US Dollar set for a weekly loss over 1.5% in horror January Retail Sales result

- The US Dollar dives lower in the US Retail Sales aftermath and is set to close out the week at a loss.

- Almost a full -1 % slide in headline Retail Sales for January spells domestic issues for President Trump.

- The US Dollar Index (DXY) drops substantially below 107.00 and is on its way to 106.50.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, is devaluing substantially towards 106.50 at the time of writing, amounting to over 1.5% loss on the week since Monday. United States (US) President Donald Trump might be facing his first domestic challenge next to the egg-crisis, with now even US Retail Sales starting to turn over big time. With a whopping -0.9% decline in January headline sales and a surprise decline in Sales excluding cars and transportation by -0.4%, it becomes clear that the US consumer is clearling keeping his money aside for a rainy day.

The economic calendar will start to shift as of now to next week> Investors will focus on the S&P Global Purchase Managers Index (PMI) preliminary data for February due on Friday 21. Meanwhile the weekend could get interesting in case President Donald Trump releases more headlines or actions on tariffs, Ukraine or other topics.

Daily digest market movers: Retail sales look bleak

- Here are the most important data releases for this Friday:

- January Import/Export came out, with the monthly Export Price Index rising to 1.3%, beating the 0.3% expected, while the Import Price Index fcame in at 0.3%, missing the estimate from 0.4% compared to resived 0.2% in December.

- January Retail Sales shrank by 0.9% compared to the expected 0.1% contraction, a wide decline from the revised up 0.7% growth in December. Retail Sales without Cars and Transportation contracted by 0.4%, a big disappointment from the expected 0.3% growth and the revised 0.7% in the previous month.

- Equities are taking a turn for the worse and are all sliding in red numbers across the board with both European and US indices in red numbers just before the US opening bell.

- The CME FedWatch tool shows a 57.4% chance that interest rates will remain unchanged at current levels in June. This suggests that the Fed would keep rates unchanged for longer to fight against persistent inflation.

- The US 10-year yield is trading around 4.47%, a nosedive move over just two days time from this week’s high of 4.657%.

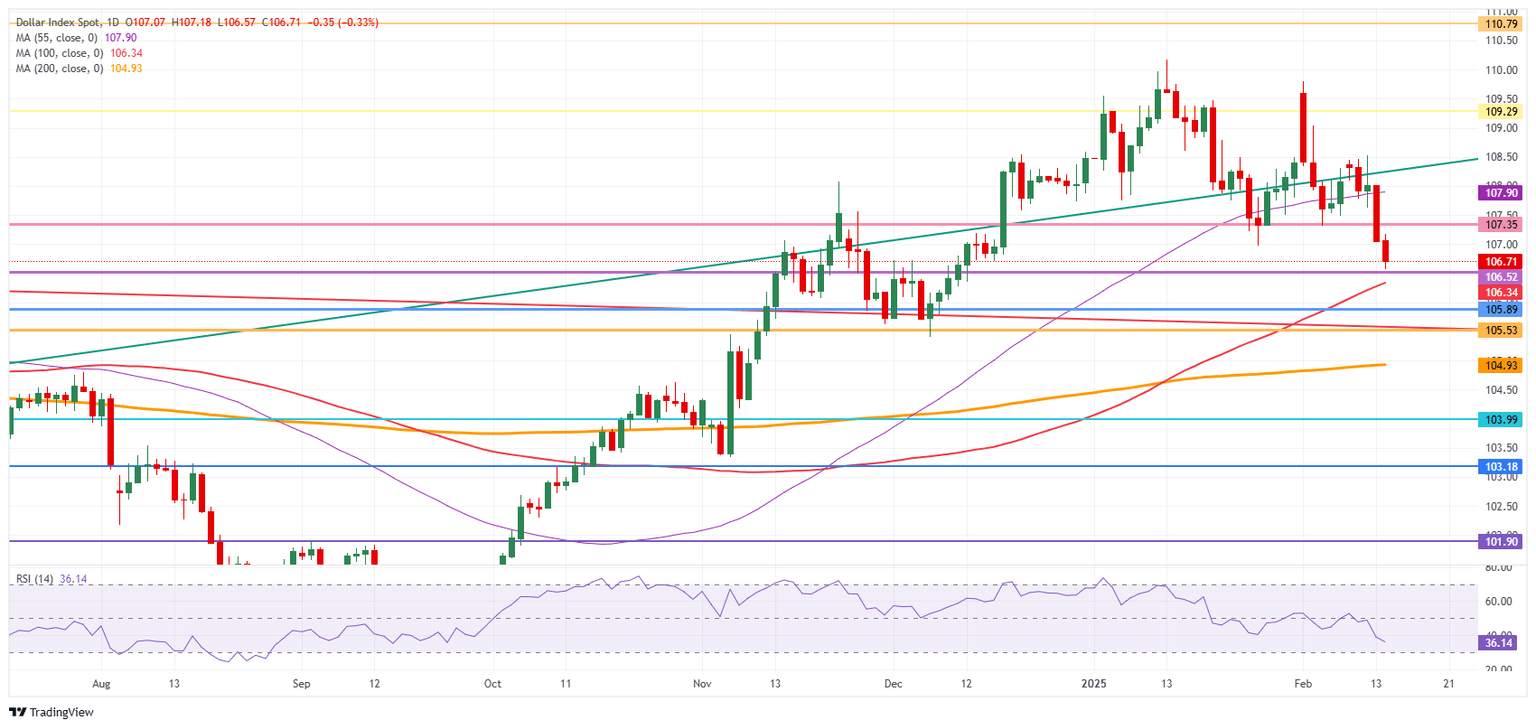

US Dollar Index Technical Analysis: Next leg lower

The US Dollar Index (DXY) is done for this week. A clear weekly loss is unavoidable, and the strong resistance at 107.35 is far away. From here, the DXY is technically handed over to the mercy of the moving averages and the Relative Strength Index (RSI), which is still bearing plenty of room for more downturn. The 200-day Simple Moving Average (SMA), trading around 104.93, might be the one to look out for.

On the upside, that previous support at 107.35 has now turned into a firm resistance. Further up, the 55-day SMA at 107.90 must be regained before reclaiming 108.00.

On the downside, look for 106.52 (April 16, 2024, high), 106.34 (100-day SMA), or even 105.89 (resistance in June 2024) as better support levels. Even though the RSI shows room for more downside, the 200-day SMA at 104.93 could be a possible outcome.

US Dollar Index: Daily Chart

BRICS FAQs

The BRICS is the acronym denoting the grouping of Brazil, Russia, India, China and South Africa. The name was created by Goldman Sachs’ economist Jim O’Neill in 2001, years before the alliance between these countries was formally established, to refer to a group of developing economies that were predicted back then to lead the global economy by 2050. The bloc is seen as a counterweight to the G7, the group of developed economies formed by Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

The BRICS is a bloc which intends to give voice to the so-called “Global South”. The alliance tends to have similar views on geopolitical and diplomatic issues, but still lacks a clear economic integration as the governing systems and cultural divergence between its members is significant. Still, it holds yearly summits at the highest level, coordinates multilateral policies and has implemented initiatives such as the creation of a joint development bank. Egypt, Ethiopia, Iran and the United Arab Emirates joined the group in January 2024.

The five founding members of the BRICS alliance account for 32% of the global economy measured at purchasing power parity as of April 2023, according to data from the International Monetary Fund. This compares with the 30% of the G7 group.

There has been increasing speculation about the BRICS alliance creating a currency backed by some sort of commodity like Gold. The proposal is meant to reduce the use of the dominant US Dollar in cross-border economic exchanges. In the BRICS’ 2023 summit, the group stressed the importance of encouraging the use of local currencies in international trade and financial transactions between the members of the bloc as well as their trading partners. The group also tasked finance ministers and central bank governors “to consider the issue of local currencies, payment instruments and platforms” for this purpose. Even if the bloc’s de-dollarization strategy looks clear, the creation and implementation of a new currency seems to have a long way to go.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.