US Dollar sees fades picking up speed with Fed-packed US trading session getting underway

- The US Dollar sees fade broaden on Friday after a steep ride higher.

- Traders see China stepping up measures with deposit rate cuts and more stimulus details.

- The US Dollar Index rally looks to be halting for now, ahead of 104.00.

The US Dollar (USD) eases on Friday in the US trading session, under some profit-taking after steep rallies against many major G20 currencies this week. The slight retracement comes on the back of Chinese economic data and more details on the stimulus package the Chinese government is rolling out. With Chinese deposit rates being cut this Friday and more details released on the Chinese stimulus package, it looks like China is propping up its economy further.

The US calendar is very light in terms of economic data. No real market-moving data points will be issued on Friday, with only Building Permits and Housing Starts on deck. Instead, look for the Federal Reserve (Fed), where no less than three members are set to speak.

Daily digest market movers: Here come the speakers

- At 12:30 GMT, the US Census Bureau will release housing data for September. Monthly Building Permits fell to 1.428 million, compared to 1.47 million in August, while Housing Starts fell to 1.354 million against 1.61 million prior.

- At 13:30 GMT, Federal Reserve Bank of Atlanta President Raphael Bostic delivers a presentation about economic education to high school students as part of the Mississippi Council on Economic Education Event.

- Around 14:00 GMT, Federal Reserve Bank of Minneapolis President Neel Kashkari moderates a policy panel at the 2024 Macroeconomic Policy Perspectives hosted by the Minneapolis Fed, the University of Chicago, and Stanford University.

- Near 16:10 GMT, Federal Reserve Governor Christopher Waller delivers a speech about decentralized finance at the Nineteenth Annual Vienna Macroeconomics Workshop in Vienna, Austria.

- At 16:30, Fed’s Bostic gives remarks and participates in a moderated conversation at the Mississippi Council on Economic Education's Forum on American Enterprise luncheon, United States.

- Asian equities saw Chinese indices outperform on the extra wave of stimulus measures issued. European equities are trying to grasp European Central Bank President Christine Lagarde’s speech from Thursday on the sluggish European economy. US futures are flat on the day and are yet to choose a direction.

- The CME Fed rate expectation for the meeting on November 7 shows a 90.2% probability of a 25 bps rate cut, while the remaining 9.8% is pricing in no rate cut. Chances for a 50 bps rate cut have been fully priced out.

- The US 10-year benchmark rate is trading at 4.11% after having flirted with a break below 4% on Wednesday.

US Dollar Index Technical Analysis: Fed vs Politics

The US Dollar Index (DXY) sees the rally train come to a halt, with some better-than-expected Chinese data and measures taken by the Chinese government to support domestic demand. Though this rally might face a small fade, a big reversal does not seem to be in the cards. With the interest rate gap between the US, the Eurozone and other coutnries widening again, the Greenback should at least remain supported towards the US elections in November.

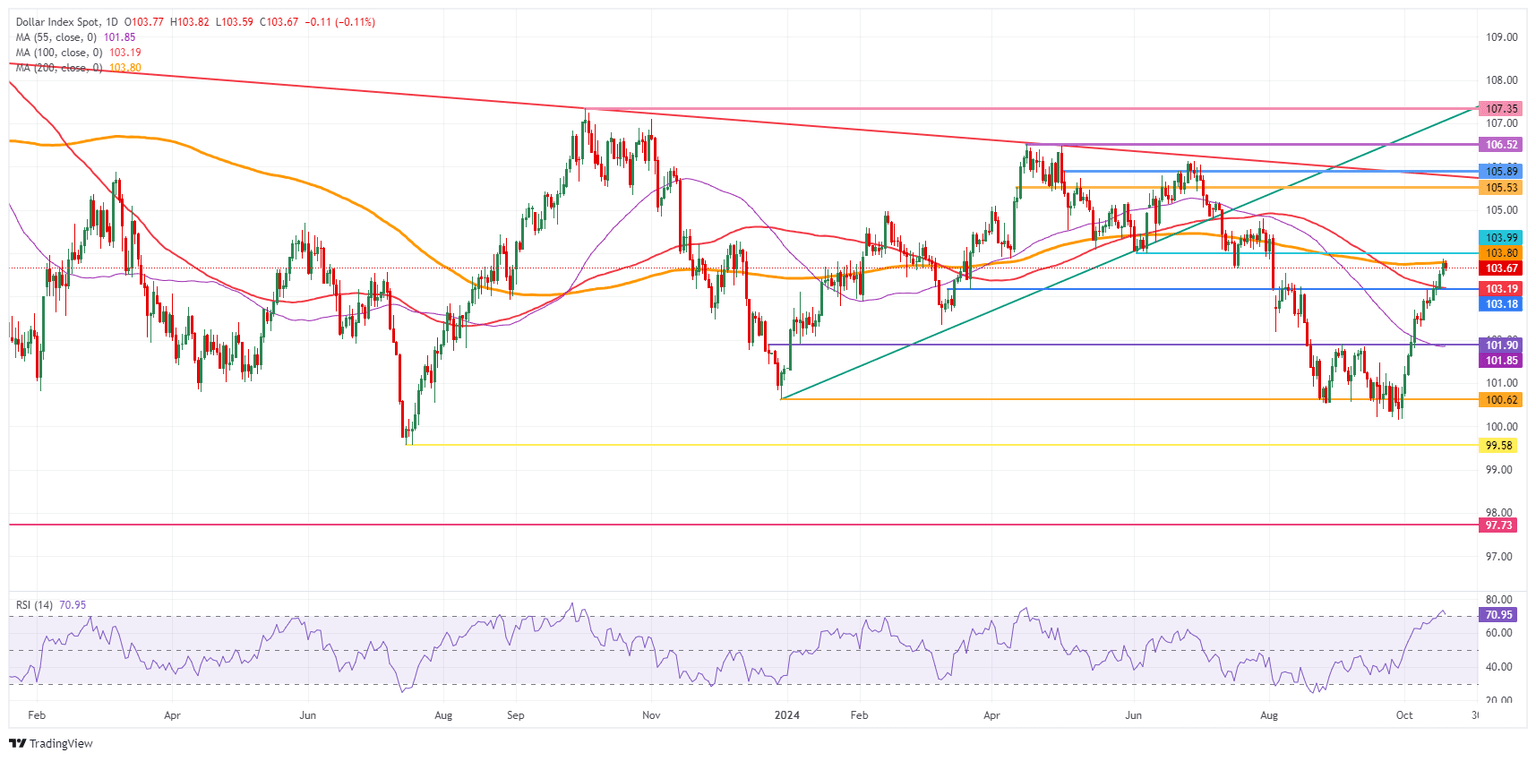

A firm resistance ahead is 103.80, which aligns with the 200-day SMA. Above that, there is a small gap before hitting the pivotal level at 103.99 and the 104.00 big figure. Should Trump further lead in the polls, a rapid swing up to 105.00 and 105.53 could be on the cards.

On the downside, the 100-day SMA at 103.19 and the pivotal level at 103.18 are now acting as support and should prevent the DXY from falling lower. With the Relative Strength Index in overbought territory, a test on this level looks granted. Further down, the 55-day SMA at 101.85 and the pivotal level at 101.90 should avoid further downside moves.

US Dollar Index: Daily Chart

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.