Tesla (TSLA Stock) faces growing challenges

Elon Musk has a mercurial aura surrounding him. He led the way with Tesla in blazing ahead with an Electric Vehicle that could be manufactured and sold to a public eager for progress on climate change. He plans to send humans to Mars, can launch reusable rockets and now, in his latest move, has finally agreed to buy Twitter. Elon Musk manages to succeed in a whole variety of ways that are hard to imagine but actually possible.

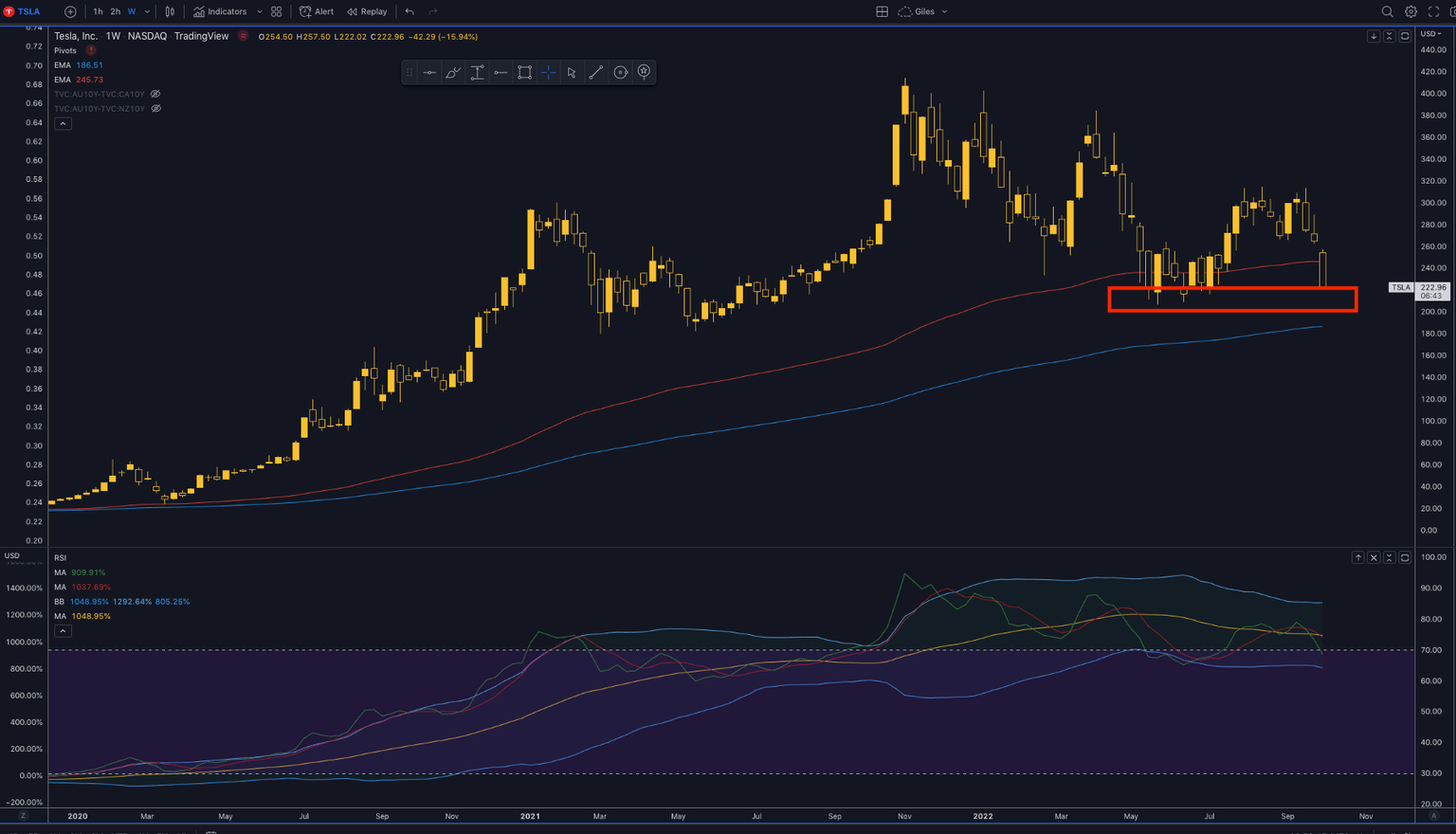

However, Tesla is facing some growing challenges that need to be evaluated carefully. Last week Tesla fell around 16% down to key support at the 210 region.

The wider set off in the US stocks on a strong US jobs print last week has not helped the car maker, but the factors influencing the falls were also disappointing car deliveries and concerns Musk will be distracted in needing to put energy into making sure Twitter works.

On the one hand, deliveries rose to a new record for Q3 this year, but deliveries still fell short of analysts’ expectations. The Model 3 & Model Y made up nearly 95% of last quarter’s deliveries yet wider challenges remain.

Broad issues that Tesla face

-

A recession looms for the US. If the US faces a hard landing then demand for high-end EVs is going to be reduced.

-

More and more main-name care manufacturers are getting their EVs to market. Ford’s F150 truck is very popular and BMW EV sales are robust.

-

Tesla shares are trading at 51 times the company’s estimated forward earnings. That is high.

-

Even if a hard landing does not occur consumers are still wary of taking on extra expenses with inflation high.

-

Elon Musk himself. Musk is both an asset and a liability. The man can do almost anything and make it successful, but he is still a man, and men have limits. What is Elon Musk’s limit? Will purchasing Twitter, which he was not wanting to do, push him beyond his limits? If it does, will Tesla suffer?

Tesla still has advantages and Elon Musk is probably the main one. The man inspires confidence and rightly so, as he has a positive can-do attitude that relished challenges. Tesla is a name synonymous with progress and that holds a premium. Elon Musk is also fully behind making the company work and the world is going to be ripe for a global EV market in a green world. So, deep dips should still be thought of as value, but more risks are emerging that buyers need to be aware of.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.