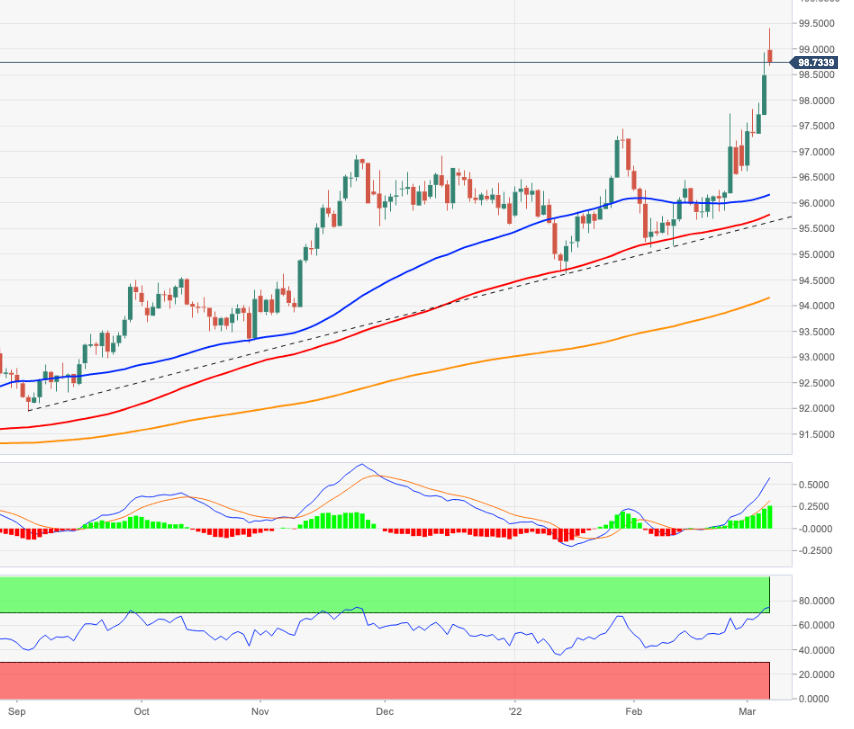

US Dollar Index Price Analysis: Immediately to the upside comes 100.00

- DXY rapidly leaves behind the 99.00 barrier on Monday.

- The continuation of the rally could see 100.00 retested.

DXY pushes higher and records new 2022 peaks past the 99.00 yardstick on Monday.

In light of recent price action, further gains remain likely in the very near term at least. That said, the next hurdle aligns at the 99.97 level (May 25 2020 high) closely followed by the psychological 100.00 mark.

The short-term bullish stance remains supported by the 5-month line, today near 95.70, while the longer-term outlook for the dollar is seen as constructive above the 200-day SMA at 94.12.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.