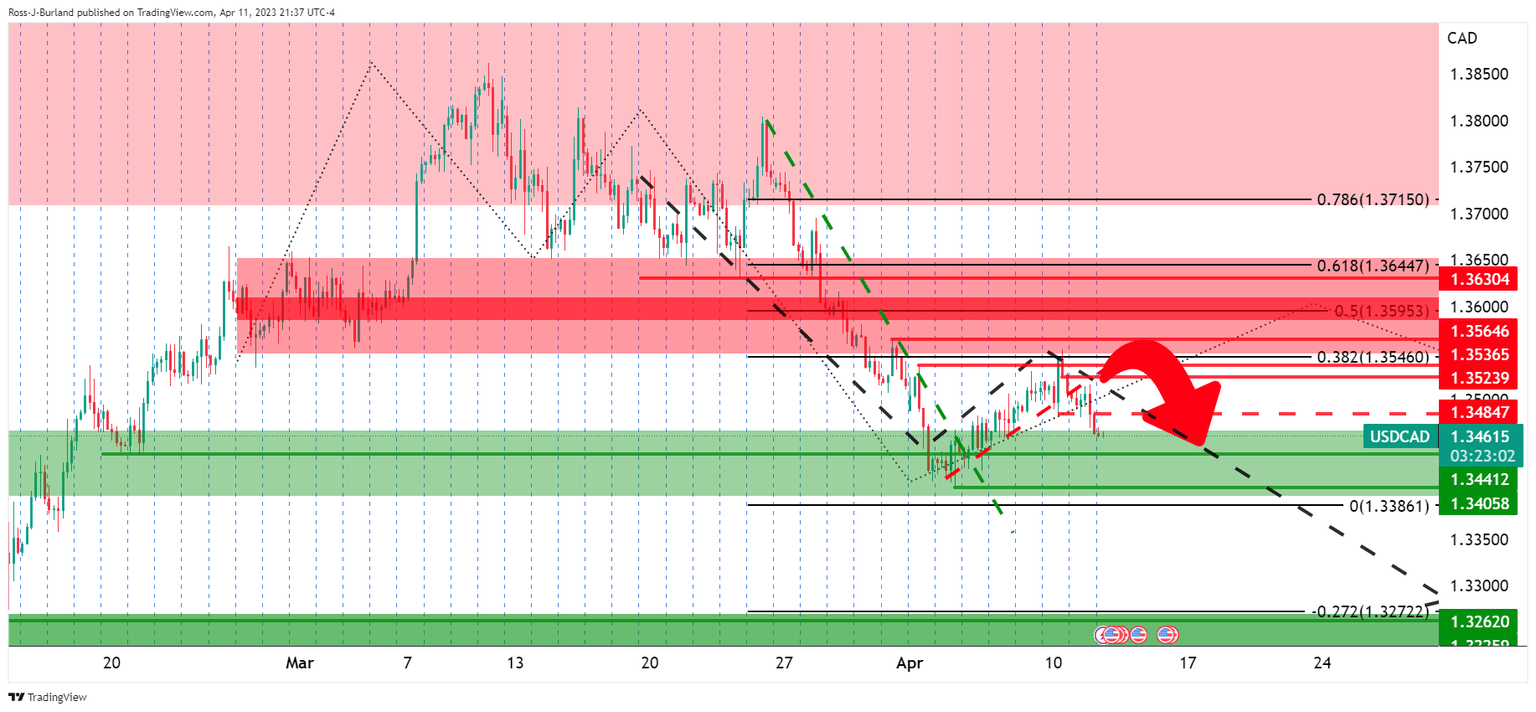

USD/CAD H4 charts

Let´s tidy this up:

A slightly cleaner four-hour chart offers a better perspective of the market structure as above. The price was meeting resistance very close to the daily 38.2% Fibonacci as already mentioned and is now breaking 4-hour structure to the downside, as illustrated more clearly below:

The price is on the back side of the prior 4-hour bullish trend/correction, and the M-formation can be regarded as a topping pattern. The neckline of the pattern might act as resistance on a pullback and lead to a subsequent lower low to target the 1.3440-50s.

A break below 1.3440 opens the risk to test 1.3400 prior lows and bearish extensions as per the weekly chart, as illustrated at the beginning of this top-down analysis.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.