Toughbuilt Industries Stock News: TBLT soars 36% as short squeeze continues

- Toughbuilt Industries stock soars as short interest looks too high.

- TBLT stock reportedly has short interest of over 100%.

- TBLT stock only IPO'd in 2018 but has been in decline since.

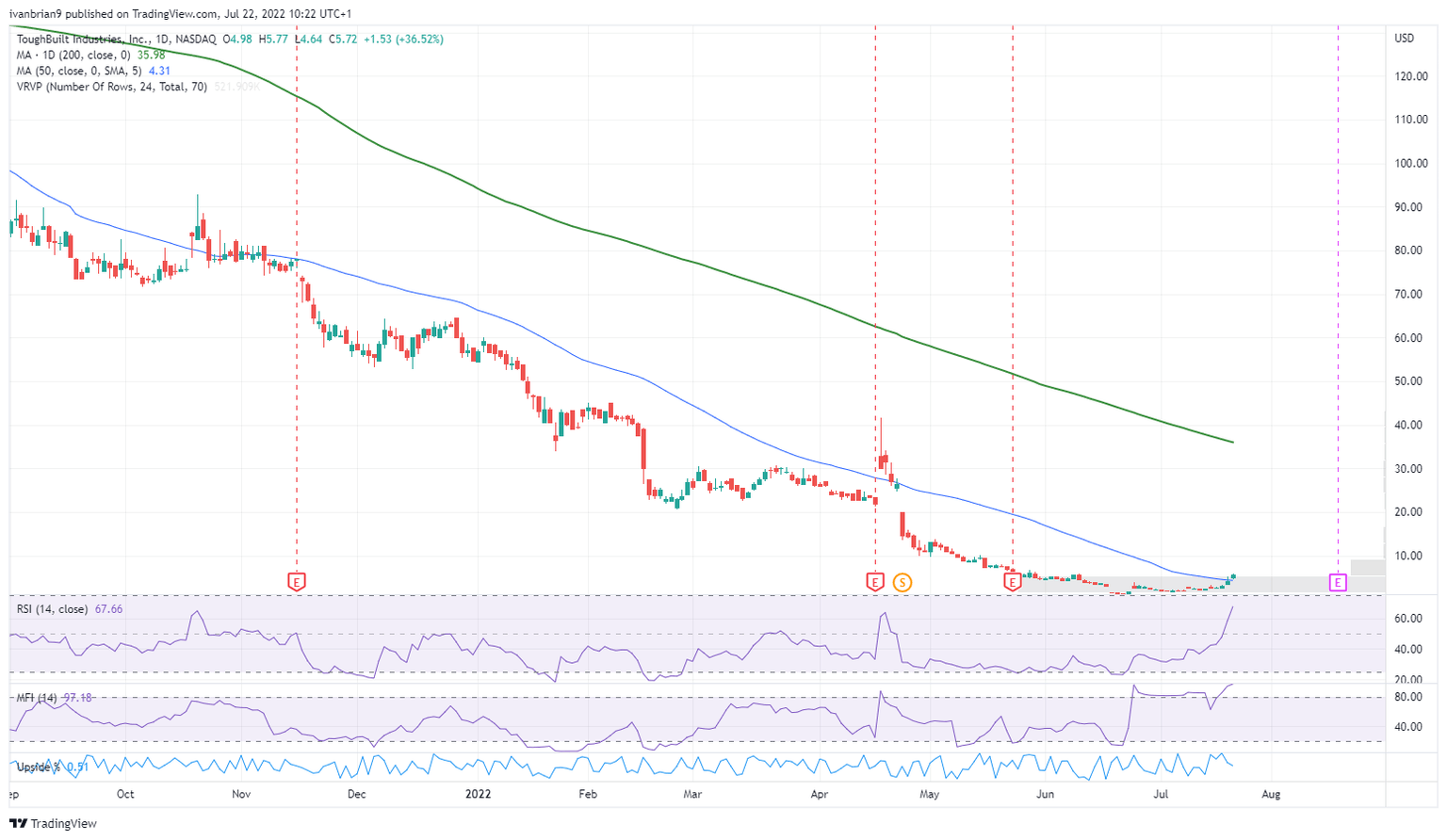

Toughbuilt Industries (TBLT) is the latest short squeeze interest for the dwindling Reddit retail army. TBLT stock has doubled this week as the short interest soared over 100%. Two 36% gains in a row on Wednesday and Thursday have seen the stock capture the attention of retail traders who sense yet another epic short squeeze.

Toughtbuilt Industries stock news

TBLT is one of the top trending names on Reddit this week, and with performance nearing 100% for the week, it is no surprise. Toughbuilt Industries went public via IPO in 2018, but since then the stock has lost nearly all of its value. Toughbuilt, as the name would suggest, makes and distributes products for the building and home improvement industry in the US. It sells its products via Amazon and big box DIY retailers. It is a micro-cap name with a market cap of just $9 million. This means it is highly volatile, and as recently as July 11 it was marked up by 27% on the back of first-half sales figures showing growth of over 20%, including $3.5 million worth of sales through Amazon (AMZN). However, those gains were short-lived as the company announced a share offering to raise approximately $6 million. Recent attention has gravitated toward the stock due to its reported high level of short interest. This is a favorite tactic of the retail sector, and TBLT looks to have short interest over 100%.

Toughbuilt Industries stock forecast

Forecasting for a micro-cap stock is fraught with volatility, and we would not urge investment in this type of space. Momentum is the main factor at play, so look for signs of that faltering. Signals from risk assets such as Bitcoin, GME and AMC can give some clues as to meme stock sentiment. Also, watch for a strong open with a weak close or a large intraday range with a close to the lower end of the range. All signs of falling momentum mean it may be time to exit.

TBLT stock, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.