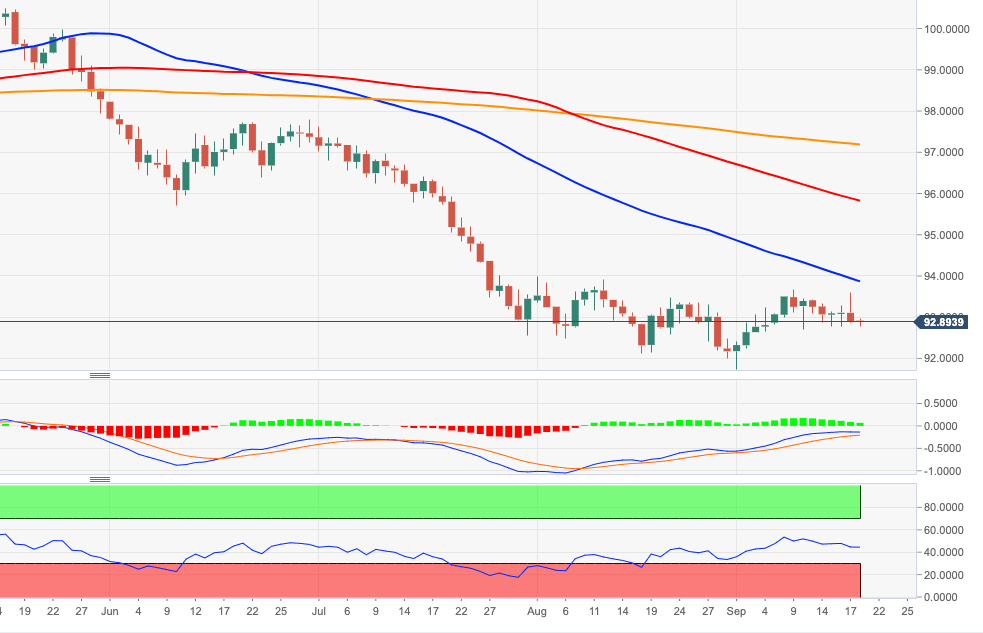

US Dollar Index Price Analysis: Potential short-term top near 93.70

- DXY adds to Thursday’s losses below the key 93.00 support.

- Immediately to the downside aligns the weekly low at 92.70.

The index has come under further downside pressure after being rejected once again from the 93.60/70 band on Thursday.

Further decline thus remains likely with the next target at the weekly lows at 92.70. A move further south of this level should put the 2020 low near 91.70 back on the investors’ radar.

The negative outlook in DXY is seen unchanged while below the 200-day SMA, today at 97.18.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.