The art of looking ahead

Sometimes there is an event that eclipses the normal ebb and flow of market dynamics. Think of the Black Friday sales, or Easter, Christmas, fireworks night, or even Valentine’s day. During Easter, chocolatiers sell more Easter eggs. On Fireworks night many retailers sell most of their fireworks. It is not a surprising thing. So, with the World Cup fast approaching, there is likely to be more demand for certain products.

The lure of the World Cup

One of the products that many football fans want is a big-screen television. The World Cup is one of the most viewed global events and many will want to time any television replacements/upgrades with this major sporting event. Other products that could receive a boost in demand could be from some of the main sponsors. Adidas, Coca-Cola, McDonald’s, Visa, and Budweiser are all other big-name sponsors for 2022.

Coca-Cola seasonals

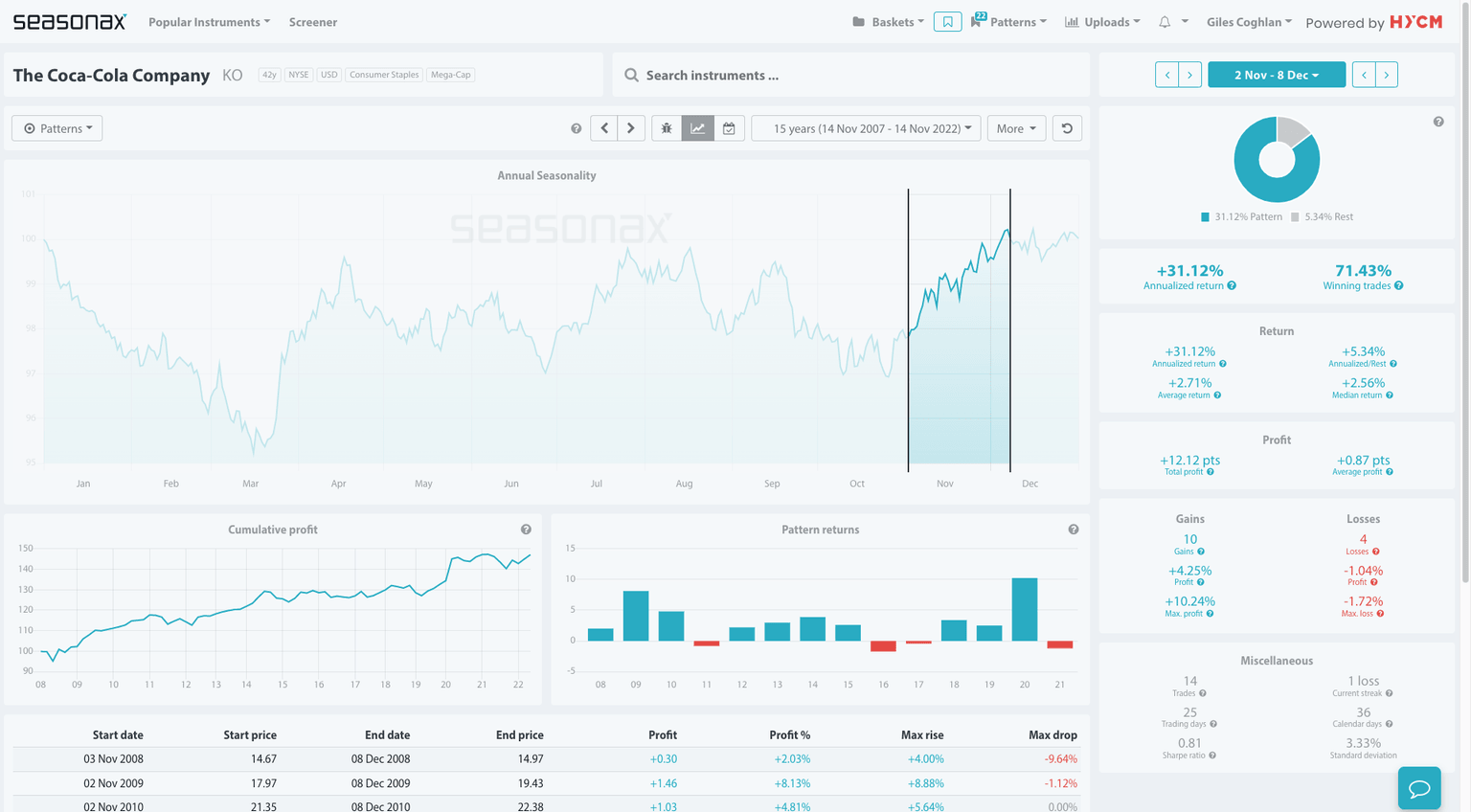

In fact, Coca-Cola is also a stock that is expected to weather a recession well. Why? Simply because in a recession many consumers can still afford a relatively inexpensive drink like coke. The seasonals are quite strong for Coca-Cola too during November. From November 02 through to December 08 Coca-Cola has gained an average of 2.71%. So, does this, coupled with Coca-Cola’s World Cup sponsorship, make for a strong potential outlook for the company heading into the start of December?

The main point of this post is to stimulate thought and get us thinking ahead. Which shift is coming that is going to increase demand for certain products? Here is another example of a longer-term shift that is expected to impact the copper markets.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.