Trump: Hopes Russia, Saudi Arabia will reach deal to cut production by as many as 15 mln bpd soon

The markets were buoyed by the sentiment of an oil production cut on Thursday in US markets following news that President Donald Trump said the world oil industry has been 'ravaged' this year and has plans to conduct meetings with industry executives later this week. The idea of tariffs on Gulf imports was floated. Subsequently, WTI spiked to the $27 handle overnight.

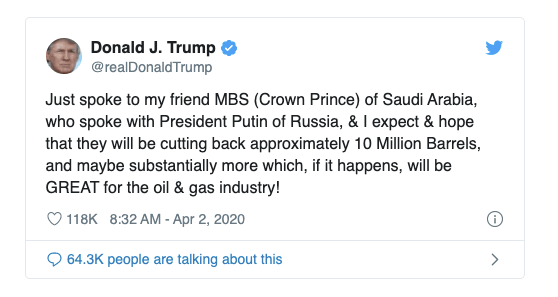

In recent trade, Trump has said that he hopes Russia, Saudi Arabia will reach deal to cut production by as many as 15 mln bpd soon.

Additional comments

- Trump says all nursing home facilities should have separate areas for healthy and sick residents

- Trump says he anticipates issuing more defense production act orders in the future

- Says he spoke to gm ceo who said gm will be starting production of ventilators quickly

- Says he issued a defense production act order for 3m for facemasks

- Says he hopes Russia, Saudi Arabia will reach deal to cut production by as many as 15 mln bpd soon.

- Says guidelines on face coverings will be nationwide.

Meanwhile, US Vice president pence says working on a proposal to compensate hospitals for the care of uninsured coronavirus patients. We also had White House adviser Navarro says that Trump will sign a defence production act order on Friday to prevent hoarding and the sending overseas of personal protective equipment.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.