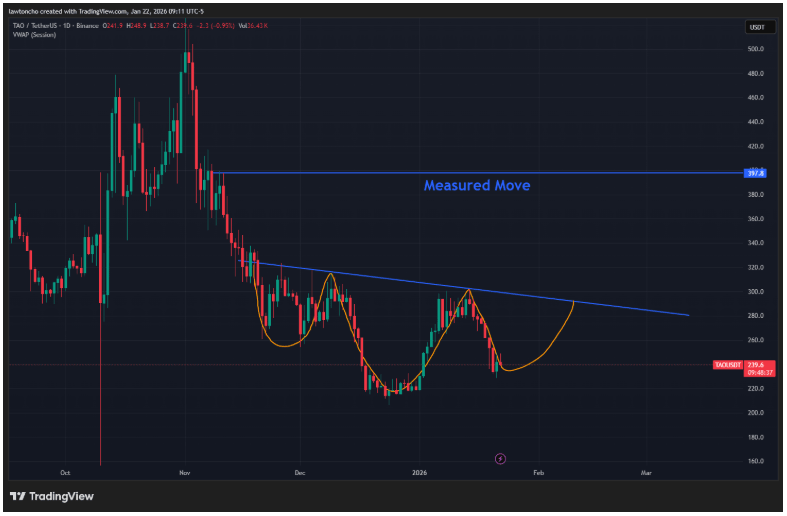

The potential inverse head and shoulders pattern forming on TAO

Bittensor (TAO) is down roughly 1% on the day, but from a technicals standpoint, this short-term weakness does not change what I’m seeing develop on the chart. On the daily timeframe, TAO is actively forming what appears to be an inverse head and shoulders pattern. This is a structure I pay close attention to, as it often reflects a shift in momentum after an extended period of downside pressure.

From my perspective, the most important level on this chart is the neckline of the pattern. If TAO can continue to push higher and successfully break above that neckline, the technicals suggest a measured move that targets the $400 area. That would represent a move of more than 65% from the current trading price. While nothing is guaranteed in this market, the structure itself is clearly defined, and the potential upside relative to risk is what makes this setup worth monitoring.

When it comes to execution, I would not chase price. My preference would be to either wait for a clean break above the neckline to the upside or for a retrace back into the neckline area following an initial breakout. That retrace often provides a more controlled entry, allowing me to define risk more clearly while still participating in the broader move suggested by the pattern.

It’s also worth briefly addressing TAO itself for context. Bittensor (TAO) is the crypto asset being evaluated here, and it has tended to experience a good deal of volatility in its history. All of my observations are based strictly on its price action and technical structure. The focus of this analysis is not on speculation or narrative, but on what the chart is objectively presenting on the daily timeframe.

As always, regardless of how compelling a setup may appear, proper risk management remains essential. Cryptocurrency markets are volatile by nature, and even high-probability technicals can fail. Position sizing, defined invalidation levels, and discipline are what ultimately determine long-term success, not any single trade idea.

Author

Lawton Ho

Verified Investing

A marketing expert sharing his journey to mastering the charts.