US Dollar trims gains after Powell's comments

- The Federal Reserve leaves interest rates unchanged at 4.5%, aligning with market expectations.

- FOMC dot plot signals rate cuts, with the median forecast for 2025 revised down to 3.375%.

- DXY pares daily gains after Powell highlights uncertainty in economic forecasts and policy adjustments.

The US Dollar Index (DXY) initially gained traction near 104.00 after the Federal Reserve decided to keep its benchmark interest rate at 4.5%, maintaining a cautious stance amid evolving inflation and economic conditions. The latest FOMC dot plot revealed that policymakers expect a median rate of 3.875% for the current period, down from the prior 4.375%, reinforcing expectations of future rate cuts.

Looking ahead, the Fed revised its 2025 rate forecast lower to 3.375%, a signal of potential policy easing in response to slower economic growth and elevated inflation projections. GDP expectations for 2025 have been downgraded to 1.7% from 2.1%, while unemployment is now forecasted at 4.4%, suggesting a softer labor market outlook. Additionally, the Fed announced a slower balance sheet runoff starting in April, adjusting its quantitative tightening approach.

However, the US Dollar Index trimmed part of its gains following Federal Reserve Chair Jerome Powell’s press conference. Powell acknowledged heightened uncertainty in economic forecasts and emphasized that policy is not on a preset course. He reiterated that the Fed is in no rush to adjust rates, preferring to wait for more clarity on economic conditions.

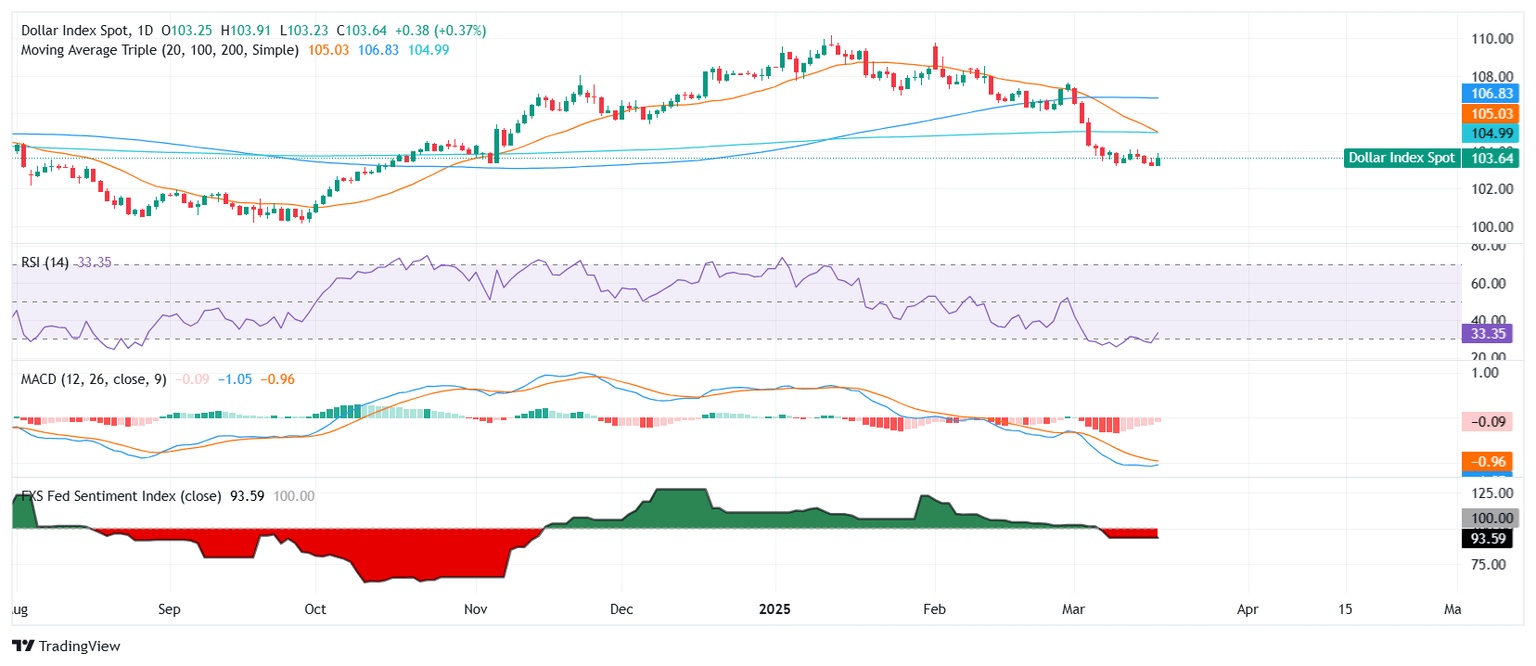

Powell also addressed concerns about inflation, noting that goods inflation has increased, and the impact of tariffs remains difficult to assess. While he downplayed immediate policy implications from tariff increases, he admitted that uncertainty surrounds their effect on price pressures. His comments reinforced the Fed’s data-dependent approach, prompting a slight pullback in the US Dollar. In the meantime, on the daily chart, the Fed's sentiment index remain in dovish terrain which seems to be adding pressure to the USD.

DXY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.