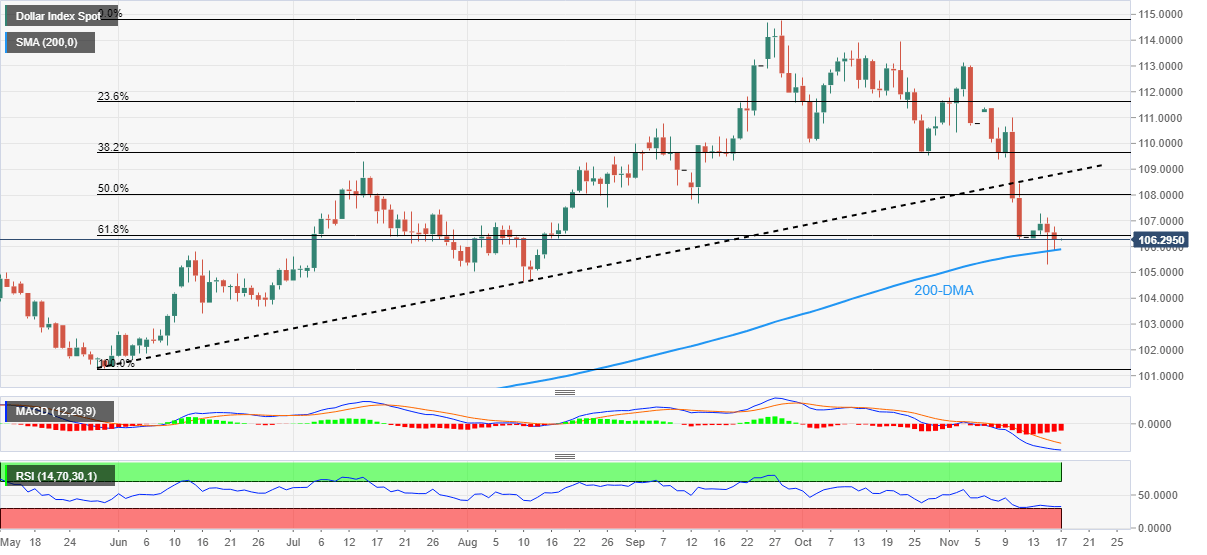

US Dollar Index Price Analysis: 200-DMA defends DXY bulls above 106.00

- US Dollar Index remains sidelined after bouncing off 200-DMA.

- Bearish MACD signals keep sellers hopeful but nearly oversold RSI favor the rebound from the key DMA.

- DXY bulls remain cautious unless crossing the previous support line from May.

US Dollar Index (DXY) seesaws around 106.30 as the 200-DMA challenges the bears early Thursday.

In doing so, the greenback’s gauge versus the six major currencies makes rounds to the 61.8% Fibonacci retracement level of the DXY’s May-September upside, close to 106.45.

Given the nearly oversold RSI conditions and the quote’s repeated failure to break the 200-DMA support, currently around 105.90, the US Dollar Index may witness recovery moves targeting the 107.00 threshold.

However, the weekly high near 107.30 and the 50% Fibonacci retracement level surrounding the 108.00 round figure could challenge the DXY bulls afterward.

It’s worth noting that the upside momentum remains elusive unless the quote stays successfully beyond the support-turned-resistance line from late May, around 108.80 at the latest.

On the flip side, a daily closing below the 200-DMA level near 105.90 could aim for the latest swing low near 105.30 before targeting August month’s bottom of 104.63.

In a case where the DXY remains bearish past 104.60, the lows marked during late June and May, respectively near 103.40 and 101.30, will gain the market’s attention.

US Dollar Index: Daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.