NIO Stock News and Forecast: Nio raises prices but shares collapse

- NIO stock slides over 8% in Hong Kong as China struggles.

- The electric vehicle builder also raises prices following other auto manufacturers.

- China lockdowns and CPI see markets fall sharply.

NIO stock is trading sharply lower in Hong Kong overnight as Chinese stocks continue to suffer economic fallout. Overnight, China announced yet more lockdowns to try and deal with the covid situation in the country. China also released a higher-than-expected CPI number which also dented equity investor enthusiasm.

Unlike most other major economies China has been lowering rates to try and stimulate its economy. This latest high CPI print will make this policy harder to pursue. This has hurt equity sentiment.

NIO and other Chinese EV names all produced strong delivery data over the past two weeks, which helped underpin the share prices. Chinese stocks had also recovered on hopes for a deal between Chinese and US regulators to give the latter access to autism of Chinese companies. This would then remove the delisting risk that has hung over the likes of BABA and DIDI.

NIO stock news: Price hikes and factory shutdown

Not much to keep NIO stockholders happy this morning. Finally, Nio Inc. bowed to the inevitable and announced price hikes to combat rising input costs. The company had only said about 2 weeks ago that it would not be hiking prices but as commodity prices continue to rise it has had to u-turn on this policy. CNEVPost announced that Nio will increase SUV prices for all suvs by 10,000 yuan. Prices for the ET7 and ET5 sedans will be unchanged. NIO will also increase battery rental prices: "The price increases are because there is no choice, and please understand," CEO William Li said.

Nio has also had to suspend production to the covid outbreak and lockdowns in China. Nio said in a statement: "Due to these factors, NIO's vehicle production has been suspended. (...) There will be a delay in the delivery of vehicles for many customers shortly, and we ask for your understanding." Nio is not alone as Tesla's giga-factory in Shanghai is also closed for production due to the restrictions.

NIO stock forecast: Multiple sell signals

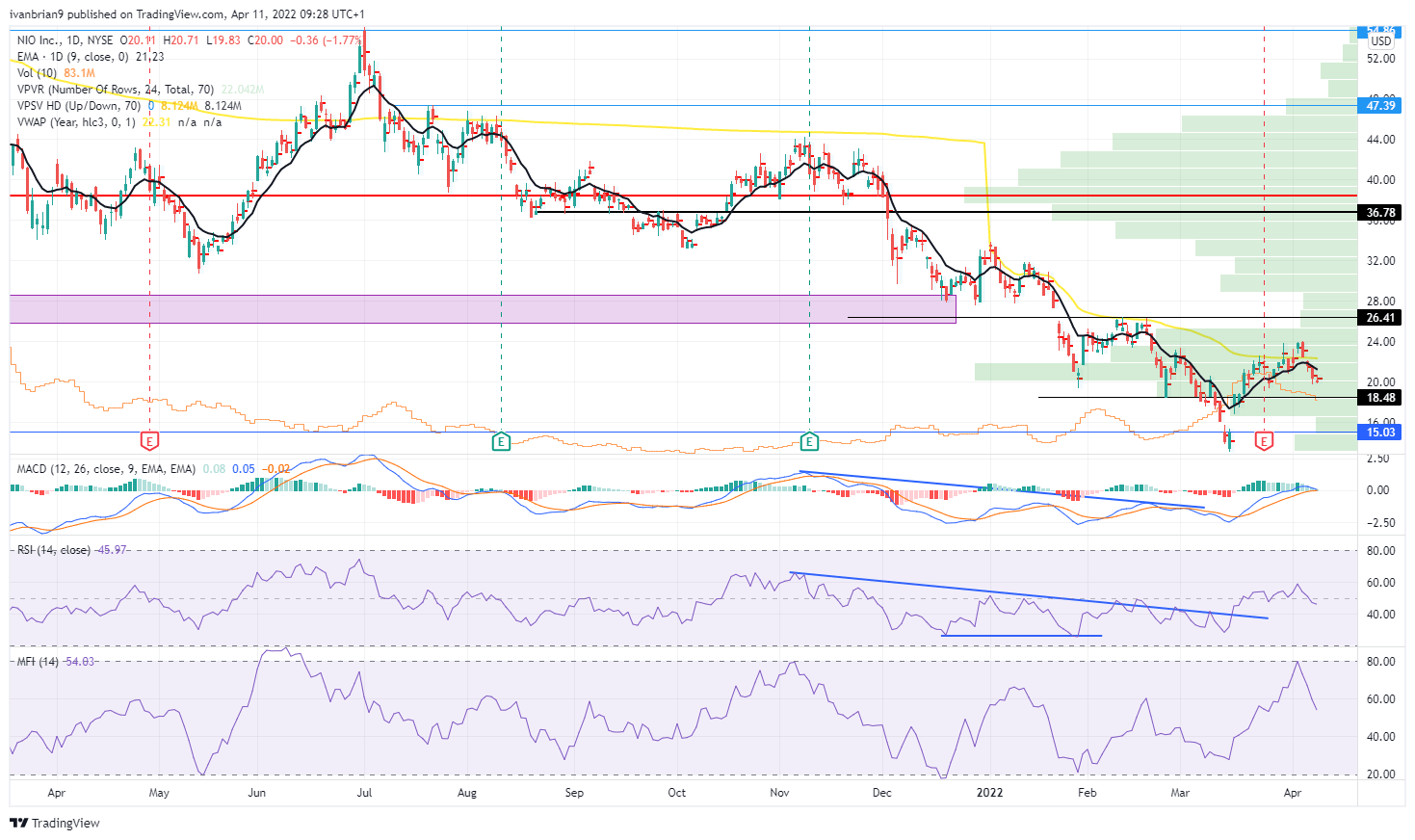

The money flow index flashed an overbought signal for NIO stock which now looks like it will play out correctly. Premarket sees $18.48 broken and so puts NIO stock firmly back in a downtrend. NIO stock needed to break above $26.41 to stay bullish but it has failed to do so. That means the downtrend targets $15.03 and then a new low below $13.01. MACD also about to flash a sell signal.

NIO stock chart, daily

*The author is long BABA.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.