Stocks face growing uncertainty amid escalating Middle East tensions

The S&P 500 is set to continue consolidating – what’s next?

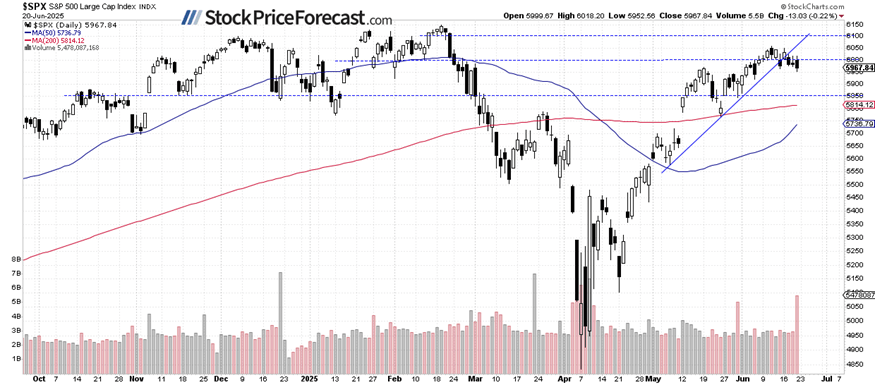

Stocks pulled back slightly on Friday, with the S&P 500 index closing 0.22% lower - its lowest close since June 5, although it remains within its current trading range. U.S. involvement in the Israel-Iran conflict over the weekend led to a lower open in the S&P 500 futures contract and rallies in gold and oil prices. However, sentiment has since improved, and the futures are now pointing to a modest -0.1% decline at the open this morning.

Markets are now awaiting the release of key Flash Manufacturing and Services PMI data at 9:45 a.m. Attention will also turn to Fed Chair Jerome Powell’s testimony scheduled for tomorrow and Wednesday.

In my opinion, this remains a short-term consolidation phase, with no confirmed bearish signals at the moment.

Investor sentiment has slightly deteriorated, as reflected in the last Wednesday’s AAII Investor Sentiment Survey, which reported that 33.2% of individual investors are bullish, while 41.4% are bearish.

The S&P 500 pulled back below the 6,000 level last week, as the daily chart indicates.

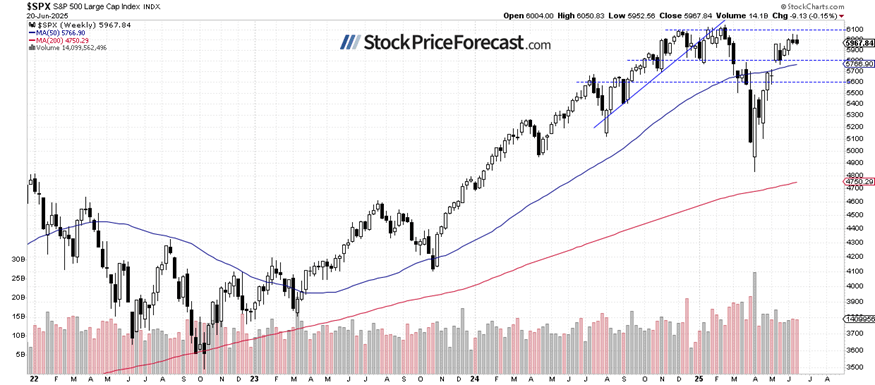

S&P 500: Another sideways weekly change

The S&P 500 lost 0.15% last week, which should be viewed as a relatively neutral reaction amid escalating tensions in the Middle East.

The index continues trading above the early May weekly gap-up, which is a bullish technical signal. However, resistance remains around 6,100.

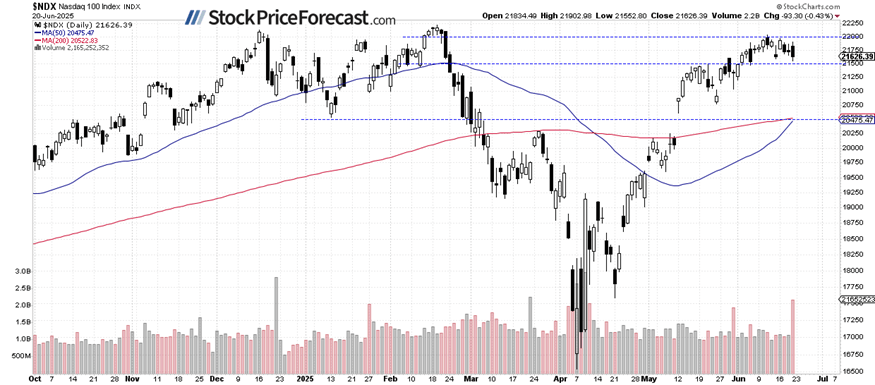

Nasdaq 100 hovering near recent lows

The Nasdaq 100 closed 0.43% lower on Friday, showing relative weakness compared to the broader market. Still, the decline was rather muted given the geopolitical context.

Key support remains around 21,500, with resistance in the 22,000–22,200 range.

VIX remains around 20

Last Wednesday, the Volatility Index (VIX) dropped to a local low of 16.23, signaling reduced investor fear. However, it rebounded last week to a high of 22.00 amid rising Middle East tensions. On Friday, it remained slightly above 20.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

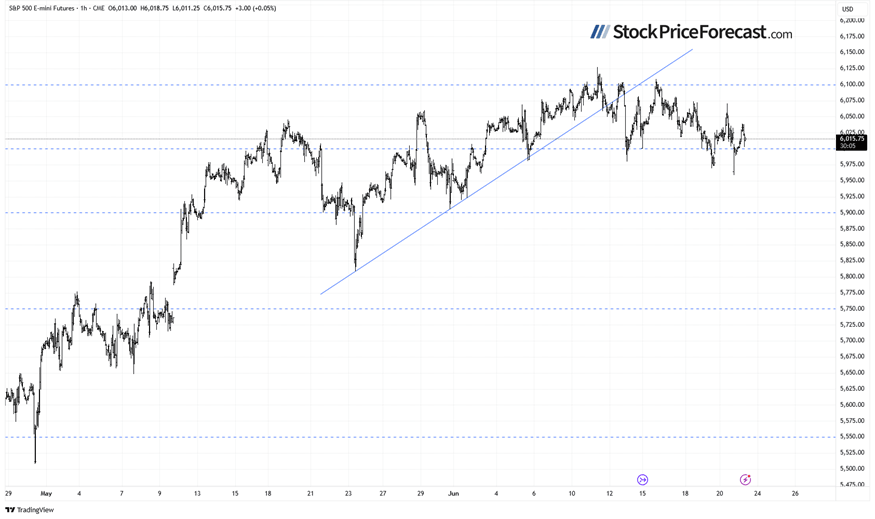

S&P 500 futures contract: Fluctuating around 6,000

This morning, the S&P 500 futures contract is trading above the 6,000 level after rebounding from an overnight low near 5,959.

Key support is in the 5,960–6,000 zone, marked by recent local lows. Resistance is around 6,100. The market remains sensitive to geopolitical developments and may continue to consolidate.

Conclusion

Stock prices are likely to open slightly lower to flat today - a better-than-expected outcome following the weak futures open triggered by Middle East tensions.

Will the market eventually correct more of its late-May gains? I think that for now, there are no confirmed bearish signals. It still looks like a consolidation within an uptrend.

Here’s the breakdown:

-

The S&P 500 is set to extend its consolidation around the 6,000 level, despite geopolitical risks.

-

There are no clear bearish signals yet, but a deeper downward correction is not out of the question at some point.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.