USD/CAD fits below 1.3600 as US Biden compromises budget spending for debt-ceiling raise

- USD/CAD has shifted its auction below 1.3600 after a modification in the US debt structure.

- Fresh incoming data is advocating for more interest rate hikes by the Federal Reserve.

- Resilience in the Canadian economy could force the Bank of Canada to start hiking interest rates again.

- USD/CAD asset has dropped after facing barricades around the horizontal resistance placed from April 26 high at 1.3651.

USD/CAD has shifted its auction below the round-level support of 1.3600 in the early European session. The Loonie asset has faced intensive selling pressure after a sharp decline in appeal for the US Dollar Index (DXY). The USD Index lost its appeal after US President Joe Biden comprised the scale of spending initiatives proposed for the budget for approving a raise in the United States borrowing cap limit to avoid default. US Treasury Secretary Janet Yellen already warned Congressional leaders that the Federal government could default by June 05 on obligated payments.

S&P500 futures have surrendered at least half of gains generated in early Asia after US President Joe Biden announced that an agreed deal on the US debt-ceiling is going to Congress. Investors have trimmed their positions in US equities as the US markets will remain closed on Monday on account of Memorial Day.

The US Dollar Index (DXY) has refreshed its day’s low at 104.11 after retreating from 104.20. The USD Index is struggling to firm its feet despite chances of further policy-tightening by the Federal Reserve (Fed). The street is anticipating more interest rate hikes from the Federal Reserve after a rebound in consumption expenditure by US households.

Modification in US debt structure trims appeal for USD Index

Vigorous negotiations among White House officials and House of Representatives Kevin McCarthy-led team concluded in early Asia after US President Joe Biden agreed to downsize the scale of spending initiatives proposed for the budget for raising the US debt-ceiling limit. The $31.4 trillion US borrowing limit has received approval for two years and fears of a default situation for the United States economy have faded. The White House agreed to cut spending for the budget but remained stubborn for neither cutting on health coverage nor increasing poverty.

Investors should note that an increase in the US debt-ceiling would attract credit rating agencies, which would downgrade the long-term credibility of the US economy. This may have a significant impact on the US Dollar Index (DXY) and US equities.

Increase in consumer spending to force the Federal Reserve to remain hawkish

The expectations for a pause in the policy-tightening spell by the Federal Reserve (Fed) were extremely solid last week after Federal Reserve chair Jerome Powell announced that more rate hikes are less appropriate as tight credit conditions by US regional banks are weighing significant pressure on inflation.

Firms are struggling to fetch credit for augmenting working capital requirements, which has forced them to rely on less production capacity. However, the recent US Personal Consumption Expenditure (PCE) Price Index (April) showed that households’ spending is resilient despite the higher cost of living. The monthly headline and core PCE Price Index accelerated by 0.4%, higher than anticipated by market participants. Also, US Durable Goods Orders data expanded by 1.1% while the street was anticipating a contraction by 1.0%. Fresh incoming data is advocating for more interest rate hikes by the Federal Reserve.

Canada’s GDP figures in spotlight

A power-pack action is anticipated from the Canadian Dollar, this week, amid the release of the Gross Domestic Product (GDP) data, which will release on Wednesday. As per the preliminary report, monthly GDP (March) is seen contracting by 0.1% vs. an expansion of 0.1% recorded in February. Q1 and annualized GDP are seen significantly expanding by 0.4% and 2.1% respectively vs. a stagnant performance.

Resilience in the Canadian economy could force Bank of Canada (BoC) Governor Tiff Macklem to start hiking interest rates again. Investors should be aware that the Bank of Canada is keeping its interest rates steady from March considering that the current monetary policy is restrictive enough to tame stubborn inflation.

USD/CAD technical outlook

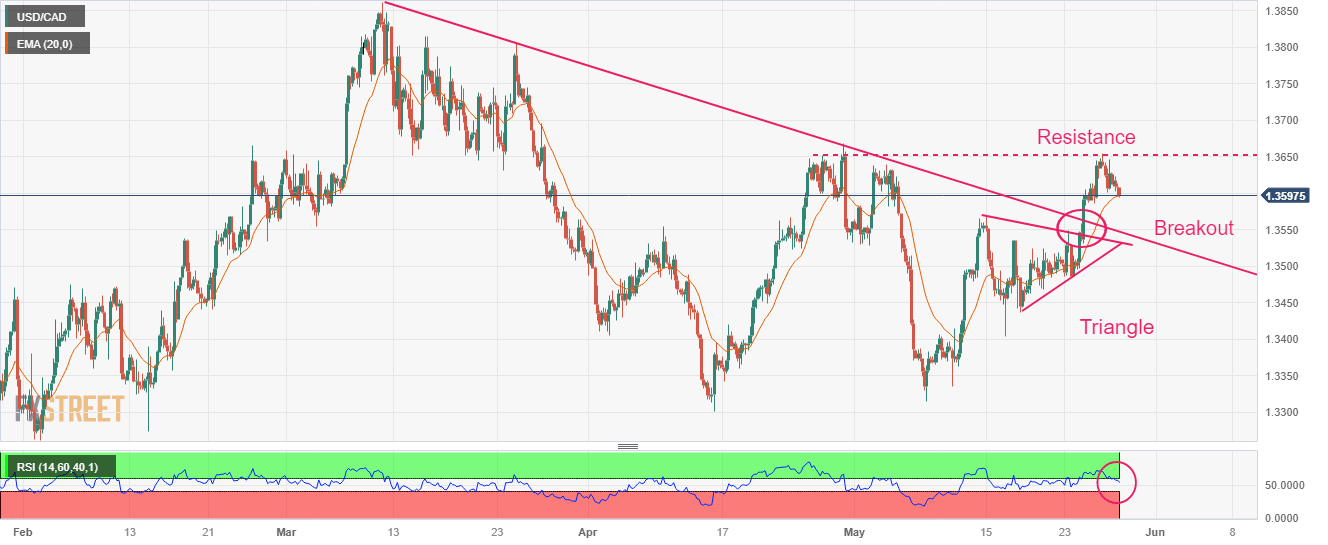

USD/CAD showed a stellar upside action after a breakout of the Symmetrical Triangle formed on a four-hour scale. The US Dollar bulls got strength after climbing above the downward-sloping trendline plotted from March 10 high at 1.3862. After an upside move, the Loonie asset has dropped after facing barricades around the horizontal resistance placed from April 26 high at 1.3651.

The asset has shown a mean-reversion move to near the 20-period Exponential Moving Average (EMA) at 1.3594.

A range shift move by the Relative Strength Index (RSI) (14) into the 40.00-60.00 territory from the bullish zone of 40.00-60.00 indicates a loss in the upside momentum.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.