USD/CAD Price Analysis: Drops vertically to near 1.3300 as bets for neutral Fed policy remain solid

- USD/CAD has shown a vertical fall to near 1.3300 due to a solid recovery in the oil price.

- Market sentiment has turned extremely positive as a skip in the policy-tightening spell by the Fed will trim fears of US recession.

- USD/CAD has tested the demand zone placed in a range of 1.3270-1.3300.

The USD/CAD pair has shown a perpendicular fall to the round-level support of 1.3300 after facing stiff barricades around 1.3320 in the European session. The Loonie asset has dropped sharply following the footprints of the US Dollar Index (DXY). It is observed that the pace of falling Loonie is higher than the velocity of decline in the USD Index.

Upbeat oil prices are providing a cushion to the Canadian Dollar as investors are hoping for a neutral interest rate policy by the Federal Reserve (Fed). Market sentiment has turned extremely positive as a skip in the policy-tightening spell by the Fed will trim fears of a recession in the United States.

Meanwhile, the street is hoping that the Bank of Canada (BoC) will continue raising interest rates further due to resilience in the Canadian economy. BoC Governor Tiff Macklem raised interest rates surprisingly by 25 basis points (bps) to 4.75% last week.

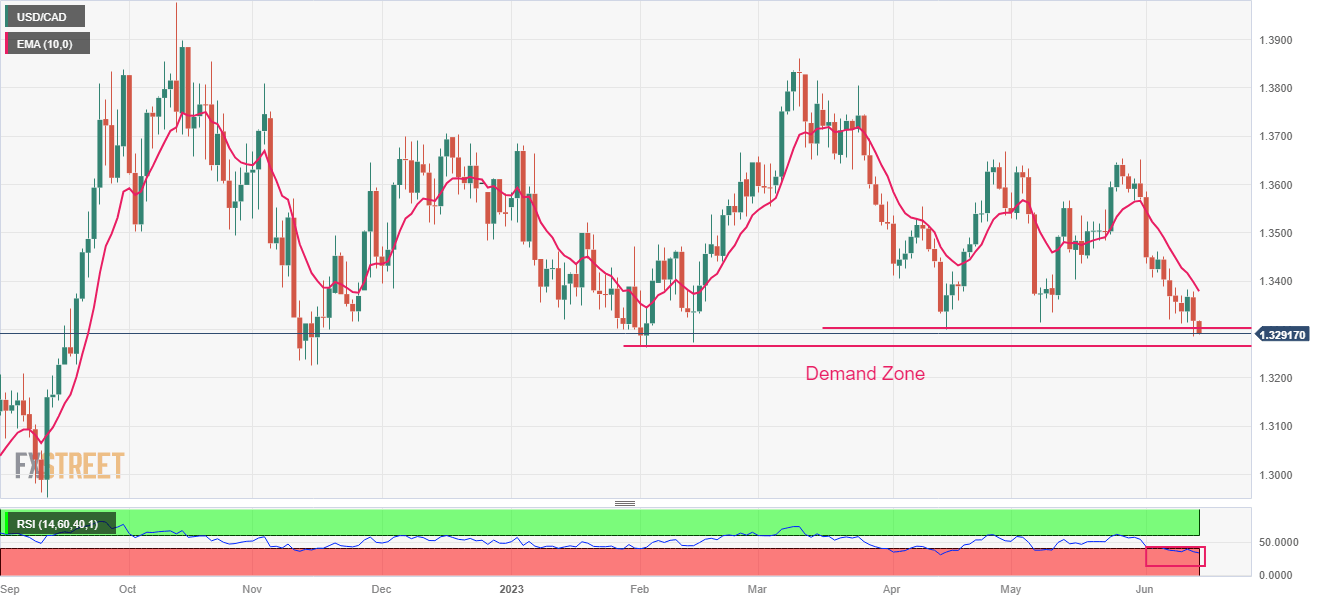

USD/CAD has tested the demand zone placed in a range of 1.3270-1.3300 on a daily scale. The Loonie is expected to remain volatile after the interest rate decision by the Fed. Downward-sloping 10-period Exponential Moving Average (EMA) at 1.3380 indicates that the short-term trend is extremely bearish.

The Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates that the downside momentum is already active.

Should the asset break below June 13 low at 1.3286, Canadian Dollar bulls will expose the Loonie asset to 15 November 2022 low at 1.3226 followed by the round-level support at 1.3200.

On the flip side, a break above June 08 high at 1.3388 will drive the asset toward June 05 high at 1.3462 and the psychological resistance at 1.3500.

USD/CAD daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.