US Dollar Index Price Analysis: DXY rebound aims for three-week-old hurdle

- US Dollar index bounces off intraday low amid a quiet session in Asia.

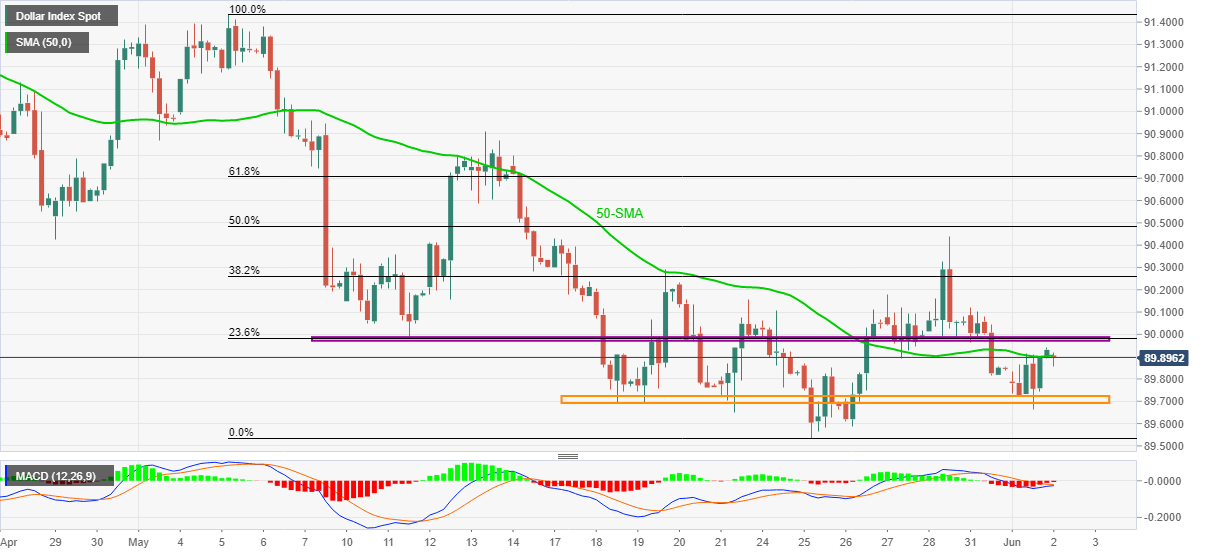

- Receding bearish bias of MACD backs another attempt to cross short-term key resistance.

- Sellers await a clear break of 89.70 for fresh entries.

US dollar index (DXY) trims intraday losses while picking up bids to 89.90 amid a sluggish Asian session on Wednesday.

In doing so, the greenback gauge versus the major currencies clings to 50-SMA amid receding red signals from the MACD indicator, suggesting a rebound in prices.

However, a horizontal area comprising multiple levels marked since May 11, near 90.00, restricts the quote’s short-term upside.

In a case where DXY bulls successfully cross the 90.00 threshold, the 90.30 and recent swing top around 90.45 will be in the spotlight.

On the flip side, pullback moves won’t be considered important until staying below 89.70 including many highs and lows from May 18. Though, a clear break of 89.70 may even refresh the multi-month low beneath the recent bottom surrounding 89.53.

DXY four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.