US Dollar flat with markets remaining calm after messy CPI release

- The US Dollar trades flat this Thursday in the US CPI release aftermath.

- Markets were rather struggling with the Jobless Claims which are distorted due to the hurricanes passing.

- The US Dollar Index trades above 102.50 and looks for support for now.

The US Dollar (USD) sees its rally stalling for now after the release from the US Consumer Price Index (CPI) data and the weekly Jobless Claims. Main takeaway is that all CPI components are coming in higher than expected, and is halting the disinflationary trajectory for now. Algo's sent the Greenback all over the place in the first seconds after CPI and Jobless Claims came in, because the higher Claims data was seen by the algo's as a negative factor for the US Dollar, while that number is out of context due to the hurricanes hitting the southern states in the US.

The economic calendar the Federal Reserve is up next with Ban kof New York President John Williams and Federal Reserve Governor Lisa Cook. Any comments from them might guide markets a bit more on this small uptick in the US inflation release. Fast forward to Friday then with markets facing the Producer Price Index and Prelimenary University of Michigan readings for September.

Daily digest market movers: Fed speakers to guide

- US Treasury rates are rallying and are outpacing other sovereign rates, which means that rate differentials are widening again between the US and several other countries. This supports a stronger US Dollar across the board.

- At 12:30 GMT, volatility picked up with these numbers:

- US Consumer Price Index data for September:

- Monthly core inflation grew by 0.3%, unchanged from August.

- In line with the core reading, monthly headline inflation saw the same print as in August at 0.2%..

- Yearly core inflation rose to 3.3%, coming from 3.2%. The Yearly Headline component was the only one to remain in disinflation by coming in at 2.4%, from 2.5%.

- Initial Jobless Claims spiked higher to 258,000, coming from 225,000 previous week. Main reason seems to be the hurricanes hitting big parts of the US.

- US Consumer Price Index data for September:

- Near 13:15 GMT, Federal Reserve Governor Lisa Cook delivers a speech about entrepreneurship and innovation at the Women for Women Summit organized by the College of Charleston School of Business in Charleston, South Carolina. Cook is considered rather dovish in terms of policy stance.

- At 15:00 GMT, Federal Reserve Bank of New York President John Williams delivers keynote remarks at an event organized by Binghamton University in New York. Williams is considered neutral in terms of policy stance.

- European and US equities are not happy with these US inflation numbers. European indices are heading into small losses while US equities are descending further on the day.

- The CME Fedwatch Tool shows an 80.1% chance of a 25 bps interest rate cut at the next Fed meeting on November 7, while 19.9% is pricing in no rate cut. Chances for a 50 bps rate cut have been fully priced out now.

- The US 10-year benchmark rate trades at 4.06%, of its nearly two-month high for now.

