US Dollar Index Price Analysis: Scope for further retracement near term

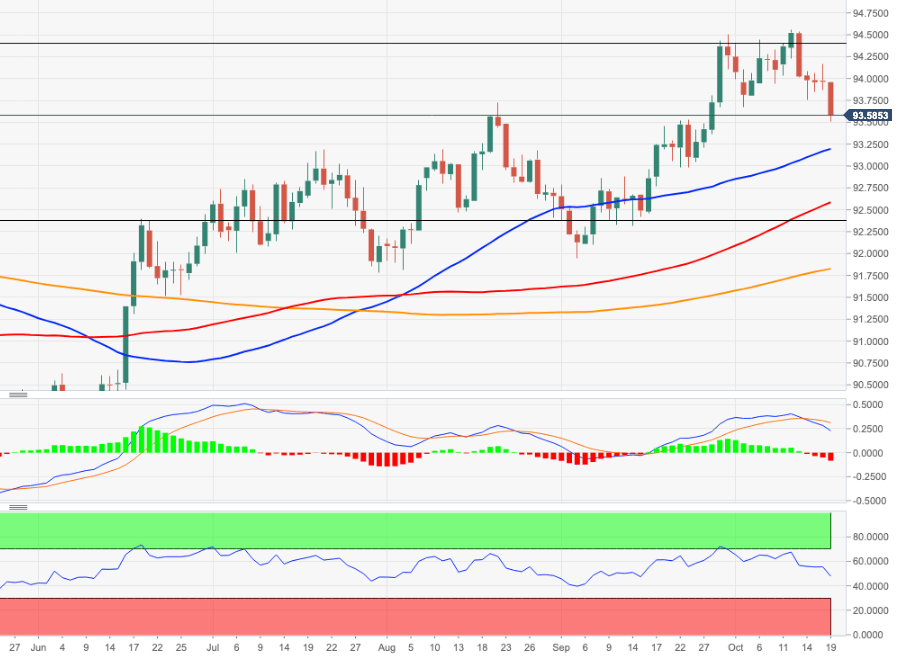

- DXY accelerates losses and retests the 93.50 zone on Tuesday.

- There is an interim support at the 93.18, the 55-day SMA.

DXY extends the downside for the fifth consecutive session on Tuesday and visits again the 93.50 region, where some initial contention turned up so far.

In case the selling impulse gathers further steam, the 55-day SMA at 93.18 should offer some minor contention ahead of a deeper pullback to the 93.00 neighbourhood (low September 23). Further south comes the 100-day SMA, today at 92.57.

Looking at the broader picture, the constructive stance on the index is seen unchanged above the 200-day SMA at 91.82.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.