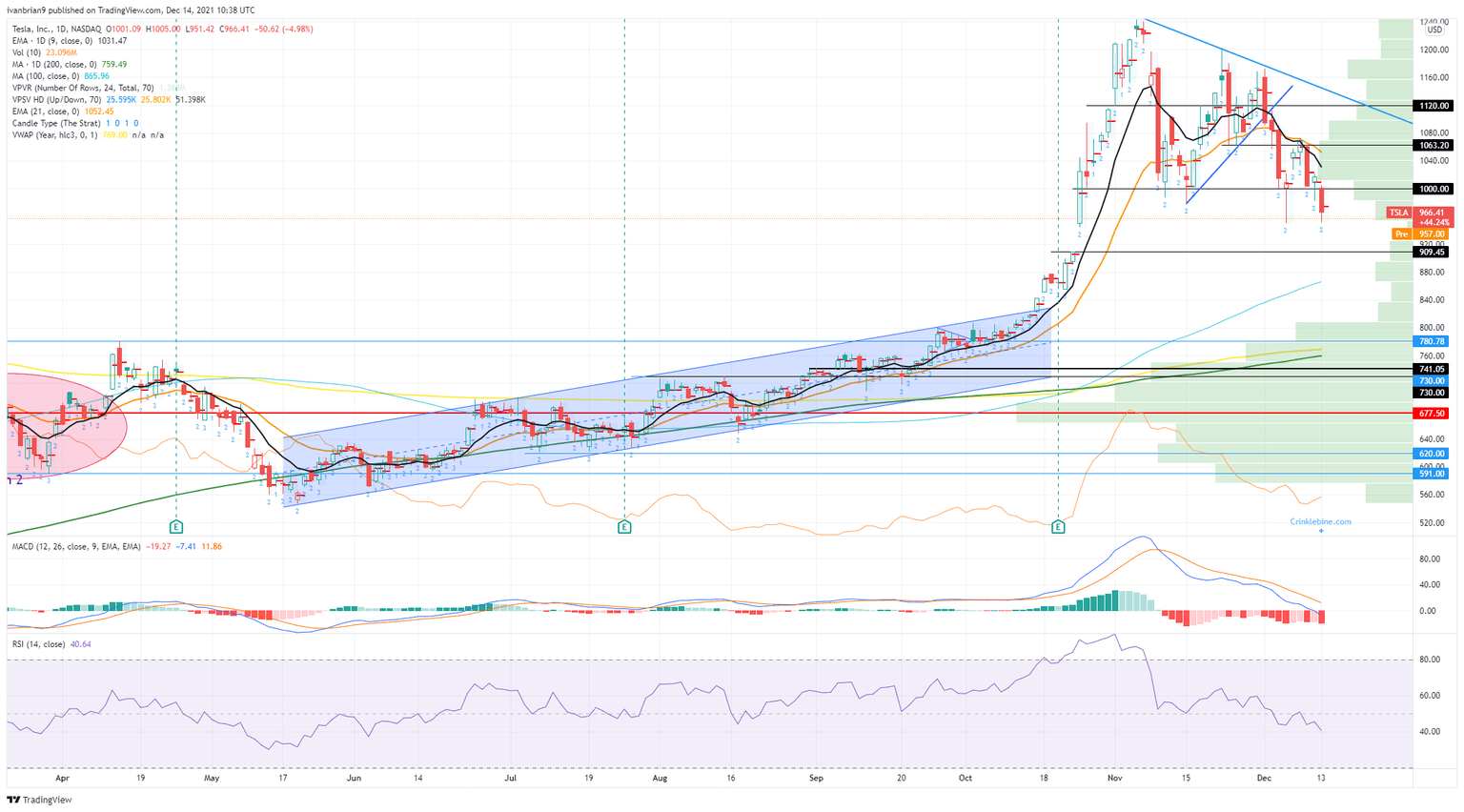

TSLA Stock Price and Forecast: Tesla targets $910 next

- Tesla stock price closes below $1,000 for the first time since October 22.

- TSLA stock has been under pressure from Elon Musk selling stock.

- Tesla shares are likely to test support at $910 in our view.

Tesla (TSLA) shares finally closed below the psychological $1,000 support level on Monday. The shares had been threatening this for some time, and we anticipated the move yesterday after a few failures. It is a normal feature of support and resistance levels that the more times they are tested the more likely they are to fail. Tesla had been flirting with breaking below $1,000 ever since Elon Musk tweeted about selling shares. The level had been broken intraday on a few occasions since, but never had Tesla managed to close below it.

That was until yesterday. This feels like a significant break. The next obvious level in our view is the $910 support, which was formed from the "Hertz" effect – the price explosion when Hertz announced it was placing a huge order for Tesla cars.

Tesla (TSLA) chart, 15-minute

Tesla (TSLA) stock news

The chart above shows Tesla shares opened below $1,000 and never really managed any positive momentum through the session. Currently, more losses are being flagged in the premarket with the stock trading at $957. There was not any particular catalyst directly attributable to Tesla stock. Rather a combination of broad market weakness and profit-taking were the main factors at play, combined of course with the technical implications of breaking $1,000. Retail stocks were certainly under pressure with AMC and GME suffering large losses.

Tesla (TSLA) stock forecast

Closing below a key level is much more significant than an intraday breach. The next support, therefore, is the gap open from October 22 at $910. Already Tesla is indicating lower in Tuesday's premarket despite stock index futures and European markets looking positive. Both MACD and RSI are trending lower and signalling a likely continuation of the bearish trend in the short term.

Tesla daily chart

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637750748336530549.png&w=1536&q=95)