Tesla Stock News and Forecast: TSLA stock keeps advancing above $700.00

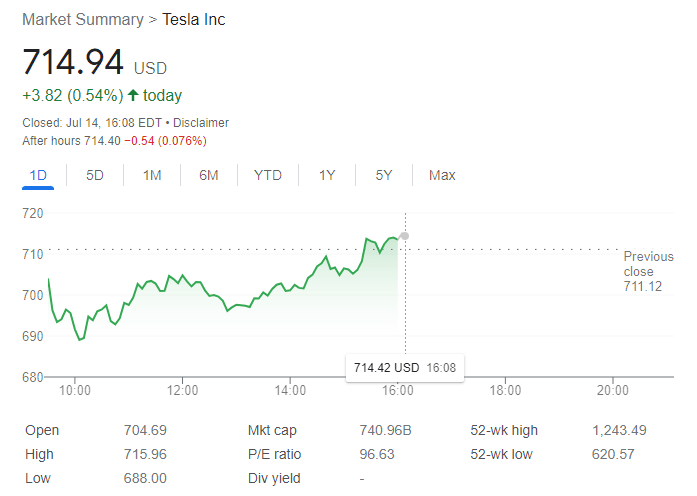

- Tesla stock extends gains on Thursday and settles at $714.94.

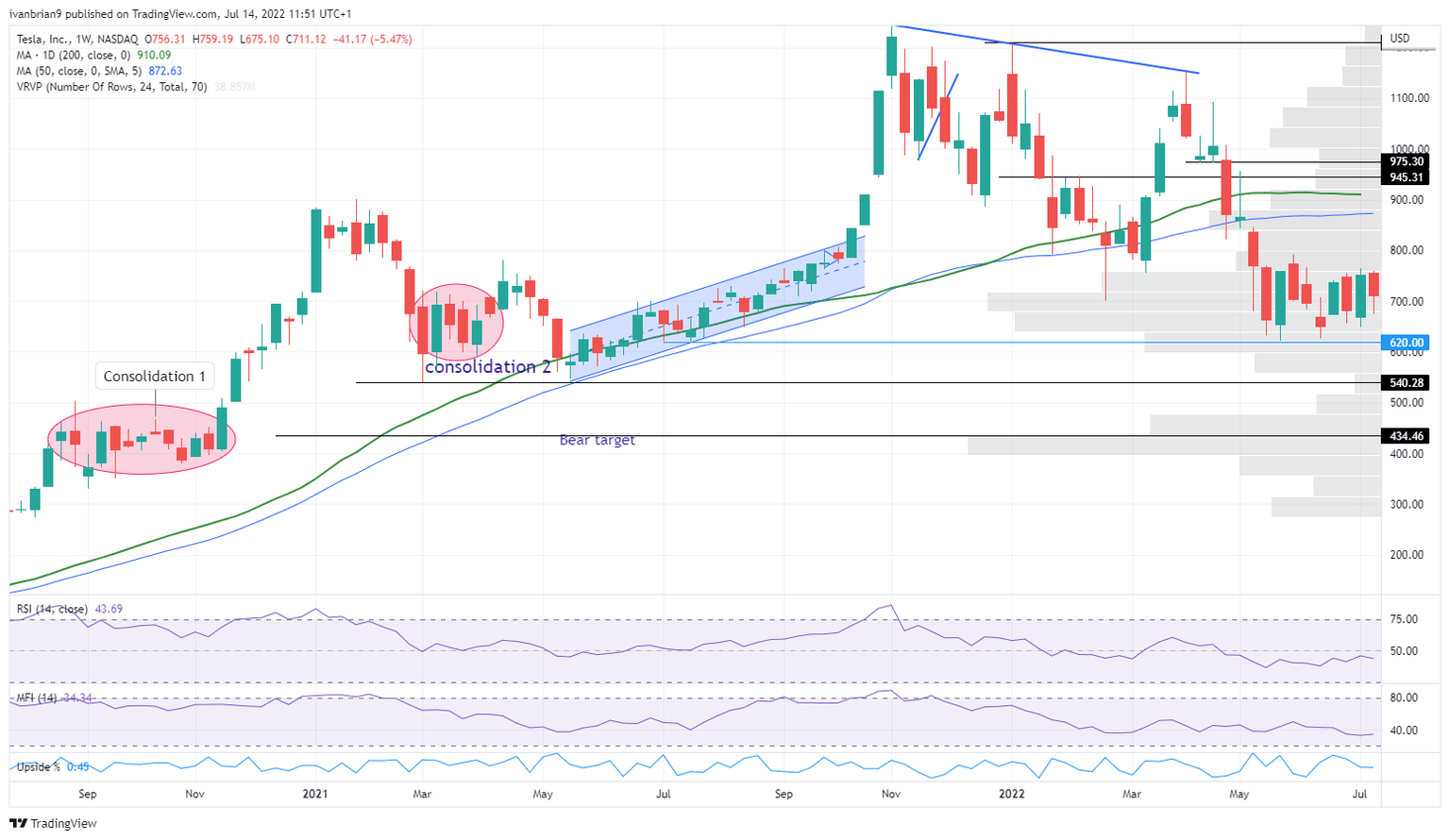

- TSLA stuck in a wide band of $620 to $760.

- Twitter files suit against Tesla CEO Elon Musk.

Update: Tesla (TSLA) shares were up 0.54% on Thursday and closed at $714.94. Wall Street started the day dip in the red as fears of a recession undermined demand for high-yielding assets. However, US indexes managed to bounce back after Federal Reserve Governor Christopher Waller noted that markets may have gotten ahead of themselves by pricing a 100 basis points rate hike in July, adding that a 75 bps hike will bring them to neutral. The Dow Jones Industrial Average finished the day down 142 points, while the S&P 500 lost 0.30%. The Nasdaq Composite managed to add 3 points or 0.03%.

Tesla (TSLA) remains volatile and directionless, both in terms of stock performance and its autonomous driving unit. The stock has been under pressure for most of 2022 but so far has held the key $620 support. Tesla has been caught in the downdraft from Elon Musk's attempt to buy Twitter (TWTR). As things turn ugly in that sphere, investors are trying to determine how that impacts Tesla. It could be seen as a positive with Elon Musk now less stretched on the acquisition and free to focus more energy on Tesla. Another positive can be taken from the lack of any need to pledge Tesla stock as collateral for the Twitter deal, but the news on Tuesday that Twitter had filed suit sent Twitter shares higher in hopes of potentially pushing the deal through. This, in our view, is highly unlikely.

Tesla Stock News: Is Tesla now driverless?

As well to the fury surrounding the Twitter lawsuit, it also came to light on Wednesday that Tesla's Head of AI has now formally left the company after a four-month break.

It’s been a great pleasure to help Tesla towards its goals over the last 5 years and a difficult decision to part ways. In that time, Autopilot graduated from lane keeping to city streets and I look forward to seeing the exceptionally strong Autopilot team continue that momentum.

