SuperVerse initiating the Elliott Wave super rally

SuperVerse SUPER is building the Web3 infrastructure for Gaming and expected to be one of the leading pioneers in the industry. In this article, we’ll explore the potential bullish Elliott Wave path.

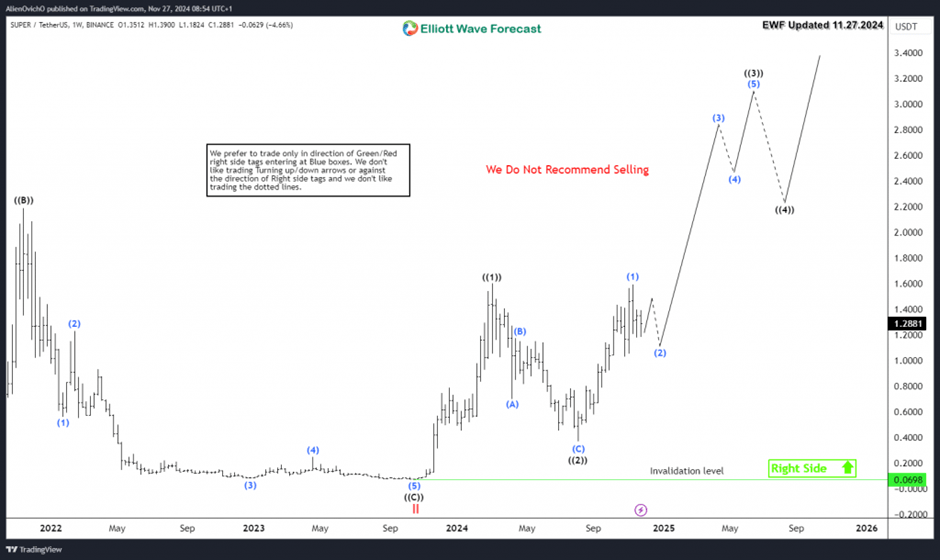

SUPER initially rallied within an impulsive 5 waves advance since October 2023 and it ended wave ((1)) at $1.6 on March 2024. The token did a 3 waves pullback for 6 months in wave ((2)) before a turn higher took place. During the new move to the upside, SUPER did break above wave ((1)) which created a new bullish sequence coming from the 2023 low. Consequently, this move confirms the start of the next bullish phase as the token is entering the wave (3) of ((3)). That is to say, the strongest advance usually takes place within the 3rd wave of the cycle and the token will be looking for most gains to happen during that period of time.

In conclusion, SUPER technical structure is suggesting a continuation within it’s bullish trend and we expect the token to see targets higher at technical level $2.8 – $4.3.

SUPER Weekly Chart 11.27.2024

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com