US Dollar Index Price Analysis: DXY stays pressured around 90.00

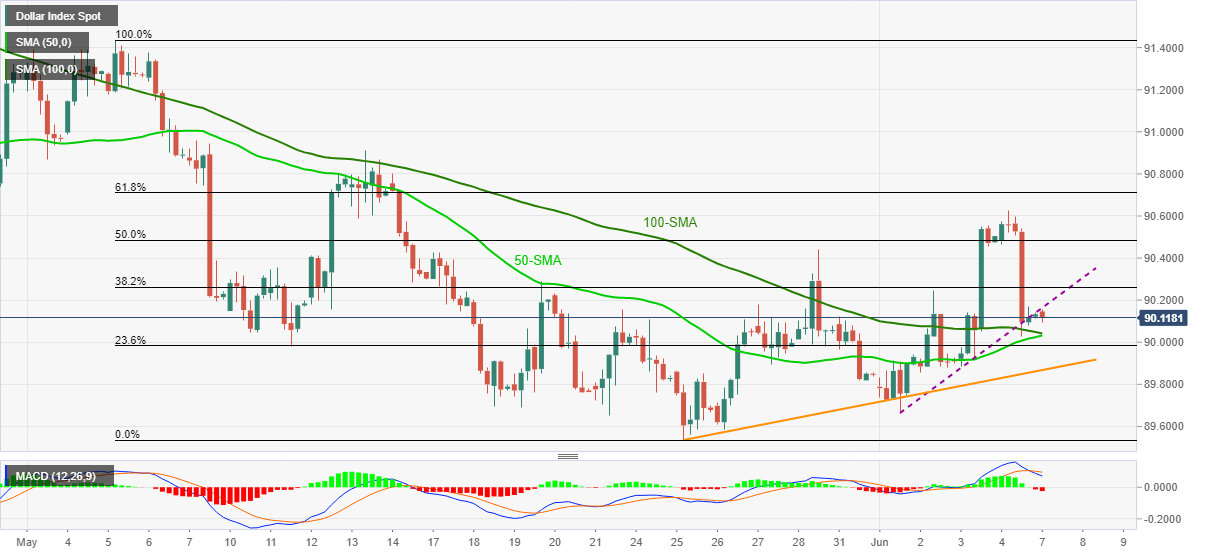

- DXY extends Friday’s breakdown of weekly support, now resistance, as bearish MACD favor sellers.

- 50-SMA, 100-HMA and a two-week-old support line test bears.

US dollar index (DXY) keeps the previous day’s downbeat performance while declining to 90.10 during Monday’s Asian session.

In doing so, the US dollar gauge versus six major currencies justifies Friday’s downside break of a short-term support line amid bearish MACD.

However, a convergence of 100-SMA and 50-day SMA near 90.00, followed by an ascending trend line from May 25, close to 89.85, will be strong supports to challenge the quote’s further weakness.

It’s worth noting that the DXY south-run past-89.85 won’t hesitate to challenge May’s low near 89.55.

On the flip side, a corrective pullback beyond the previous support line surrounding 90.15 may struggle around 38.2% and 50% Fibonacci retracement levels of the previous month’s downside, respectively near 90.25 and 90.50.

Also acting as the upside filters, beyond 90.50, is the monthly high of 90.62 as well as May 13 swing-top near 90.90.

DXY four-hour chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.