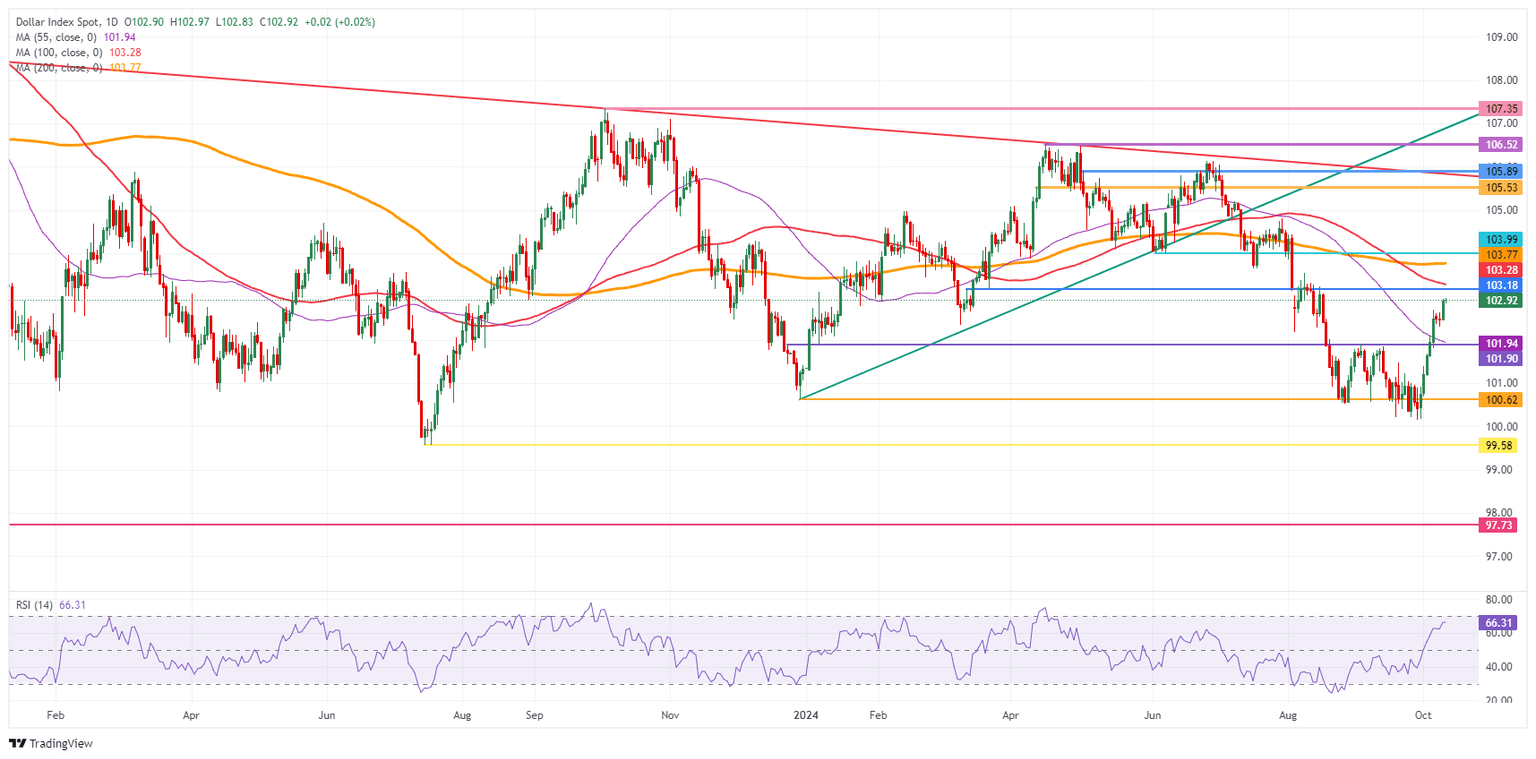

US Dollar Index Technical Analysis: Rates in the driving seat again

The US Dollar Index (DXY) knows no limits and rallies higher again on Thursday ahead of the US CPI release. With the US rates rallying, it should become clear that markets are starting to put less faith in the Fed being in a rate-cut cycle. The elevated levels and probabilities of no more bigger rate cuts this year could mean a rallying Greenback going into the US elections.

The psychological 103.00 is the first level to tackle on the upside. Further up, the chart identifies 103.18 as the very final resistance level for this week. Once above there, a very choppy area emerges, with the 100-day Simple Moving Average (SMA) at 103.28, the 200-day SMA at 103.77, and the pivotal 103.99-104.00 levels in play.

On the downside, the 55-day SMA at 101.94 is the first line of defence, backed by the 102.00 round level and the pivotal 101.90 as support to catch any bearish pressure and trigger a bounce. If that level does not work out, 100.62 also acts as support. Further down, a test of the year-to-date low of 100.16 should take place before more downside. Finally, and that means giving up the big 100.00 level, the July 14, 2023, low at 99.58 comes into play.

US Dollar Index: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.