US dollar and yields keep the fire burning in otherwise subdued markets

- US dollar firms as US yields are on the rise in Asian markets.

- The US ten-year Treasury yield prints a fresh cycle high and the DXY takes on the prior daily support.

In recent trade, despite the quiet Asian session, US yields have marked a fresh cycle high in the 10-year Treasury yield which has lifted the greenback, if only marginally. At the time of writing, DXY is testing the psychological 95.80 level. This is a significant area as per the following technical analysis below.

Meanwhile, the price is back above support levels that have held for the past few months in anticipation of rising US interest rates. The US Federal Reserve meets to set policy next week. In the absence of Fed speakers during the blackout period, the markets have been second-guessing what the outcome of the meeting might be. The greenback has been performing in tow with rising US yields and bouts of risk-off in broader financial markets which are gearing up for the potential of another hawkish surprise.

The yield curve bear flattened as traders have put their focus on Fed hikes, pricing in the first-rate hike in March 2022, and four hikes throughout 2022. The 2-year government bond yields rose from 1.00% to 1.063%, and the 10-year government bond yields rose from 1.80% to 1.89% over the past 24 hours or so.'' With the 10-year breakeven inflation rates stuck below 2.50%, the real US 10-year yield rose to -0.66%, the highest since April 2021.

''This week’s price action reaffirms our view that last week’s drop in yields and the dollar were a countercyclical correction, not a trend change as many dollar bears believed,'' analysts at Brown Brothers Harriman explained.

''Given this way US yields are moving, it’s clear that the Fed’s full-court press last week made a significant impression on the bond market. We fully expect a hawkish hold next week that sets up liftoff at the March 15-16 meeting,'' the analysts added further.

''WIRP suggests a hike then is now fully priced in, followed by hikes in June, September, and December. The expected terminal Fed Funds rates is also starting to move towards 2.0%, which is a key part of the market repricing. That said, we feel that this repricing still has some ways to go.''

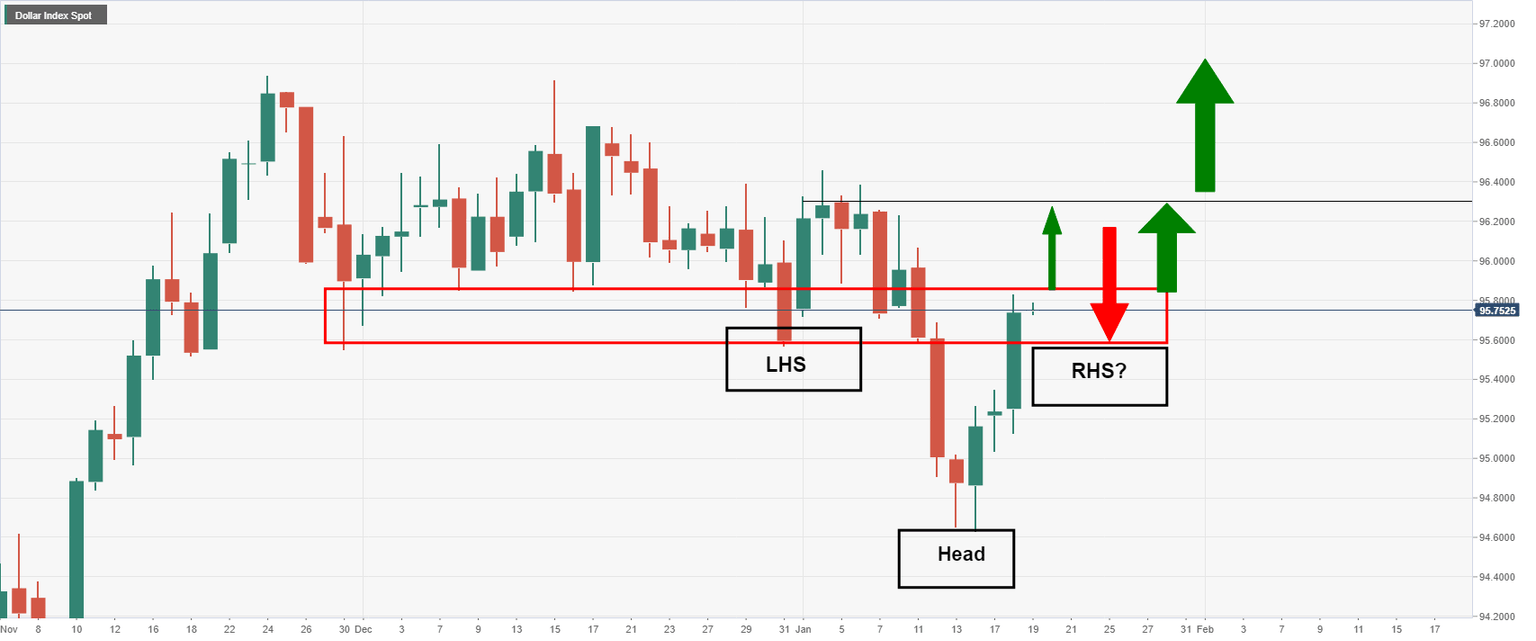

DXY technical analysis

The US dollar could be forming an inverse head and shoulders at this juncture which is a bullish pattern that leads us into the Federal Reserve meeting. The right-hand shoulder is yet to form and it will be worth monitoring over the coming days.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.