Spotify Technology S.A. (SPOT) Elliott Wave technical analysis [Video]

![Spotify Technology S.A. (SPOT) Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/windows-02_XtraLarge.jpg)

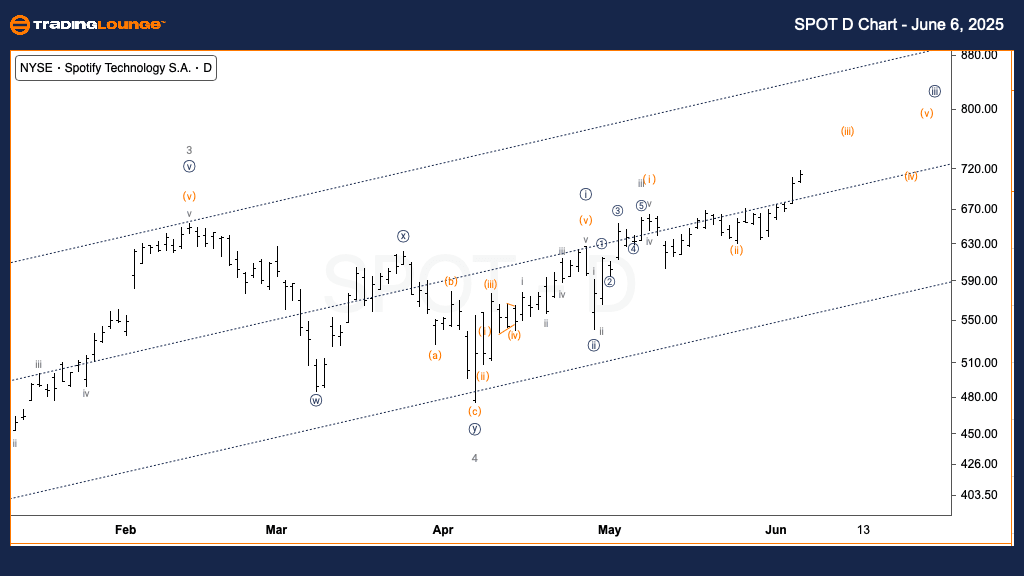

Spotify Technology S.A. (SPOT) – Daily chart

Technical analysis based on Elliott Wave theory

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (iii) of {iii}.

Direction: Upside in wave (iii).

Details: This represents the most bullish scenario for SPOT, forecasting potential movement toward the $800 level as wave (iii) extends.

Spotify is demonstrating a strong bullish structure on the daily chart, situated in wave (iii) of a larger wave {iii}. This formation suggests increasing momentum and strong upside potential, with $800 acting as the expected price target under this scenario. The chart supports the impulse structure, reinforcing upward continuation in the near term.

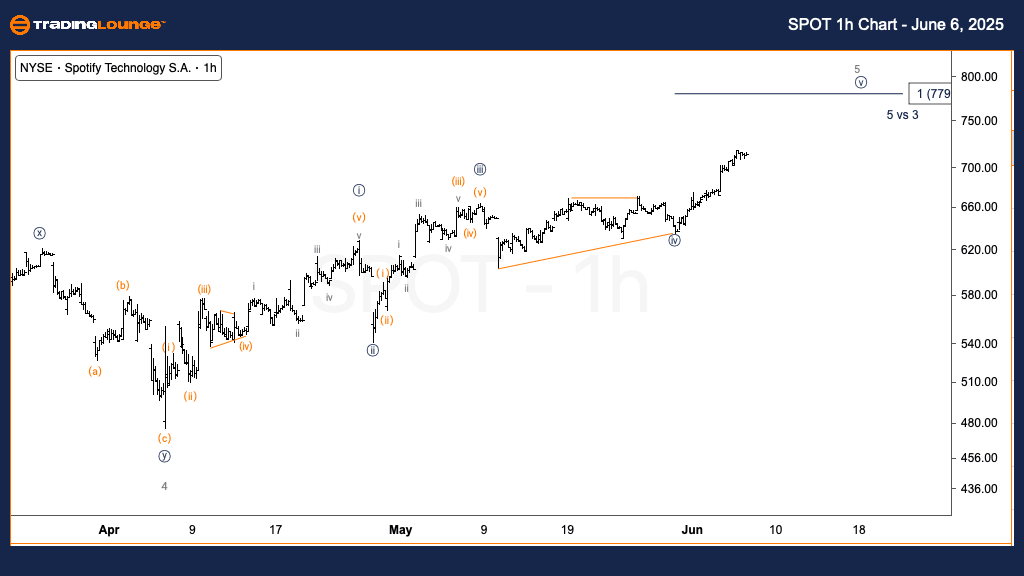

Spotify Technology S.A. (SPOT) – One-hour chart

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {v} of 5.

Direction: Upside in wave {v}.

Details: This more conservative outlook assumes wave {v} is now developing, with upside limited to $779, considering wave {iii} is shorter than wave {i}.

In the hourly timeframe, SPOT is moving within wave {v} of 5. With wave {iii} being shorter than wave {i}, upside is expected to cap at approximately $779, aligning with typical Elliott Wave guidelines. This count suggests a near-term high may soon form, followed by a likely corrective phase.

Spotify Technology S.A. (SPOT) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.