Gold rises on Fed rate cut bets, safe-haven flows

- Gold price trades in positive territory in Tuesday’s early European session.

- Traders could book their profits and rebalance their portfolios ahead of the New Year holidays.

- Growing expectations of further US rate cuts next year and safe-haven flows might help limit Gold’s losses.

Gold price (XAU/USD) edges higher above $4,350 during the early European trading hours on Tuesday. The precious metal recovers some lost ground after falling 4.5% in the previous session, which was gold's largest single-day loss since October. Increased margin requirements on gold and silver futures by the Chicago Mercantile Exchange (CME) Group, one of the world’s largest trading floors for commodities, prompted widespread profit-taking and portfolio rebalancing.

Nonetheless, the potential downside for the yellow metal might be limited amid the prospect of Fed rate cuts in 2026. Lower interest rates could reduce the opportunity cost of holding Gold, supporting the non-yielding precious metal. Furthermore, persistent global economic uncertainty and geopolitical tensions could boost traditional assets such as Gold.

Trading volumes are expected to remain thin ahead of the New Year holidays. Traders brace for the release of the Federal Open Market Committee (FOMC) Minutes later on Tuesday for fresh impetus.

Daily Digest Market Movers: Gold rises on Fed rate cuts bets in 2026 and geopolitical turmoil

- Russia accused Ukraine of launching a drone strike on the Russian presidential residence in northern Russia, prompting Moscow to reconsider its stance in peace negotiations, Reuters reported on Monday. Ukraine dismissed Russian statements about the drone attack, and its foreign minister said Moscow was seeking "false justifications" for further strikes against its neighbor.

- The CME raised margin requirements for gold, silver, and other metals in a notice posted to the exchange's website on Friday. These notices require traders to put up more cash on their bets in order to insure against the possibility that the trader will default when they take delivery of the contract.

- The US Pending Home Sales rose 3.3% MoM in November after an upwardly revised 2.4% gain in October, according to the National Association of Realtors on Monday. This figure came in stronger than the estimations of 1.0% and registered its highest level since February 2023.

- US President Donald Trump said last week that he expects the next Fed Chairman to keep interest rates low and never “disagree” with him. The comments are likely to heighten concerns among investors and policymakers about Federal Reserve independence.

- Financial markets are pricing in nearly a 16.1% probability that the Fed will cut interest rates at its next meeting in January, according to the CME FedWatch tool.

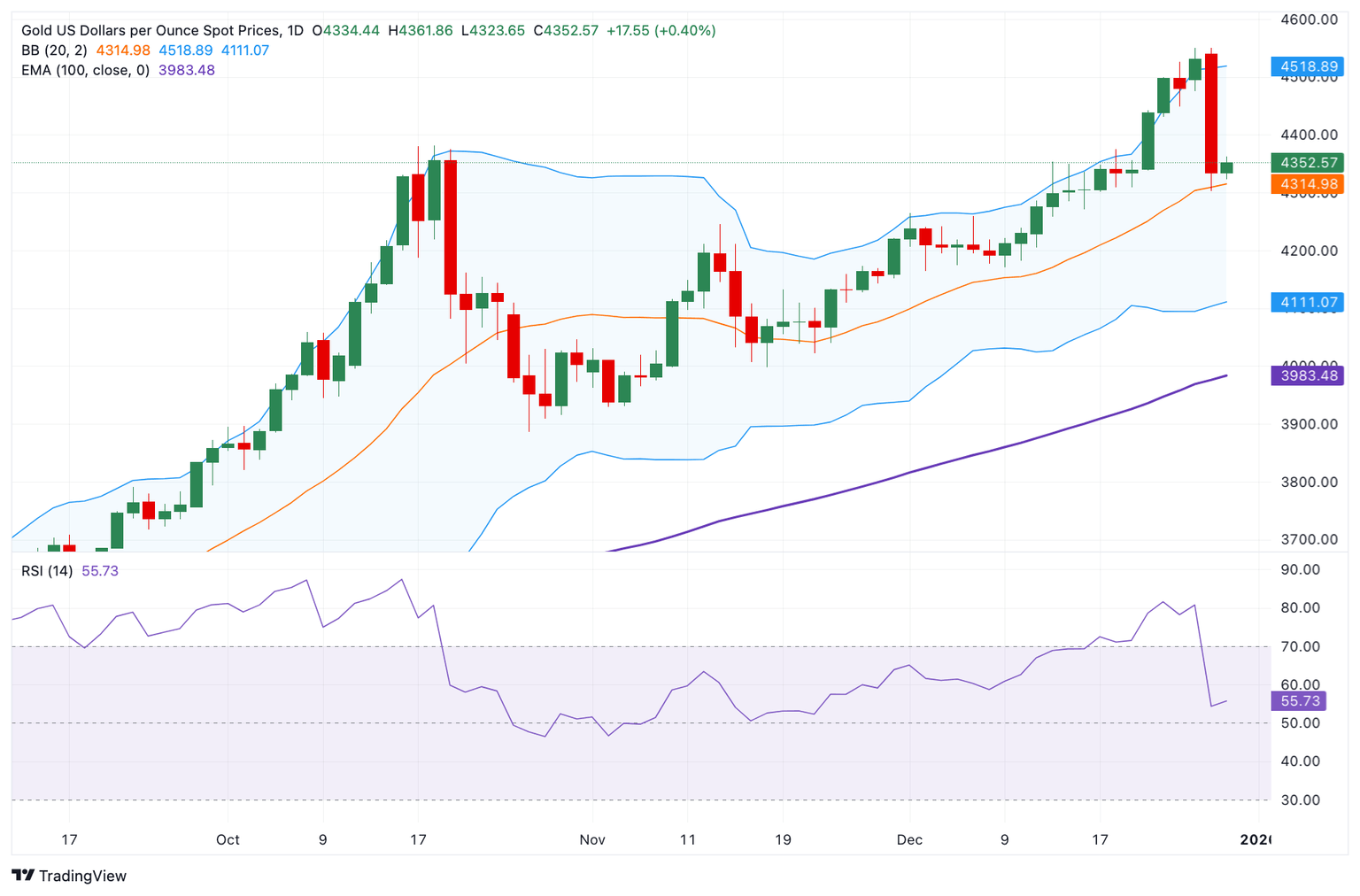

Gold maintains a bullish bias, RSI suggests near-term consolidation

Gold trades on a positive note on the day. The constructive outlook of the precious metal prevails as the price remains above the key 100-day Exponential Moving Average (EMA) on the daily chart, while the Bollinger Bands widen.

Nonetheless, further consolidation or temporary sell-off cannot be ruled out as the 14-day Relative Strength Index (RSI) hovers around the midline. This suggests the neutral momentum in the near term.

The immediate resistance level to watch is the upper boundary of the Bollinger Band of $4,520. A decisive break above this level would likely trigger a retest of the all-time high of $4,550, en route to the $4,600 psychological mark.

On the flip side, the initial support level for XAU/USD emerges in the $4,305-$4,300 zone, representing the December 29 low and round figure. Any follow-through selling below the mentioned level would signal that the correction has more room to run and could target the December 16 low of $4,271.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.