Tesla provided the short-term selling opportunity at the blue box area

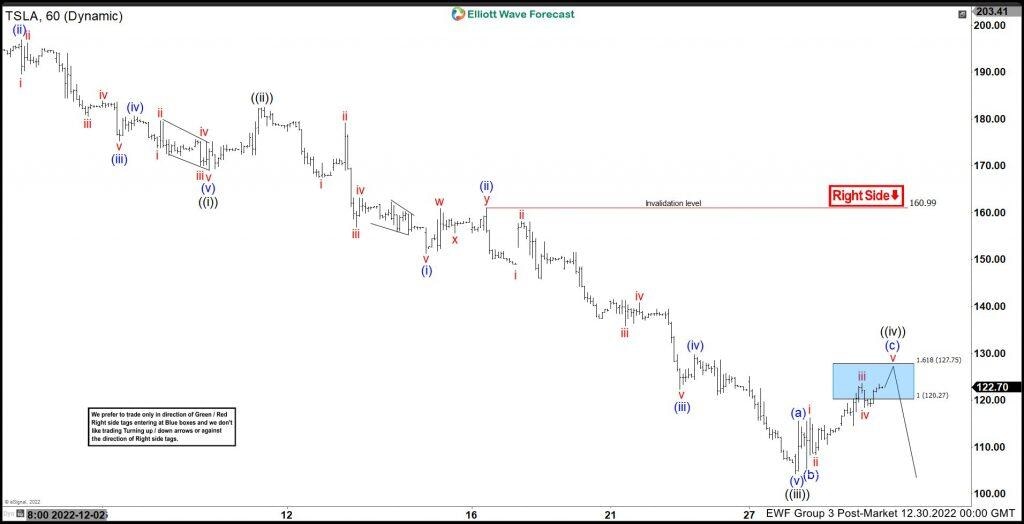

In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of the Tesla ticker symbol: TSLA. In which, the decline from the 01 December 2022 high unfolded as an impulse sequence and showed a lower low sequence within the bigger cycle from November 2021 peak. Therefore, we knew that the structure of Tesla is incomplete to the downside & should see more weakness. So, we advised members to sell the bounces in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

Tesla 1-hour Elliott Wave chart

Here’s the 1-hour Elliott wave Chart from the 12/30/2022 update. In which, the decline to $104.22 low ended wave ((iii)) & made a bounce in wave ((iv)). The internals of that bounce unfolded as an Elliott wave flat correction. And managed to reach the blue box area towards $120.27- $127.75 blue box area from where sellers were expected to appear looking for more downside or for a 3 wave reaction lower at least.

Tesla latest 1-hour Elliott Wave chart

This is the Latest 1-hour view from the 1/04/2023 Midday update. In which the stock is showing a reaction lower taking place from the blue box area allowing shorts to get into a risk-free position shortly after taking the position. However, a break below the 12/28/2022 low would still be needed to confirm the next extension lower & avoid a double correction higher. Now, as far as bounces fail below $124.56 high Tesla should see some more downside towards $99.24- $91.44 area lower minimum before a bounce happens.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com