US Dollar stuck in sliding mode on Thursday after disappointing Jobless Claims

- The US Dollar softer on Thursday against major currencies.

- US President Donald Trump sees a deal with China as a possible outcome.

- The US Dollar Index (DXY) erases Wednesday's gains and dips below 107.00 after a firm upside rejection on Wednesday.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, and is back below 106.90 at the time of writing. The correction comes after United States (US) President Donald Trump mentioned that a trade deal with China might come. This is a big sigh of relief in markets on the tariff and trade front, as it would mean that some easing could come before April when levies are due to kick in.

The US economic calendar is quite calm this Thursday, except for the weekly Initial Jobless Claims, the Philadelphia Fed Manufacturing Survey for February and some speeches by Fed policymakers. However, as it happened in the earlier part of this week, US data is likely to be overshadowed by Trump’s comments.

Daily digest market movers: Stuck for now

- The weekly US Jobless Claims were not in a good mood. Initial Claims for the week ending February 14 came in at 219,000, a miss above the estimated 215,000 and from 213,000 last week. Continuing Claims for the week ending February 7 are coming in at 1.869 million, beating the 1.868 million and above the previous 1.85 million.

- At the same time, the Philadelphia Fed Manufacturing Survey for February came in at 18.1, above the expected 14.3 and below the 44.3 previous reading.

- Quite an army of Fed speakers are scheduled for this Thursday:

- At 14:35 GMT, Chicago Fed President Austan Goolsbee speaks in a moderated Q&A at an event hosted by the Chicagoland Chamber of Commerce.

- At 17:05 GMT, St. Louis Fed President Alberto Musalem speaks to the Economic Club of New York about the US economy and monetary policy

- At 19:30 GMT, Fed Vice Chair for Supervision Michael Barr talks about supervision and regulation at an event at Georgetown University Law Center.

- Around 22:00 GMT, Federal Reserve Governor Adriana Kugler gives a speech on "Navigating inflation waves while riding on the Phillips curve" at a lecture hosted by Georgetown University.

- Equities are in red numbers across the globe, except for the European ones, with the German Dax and the pan-European Stoxx 50 in the green.

- The CME FedWatch tool shows a 51.2% chance that interest rates will remain unchanged at current levels in June.

- The US 10-year yield trades around 4.51%, slipping lower from its Wednesday’s high of 4.574%.

US Dollar Index Technical Analysis: Where to go from here

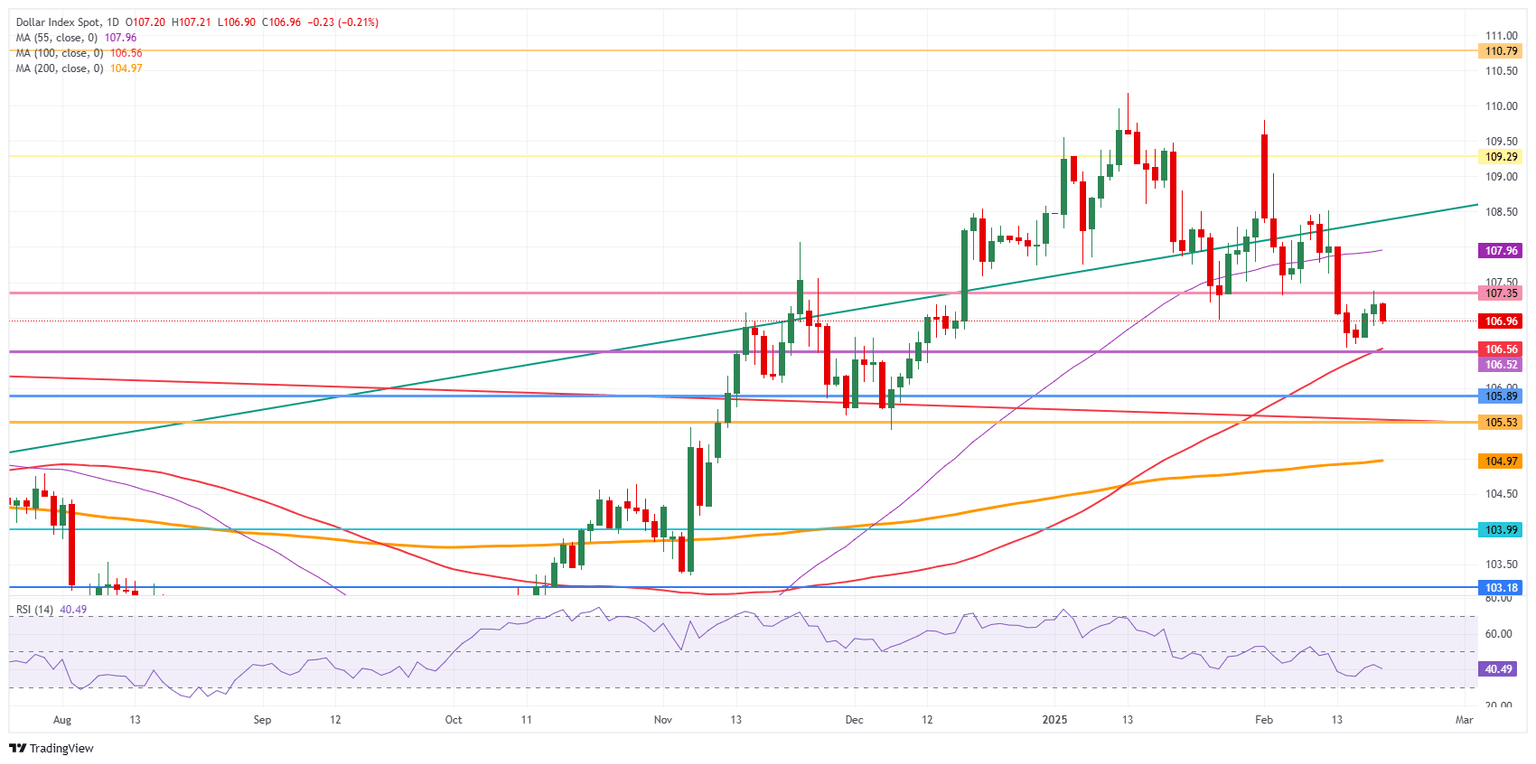

The US Dollar Index (DXY) is back to square one and gives up all its Wednesday’s gains. The firm technical rejection at 107.35 was enough to push the DXY back to where it was earlier this week. If US President Trump comes out with more easing or softening comments on tariffs or other deals, a revisit to 106.60 could be in the cards.

On the upside, the previous support at 107.35 has now turned into a firm resistance. Further up, the 55-day SMA at 107.96 must be regained before reclaiming 108.00.

On the downside, look for 106.56 (100-day SMA), 106.52 (April 16, 2024, high), or even 105.89 (resistance in June 2024) as support levels. The Relative Strength Index (RSI) momentum indicator in the daily chart shows room for more downside. Therefore, the 200-day SMA at 104.97 could be a possible outcome if a firm catalyst emerges.

US Dollar Index: Daily Chart

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.