This key bar will make or break S&P 500 [Video]

![This key bar will make or break S&P 500 [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse1-637299020939878938_XtraLarge.jpg)

Watch the video above from the WLGC session before the market opens on 19 Nov 2024 to find out the following:

-

Is the market losing momentum, or is this just a healthy pullback in an ongoing uptrend?

-

Could the recent spike in supply and localized volatility signal a deeper correction ahead?

-

How to use the smaller timeframe to identify the key resistance level and anticipate the market movement.

-

And a lot more...

Market environment

The bullish vs. bearish setup is 384 to 138 from the screenshot of my stock screener below.

Three stocks ready to soar

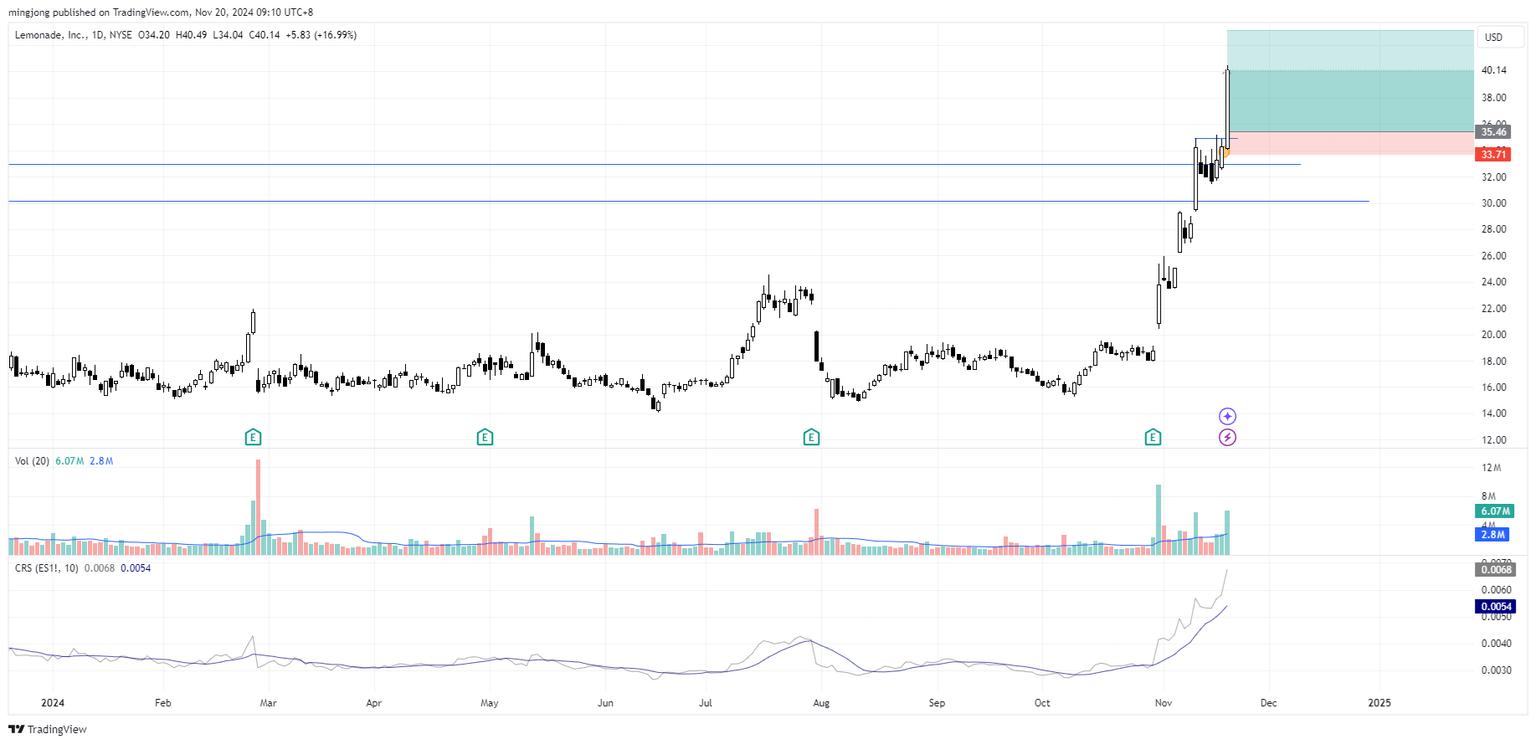

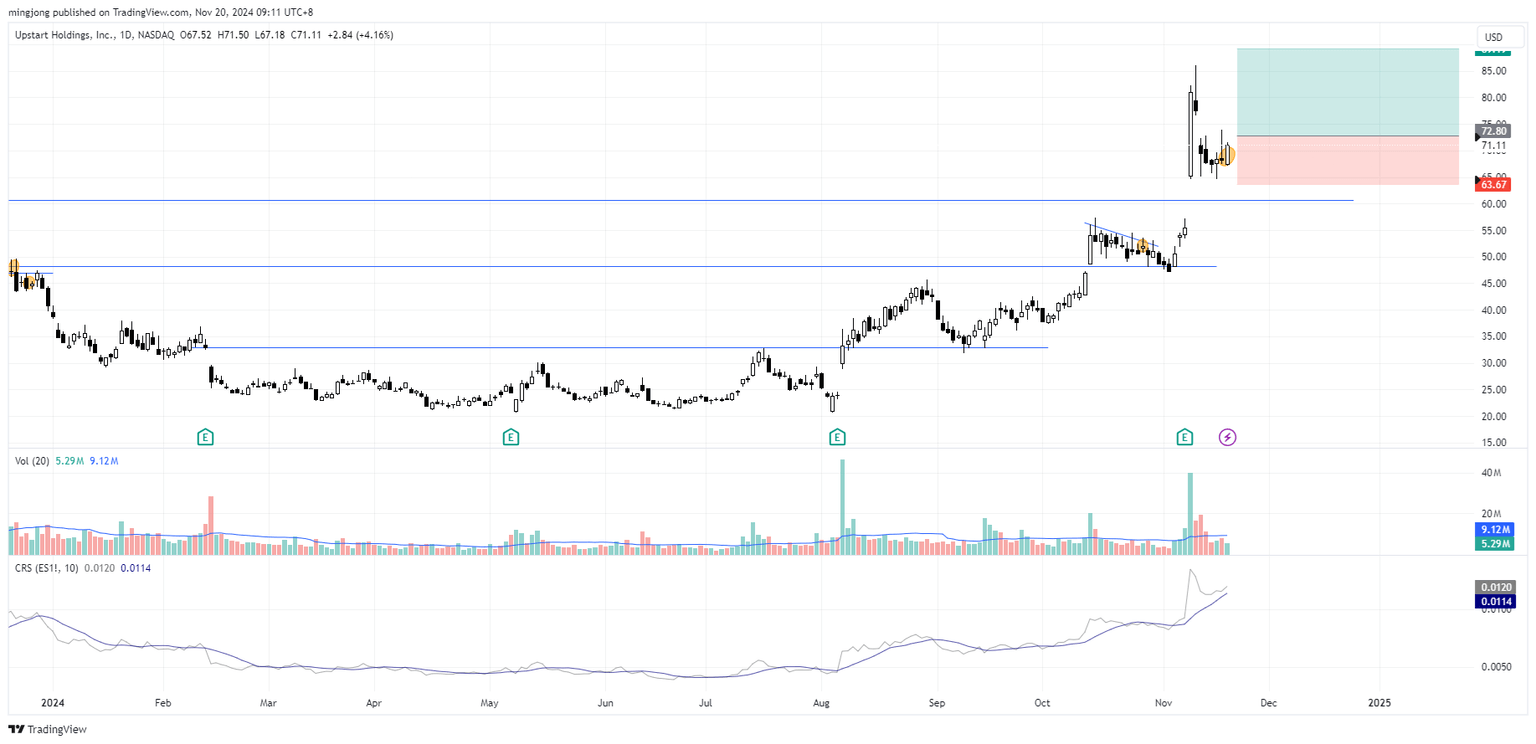

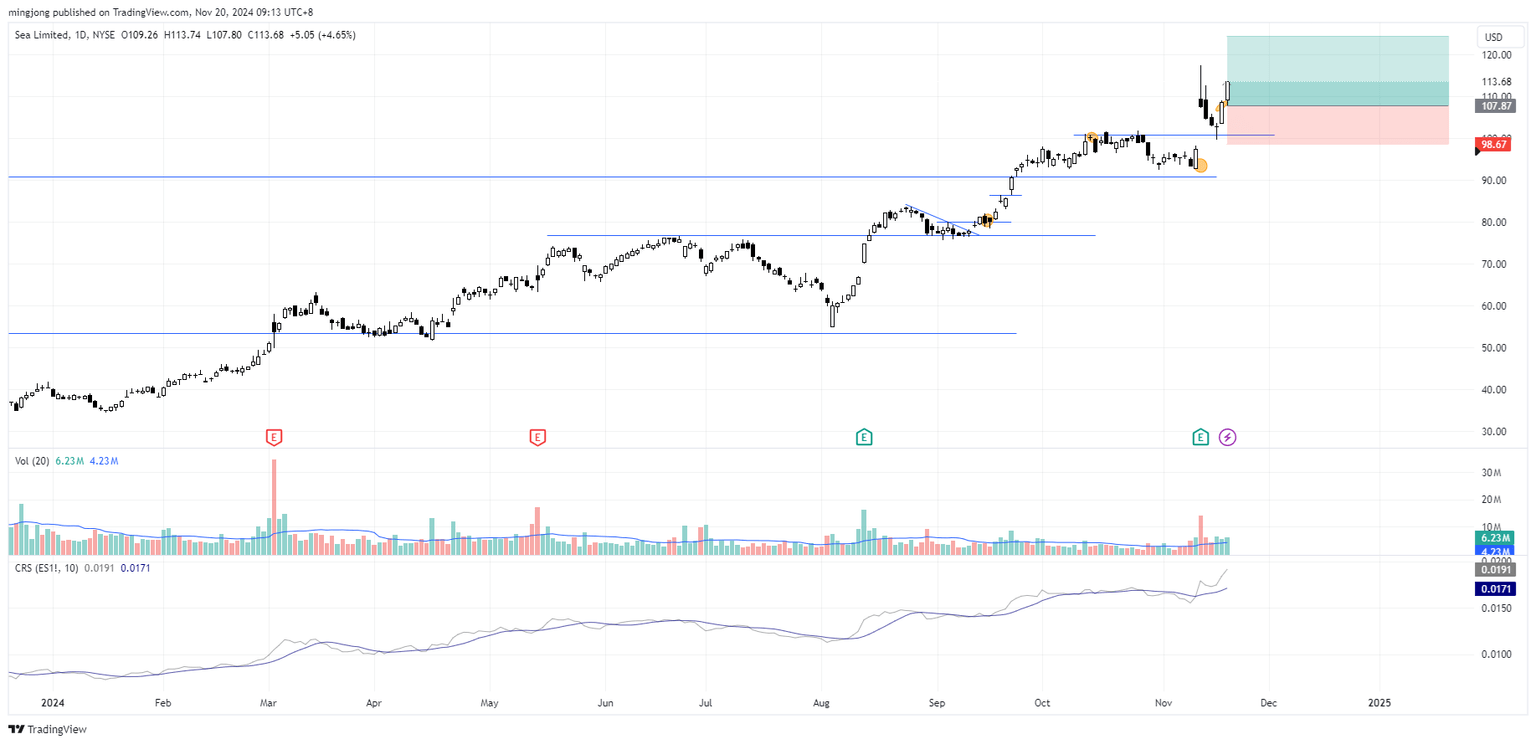

28 actionable setups including 8 growth stocks (check out 3 of the charts LMND, UPST, SE below) completed 2+ years of accumulation structure and are in the “sweet spot” to transit into uptrend (phase E) were discussed during the live session before the market open (BMO)..

The pullback in the market since last Tuesday provided great reversal entries for many of those over-extended strong momentum stocks.

The plan mentioned in the market update on Monday to look for reversal entries to participate the continuation of the uptrend is still relevant.

Lemonade (LMND)

Upstart Holdings (UPST)

Sea Limited (SE)

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.