Trump Media & Technology Group Stock Forecast: DJT falls 4% as conviction takes its toll

- Trump Media stock rotates 4% lower after gaining in premarket.

- Donald John Trump was convicted of 34 felony counts for falsifying business records on Thursday.

- New York state jury was unanimous on all counts against former President.

- DJT stock support sits near $42 if shares fall out of $45 to $50 consolidation zone.

Trump Media & Technology Group (DJT) stock is sliding 4% on Friday following Thursday’s post-market conviction of namesake Donald John Trump, the former US president.

The New York state criminal jury case involving falsifying business records in order to pay off a pornstar that Trump had an affair with handed Donald Trump 34 felony counts, and sentencing is scheduled for July 11. DJT stock fell 8% post-market on Thursday before rallying in Friday’s premarket.

The NASDAQ shed 1.1% on Friday morning despite the Federal Reserve’s (Fed) favored survey of inflation — the Personal Consumption Expenditures (PCE) report — coming in lower than expected on monthly core inflation.

Trump Media stock news

The general belief from pundits is that Trump will not serve any prison time for his conviction. If he does, that would likely reduce the value of the TRUTH Social app owned by Trump Media & Technology Group.

The felonies are class E, which is the lowest level of felony in the New York state justice system. The sentence could include up to four years in prison. Legal opinion, however, expects Trump to face parole and fines rather than serving time in detention since he is a first-time offender.

Needless to say, Trump will continue to run for the presidential election. If he wins, however, he will not be able to discard the state case since presidents are only able to issue pardons for federal crimes.

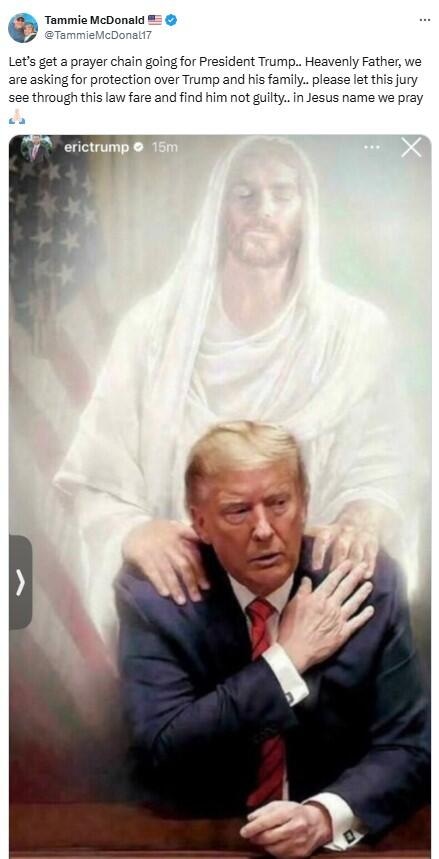

Trump’s political supporters are resolute in calling the conviction a “miscarriage of justice”. Social media is full of posts similar to the following:

A post taken from X social media site (formerly Twitter)

Meme stocks FAQs

Meme stocks are stocks favored by retail traders – but not by professional or institutional traders – that grow popular through its backers publishing memes on social media websites to win converts. Images or GIFs are typically used to transmit some type of excitement, committment or comedy regarding investment in the stock. These stocks normally are beaten down names that appear to have an uncertain or dour future based on falling sales figures or rising losses. Interest in these names normally comes from either belief in a turnaround story or its heavy short ratio.

Online investing forums like Reddit’s r/WallStreetBets are known to be breeding grounds for meme stocks. Normally, some small group of posters begin making memes of a stock they are buying. If the argument behind it is cogent or even just funny, the memes may provoke other retail investors to jump aboard. Interestingly, the merits of a stock are normally immaterial to it becoming a popular meme stock other than it being abandoned by the wider market and thus cheap. Stocks with high short ratios are usually likely to become meme stocks, because the nature of the argument for investing in the stock is that it can be the subject of a short squeeze.

A short squeeze is when investors swiftly buy up the shares of a heavily-shorted stock. Because the stock is heavily shorted, there is a dearth of available shares to purchase. This allows smaller volumes of buying to push the stock’s price up more easily. Since the share price suddenly rises, short-sellers need to purchase the stock to close out their short positions. This rapid buying and closing of short positions produces an unusually low level of supply that causes the price of the stock to rise rapidly. This type of short squeeze was the result of the first meme stock craze regarding GameStop.

Besides GameStop – the ur-meme stock – there have been a number of other meme stocks. Two of the most popular are AMC Entertainment and Bed Bath & Beyond. AMC CEO Adam Aron used the popularity of AMC shares among the retail class to effect a secondary offering that raised enough money to stave off bankruptcy during the 2020-2021 pandemic. Bed Bath & Beyond saw a flurry of volatile trading but eventually went bankrupt in April 2023.

Trump Media stock forecast

DJT stock continues to trade within the $45 to $50 range where there has been ample support historically, at least in its short history as a public company. If DJT falls below this range, then the recent support at $42 may work again.

Trump Media stock has touched both the 9-day and 20-day Exponential Moving Average (EMA) in Friday's session but also resulted in a range high up to $53.92. Any return to territory above $55 is a sign that a rally is back in play.

DJT daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.