Tesla Stock Price and Forecast: Why is TSLA up on Wednesday?

- Tesla stock outperforms on Tuesday as stocks recover.

- The bounce is small as Fed news awaited.

- Tesla is stuck on neutral ground.

Tesla recovered some ground on Tuesday after equity markets took a tough beating on Monday. While broader markets struggled to bounce, Tesla stock did at least gain over 1% in a steady session. Volume was low, however, so there was not much force to the move.

This was the trend across most markets, as investors wait with bated breath for the Fed announcement later on Wednesday. Not the announcement itself but the discussion afterwards about tapering and when and how that will begin. The Fed balance sheet is strongly correlated with the stock market since the pandemic began, so any reduction or tapering could see stocks slide if the correlation continues. The Fed will be hoping this is not the case, and the underlying strength of the economy is enough to placate investors from panicking.

The 15-minute chart of Tesla below shows a fairly lacklustre session with barely a $10 range, not great for day-trading, but markets are likely to adopt a wait-and-see tone ahead of the Fed later on Wednesday. To taper or not to taper?

TSLA 15-minute chart

Tesla is nothing if not innovative and rumours have been swirling recently about a location for a new giga-factory to help with ambitious growth plans. Russia was hot on everyone's lips, but Elon Musk downplayed the speculation on Monday with a tweet saying Tesla had not yet decided on a location for its new giant factory. This morning news hits the wires of Tesla planning to offer car insurance to customers, with Elon Musk tweeting that "probably next year before we get approval in New York". Tesla already offers insurance in California and rumours suggest Texas is next up. Initially, this is not likely to be significant to the bottom line and hence investors but it may have longer-term implications if the company expands the offering.

Tesla key statistics

| Market Cap | $728 billion |

| Price/Earnings | 394 |

| Price/Sales | 23 |

| Price/Book | 29 |

| Enterprise Value | $756 billion |

| Gross Margin | 22% |

| Net Margin |

6% |

| 52-week high | $900.40 |

| 52-week low | $329.88 |

| Average Wall Street Rating and Price Target | Hold, $704 |

Tesla stock forecast

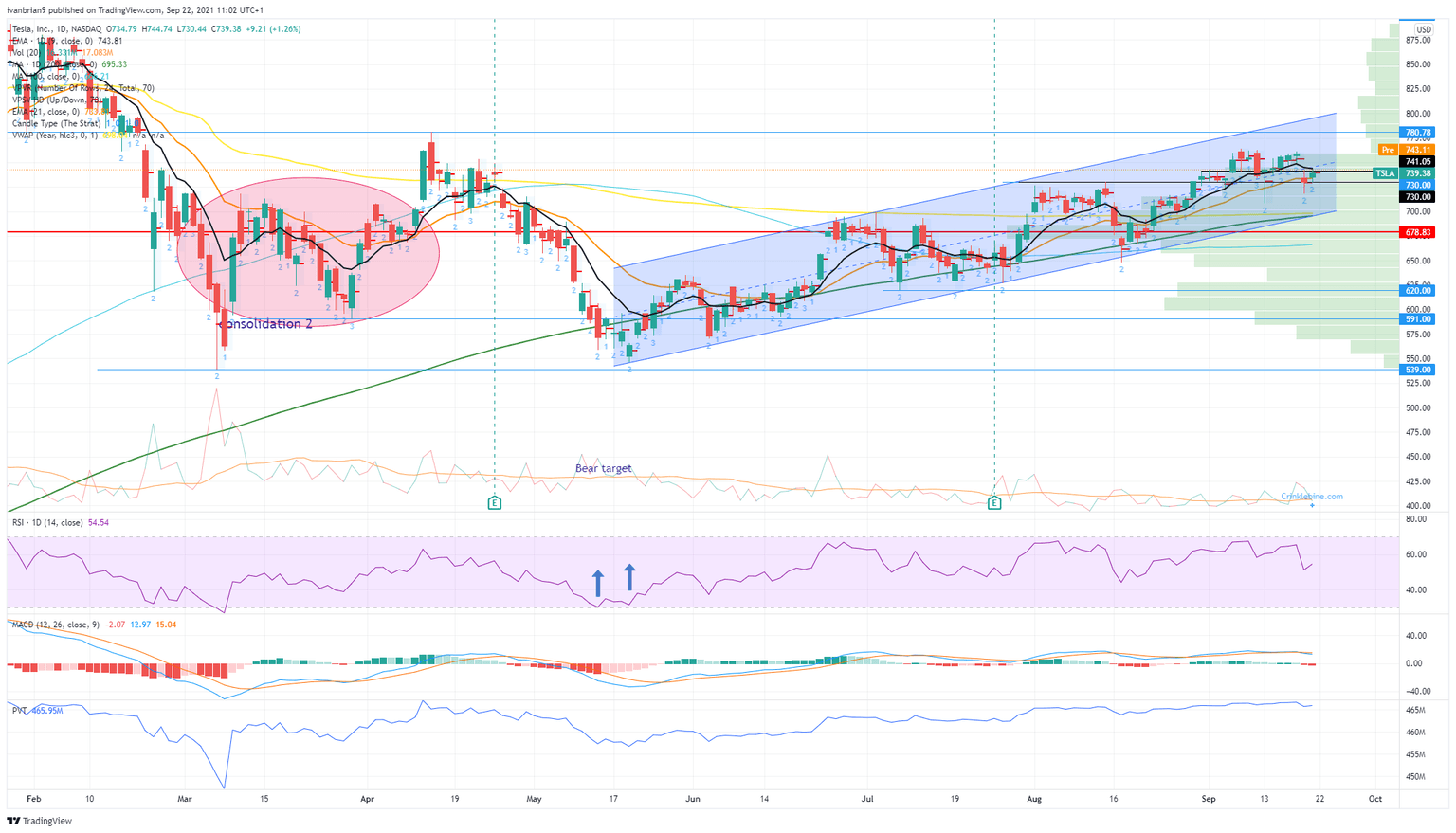

Tuesday's light volume day retraced TSLA back to the $741 resistance, well just short of it. This bounce across all markets was not exactly impressive, but it was never likely to be given the imminent Fed meeting.

Risk is off the agenda for now. Tesla needs to break $763 before it turns bullish again, as that takes out the high from last week and will put $780 back into the crosshairs. Otherwise, it is stuck in neutral. Look at that volume shelf above $760, meaning a break should see a price acceleration. This can be played with an out-of-the-money call option for a 1-2 week duration, but only once $763 is broken in our view. Breaking the option-related low from Monday last week at $708 puts Tesla into bearish mode.

FXStreet View: TSLA neutral, bullish on a break of $763, bearish on a break of $708.

FXStreet Ideas: Buy a $780 call for 1-2 week expiry if $763 is broken. Buy support zone at $680.

TSLA daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637679013725573089.png&w=1536&q=95)