Tesla Stock News and Forecast: Elon Musk turns down seat on Twitter board and enters Bitcoin mining

- TSLA stock plummets as Shanghai lockdown hits stock.

- CEO Elon Musk refuses a seat on Twitter board, signs deal with Block on BTC mining project.

- Tesla is due to report first-quarter earnings on April 20.

Tesla (TSLA) stock is under pressure this morning with multiple newsflows in evidence. Tesla lost ground on Friday as it closed 3% lower and so far is replicating that loss in Monday's premarket. Fears over lockdown in China are hurting TSLA stock as are supply chain issues and input costs.

Also read: MULN stock roars back as bulls take on Hindenburg and Bitnile chimes in

Tesla (TSLA) stock news: Newsflows all over the place

Tesla CEO Elon Musk is rarely out of the news and certainly made headlines last week when his 9.2% stake in Twitter (TWTR) stock was unveiled. However, this has now taken a fresh twist with Twitter CEO Parag Agrawal saying that Musk has turned down the offer to be a member of the board of TWTR.

This brings up some interesting questions none of which we can answer. Probably most importantly does this mean Elon Musk wants a bigger stake in Twitter? Being on the board would have restricted Musk to a maximum stake but now he could go hostile if he is determined to take over the company. That seems unlikely. Perhaps as a board member, he may not have been as free to tweet as he would like.

Whatever the reasons, it keeps investors in Tesla and Twitter guessing.

Tesla shareholders will be more concerned with what is happening in China. Shanghai is in a state of lockdown and Tesla's giga-factory was forced to suspend production. NIO and other EV makers have also been affected, but Tesla is due to release earnings for the first quarter in two weeks and the latest data is not promising.

Tesla assembled 55,462 units in China during March, compared to 68,117 in January. This is likely due to the aforementioned lockdowns. China is the world's largest EV market and recent signs are not good on a macro level. This morning we had a very high CPI number from China, meaning recent monetary policy loosening will now be more difficult to pursue. Also out this morning was data showing a drop in vehicle sales of 11.7% in March. The combination of a slowing Chinese market and limited Chinese production is not ideal.

Separately, Tesla has reportedly entered into an agreement with Jack Dorsey's Block (SQ) on a Bitcoin mining project. Block and Blockstream are trying to show that Bitcoin can be mined using renewable energy.

Finally, Reuters has reported that Tesla is to build a solar-powered facility in Texas.

Tesla (TSLA) stock forecast

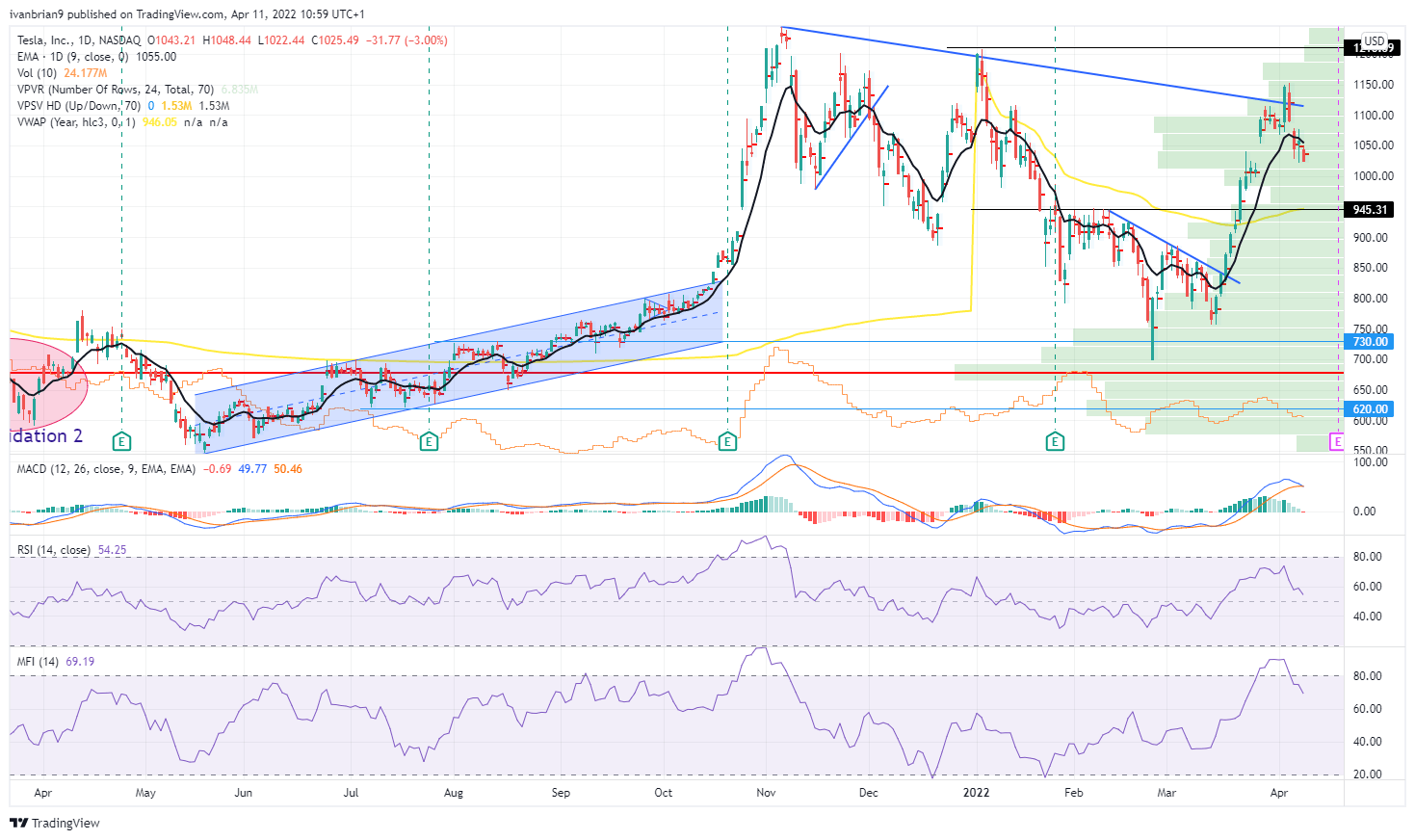

The recent TSLA stock rally was exceptionally strong and caught many investors by surprise. This was market-wide though and not all down to Tesla. The failure to make a new high signaled we remain in a long-to-medium-term downtrend, though. We still have a series of lower highs and lower lows.

The next target for TSLA stock should be to make a lower low, which means breaking $700. Resistance at $1,208 is the last major high, if that is broken then the downtrend is over and record highs beckon. The first target and support are $945. The recent move higher saw a sell signal from both the MFI (money flow index) and RSI (relative strength index).

Tesla (TSLA) stock chart, daily

*The author is short for Tesla.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.