US Election 2024: Trump takes must-win North Carolina, Republicans win Senate control

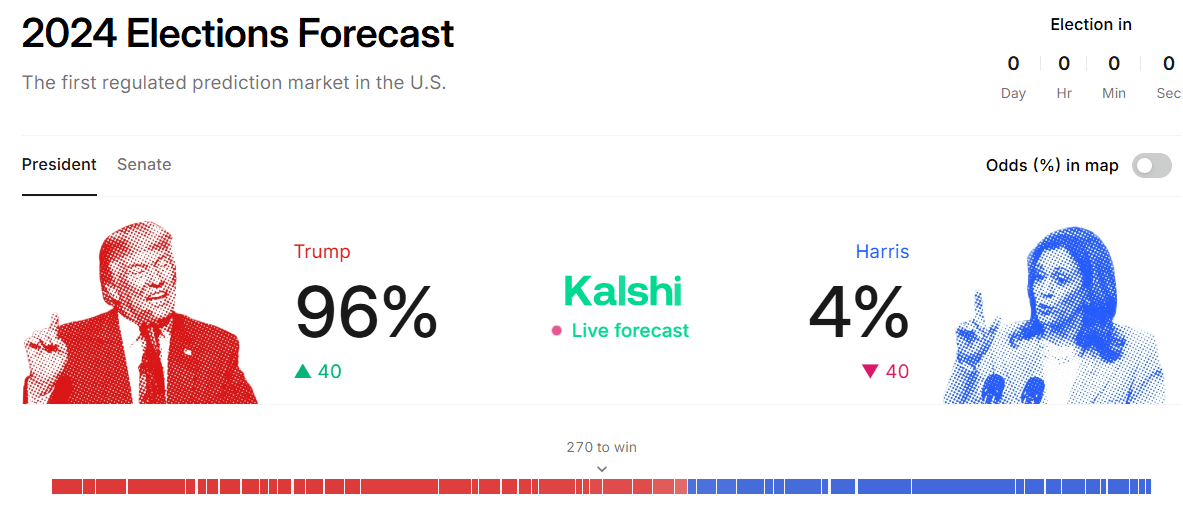

Republican nominee Donald Trump is leading the US presidential race, most likely to become the 47th president, outperforming Democratic nominee Kamala Harris in most of the battleground states after taking the must-win swing state of North Carolina. The resurgence of Trump trades has supported the renewed upside in the US Dollar (USD) and global stocks.

The current electoral vote tally is 227 for Trump and 189 for Harris, with the former US President taking hold of the other swing states - Arizona, Georgia, Michigan, Pennsylvania and Wisconsin. Fox News called a Trump victory for Pennsylvania and Wisconsin.

Meanwhile, Fox News also called Republicans in control of the US Senate. Republicans won a key Senate seat in Ohio, with Trump-endorsed nominee Bernie Moreno projected to defeat Democratic Sen. Sherrod Brown, according to CNN News, flipping yet another seat for the (Grand Old Party) GOP.

The main focus is on the control of the House. If Democrats take the House majority, it could be a ‘divided government, causing policy gridlock for the likely Trump administration. Democrats need to flip just four seats to win control of the lower chamber.

However, it appears that Republicans are still defending the control of the House by a narrow majority.

Market reaction

The US Dollar is consolidating the latest upswing against its major rivals. At the press time, the US Dollar Index (DXY) is trading at around 104.90, still adding 1.40% on the day.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.