US Dollar Index stays bid around 95.70, looks to data

- The index kicks in the week on an optimistic mood.

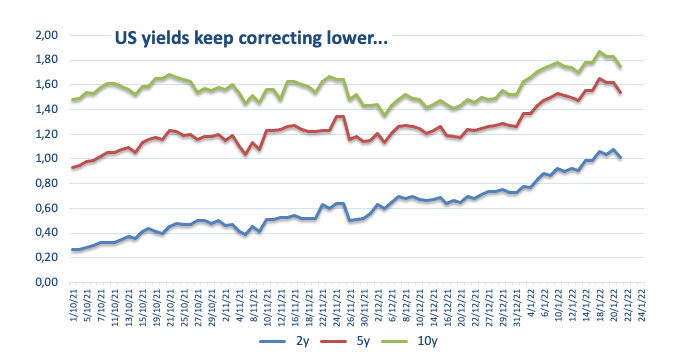

- US yields extend the corrective downside on Monday.

- Flash Markit’s PMIs next of note in the US calendar.

The greenback, in terms of the US Dollar Index (DXY), manages to reverse Friday’s pullback and resumes the upside at the beginning of the new trading week.

US Dollar Index focuses on yields, data, geopolitics

The index extends the consolidative theme in the upper end of the consolidative phase for yet another session on Monday, always tracking the price action in the US money markets, geopolitics and the broad risk appetite trends.

The greenback remains vigilant, albeit so far apathetic when it comes to reaction in prices, on the developments from the US-Russia-Ukraine conflict, where the latest US-Russia talks yielded no progress on this front.

In the meantime, US yields extend the move lower after hitting fresh tops earlier in the past week amidst some profit taking mood and the persistent adjustment from investors to the prospects of a sooner-than-anticipated Fed’s lift-off.

In the US data space, the Chicago Fed National Activity Index is due in the first turn seconded by the more relevant advanced PMIs measured by Markit for the month of January.

What to look for around USD

Despite Friday’s pullback, the index managed to close the week in a positive note well north of the 95.00 barrier. In spite of consensus already priced in a probable move on rates by the Fed at the March meeting, the constructive outlook for the greenback is expected to remain unchanged into this week and ahead of the FOMC event on Wednesday. Looking at the broader scenario, higher US yields, persistent elevated inflation, supportive Fedspeak and the solid pace of the US economic recovery should continue to underpin the buck in the months to come.

Key events in the US this week: Chicago Fed National Activity Index, Flash PMIs (Monday) – House Price Index, CB Consumer Confidence (Tuesday) – Trade Balance, New Home Sales, FOMC Meeting, Powell’s Press Conference (Wednesday) – Durable Goods Orders, Advanced Q4 GDP, Initial Claims, Pending Home Sales (Thursday) – PCE, Personal Income/Spending, Final Consumer Sentiment (Friday).

Eminent issues on the back boiler: Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issue. Escalating geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is losing 0.08% at 95.64 and a break above 95.83 (weekly high Jan.18) would open the door to 96.46 (2022 high Jan.4) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 94.75 (100-day SMA) followed by 94.62 (2022 low Jan.14) and then 93.27 (monthly low Oct.28 2021).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.