— Andrej Karpathy (@karpathy) July 13, 2022

I have no concrete plans for what’s next but look to spend more time revisiting my long-term passions around technical work in AI, open source and education.

— Andrej Karpathy (@karpathy) July 13, 2022

Thanks for everything you have done for Tesla! It has been an honor working with you.

— Elon Musk (@elonmusk) July 13, 2022

Tesla has recently announced a delay to its AI day until September 30, so perhaps this is to announce some development or replacement? Either way, it creates more uncertainty for the stock.

Tesla Stock Forecast

My short position in Tesla is more of a macro view rather than a negative take on Tesla itself. Tesla is one of the highest stocks out there in terms of P/E and other multiples. In a combined monetary and fiscal tightening scenario, stocks such as this tend to rerate pretty sharply. I do feel Tesla has some challenges ahead, but these are not unique to Tesla. The automaker will probably navigate them better than legacy automakers who are notoriously terrible at navigating recessions.

Tesla has had a free run at the EV sector just as Netflix had a free run at the streaming sector, and look what happened next once the legacy companies entered. Most Wall Street analysts forecast Tesla to have a market share of 15% of the EV or auto market. This is way too high in my opinion. No automaker has ever managed to have such market share to my knowledge. Toyota is currently the world's number 1 with a 10% market share.

Technically, $620 remains the key level. A break there should lead to a move to $540, but there is a volume gap until $430 and things could get really ugly if $620 breaks. This current phase looks like a consolidation phase after the move lower. Consolidation phases usually result in a breakout in the direction of the preceding trend, i.e. bearish. Breaking $760 ends this and likely ends my short!

Tesla chart, weekly

The author is short Tesla and Twitter.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.