SPY correction risk flashing

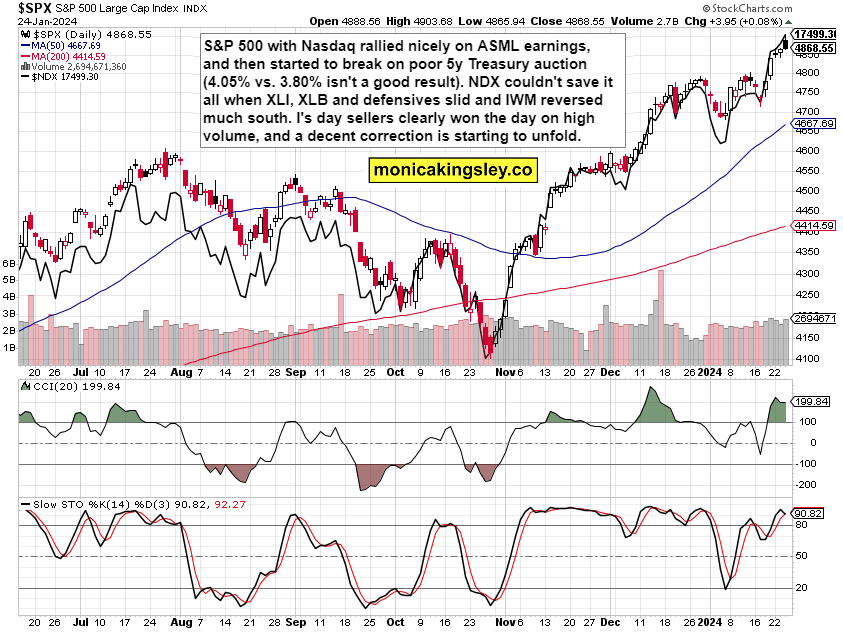

S&P 500 rallied on ASML earnings expectations and the actual figures, made it over my 4,920 target, but ran out of steam thanks to a weak 5y Treasury auction. In my view, that‘s a bearish daily victory in stocks that also forced a sizable retreat from daily highs in the most resilient index of them all, Nasdaq.

But clients have cashed in +25 ES pts whether swing trading, or made an absolute killing if they combined it with fine intraday calls in NDX and ES…

Thank you for all the recognition – great to see it‘s working out great for you… Here is what I expect from the coming set of data – GDP and then unemployment claims.

Initial reaction is bullish, and would likely prevail during the day. Way more coverage follows live on Twitter and of course on both premium Telegram channel – new clients without deeper direct experience of what I do for years, keep enjoying the full peek under the hood so as to be on the right side of market action during the coming two trading days.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 2 of them, featuring S&P 500 and precious metals.

S&P 500 and Nasdaq

Falling through 4,920 wasn‘t a fine sight given how much Nasdaq was struck simultaneously. That‘s the result of risk-off emerging fast following a weak auction, and the daily rise in volume is sealing off the odds for the coming days, just waiting for a catalyst – but yes, today buy the dippers are back.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.