US Dollar Index looks firmer above 92.00

- DXY extends the upside to new 2021 highs near 92.20.

- Investors’ attention remains on yields, inflation, vaccine rollout.

- Wholesale Inventories will be the only release in the US docket.

The greenback, when tracked by the US Dollar Index (DXY), extends the march north to new yearly highs in the 92.15/20 band at the beginning of the week.

US Dollar Index focused on stimulus, inflation, yields

The index advances for the fourth consecutive session so far on Monday as the sentiment around the dollar keeps improving among investors and yields keep creeping higher.

In fact, Friday’s above-expectations Nonfarm Payrolls added to the US economy outperformance narrative, reinforcing at the same time the dollar’s momentum in collaboration with the solid pace of the vaccine rollout in the US and prospects of higher inflation in the next months.

On the political front, the US Senate passed the Biden’s $1.9 trillion stimulus bill despite Republicans still remain sceptical regarding its need and size. The stimulus package is expected to be signed by President Biden before March 14th.

In the US data space, January’s Wholesale Inventories are only due later in the NA session.

What to look for around USD

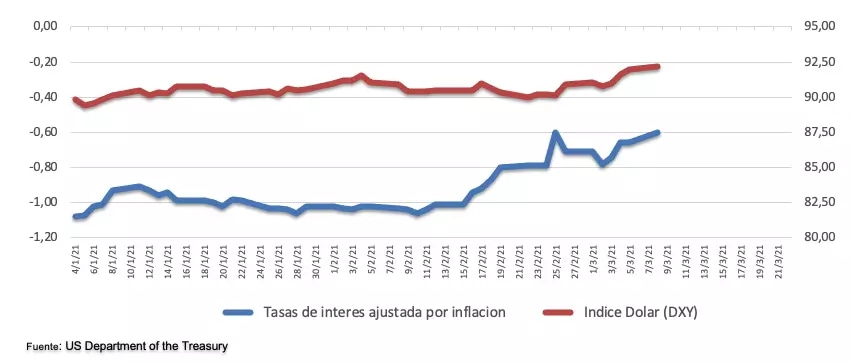

The sentiment in the dollar remains firm and finally push the index to new YTD highs beyond the 92.00 yardstick. The recent change of heart in the buck came in tandem with the strong bounce in US yields to levels recorded over a year ago, all against the backdrop of rising investors’ perception of higher inflation in the next months. However, a sustainable move higher in DXY should be taken with a pinch of salt amidst the mega-accommodative stance from the Fed (until “substantial further progress” is seen), extra fiscal stimulus and hopes of a strong economic recovery overseas.

Key events in the US this week: Inflation figures measured by the CPI (Wednesday) – Initial Claims (Thursday) – Flash February Consumer Sentiment (Friday).

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.23% at 92.19 and a breakout of 92.46 (23.6% Fibo of the 2020-2021 drop) would expose 92.91 (200-day SMA) and finally 94.30 (monthly high Nov.4). On the other hand, the next support emerges at 91.21 (100-day SMA) seconded by 91.05 (high Feb.17) and then 90.51 (50-day SMA).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.