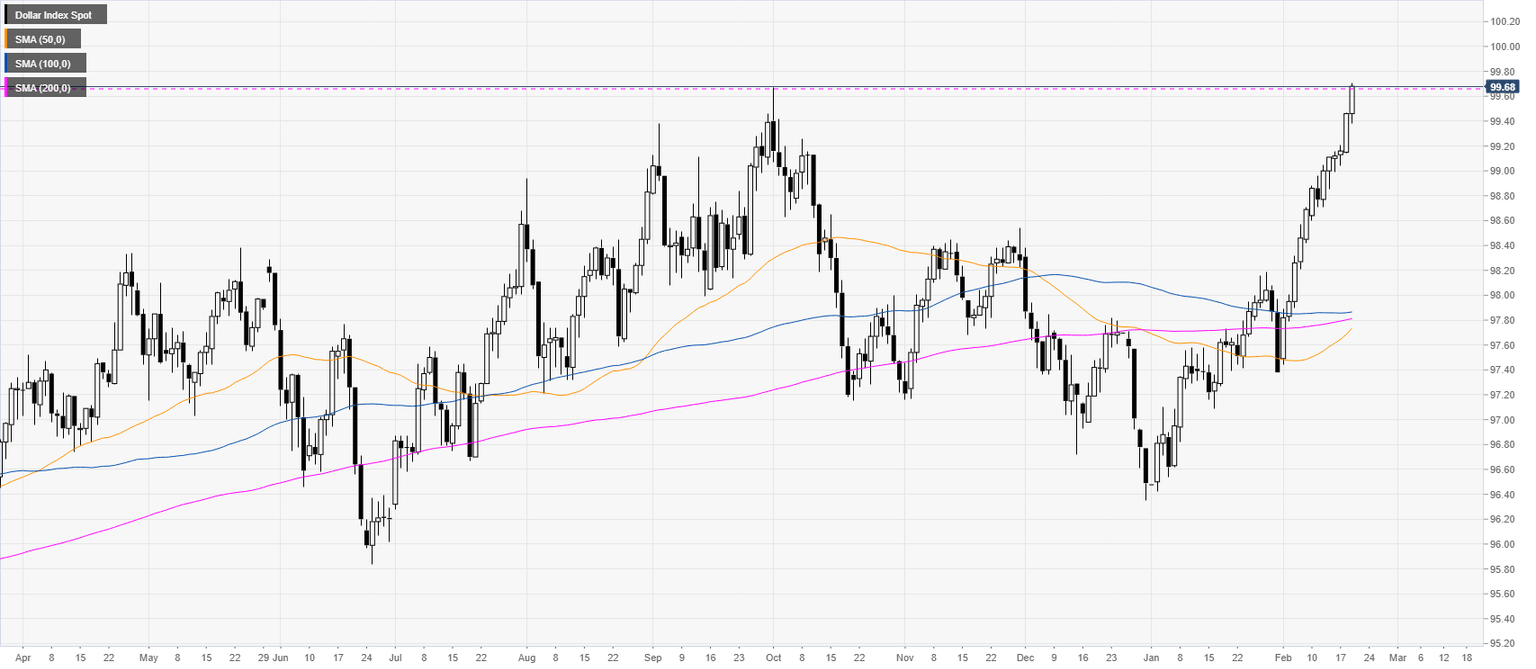

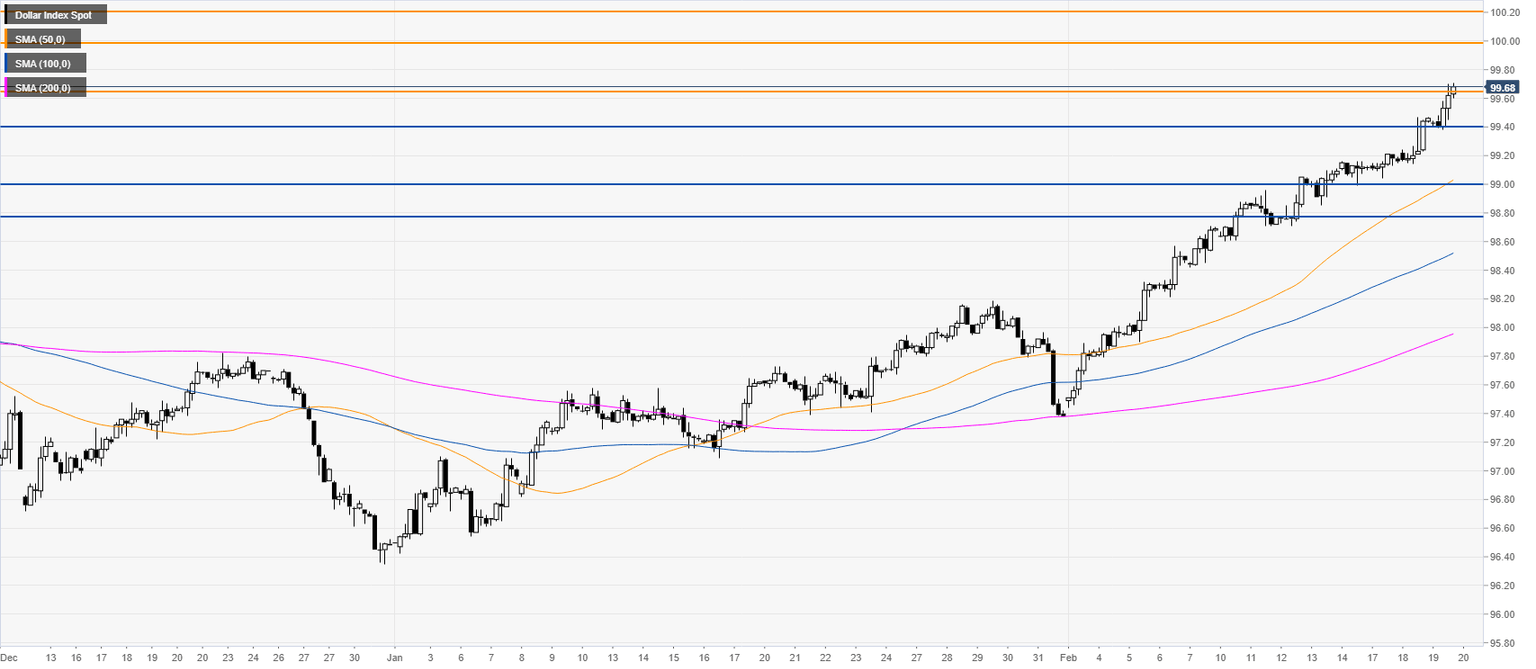

US Dollar Index Price Analysis: DXY unstoppable ahead of FOMC, trading near 45-month highs

- DXY is trading at levels not seen since May 2017.

- The level to beat for buyers is the 99.20 resistance.

- The FOMC Minutes will be released at 19.00 GMT.

DXY daily chart

DXY four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst